In response to the onset of the COVID crisis in late March 2020, Congress passed the CARES Act, which directed cash payments to nearly 80% of American households, providing temporary peace of mind for those with limited savings and living paycheck to paycheck. Approximately 70-75% of households used their stimulus checks to cover daily expenses; for others, it was a windfall

JUBILEE1

In the Old Testament, the last year of a 50-year cycle was considered a holy year of celebration, a jubilee2 in which liberty was proclaimed, debts were forgiven, and mourning was replaced by joy.

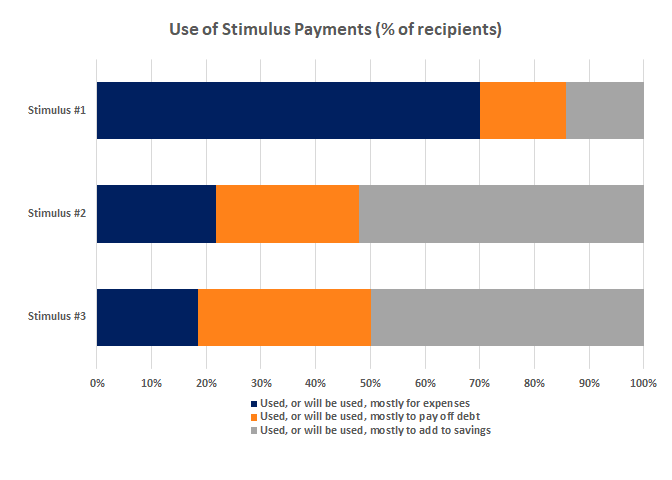

Use of Stimulus Payments(%of recipients)3

In response to the onset of the COVID crisis in late March 2020, Congress passed the CARES Act, which directed cash payments to nearly 80% of American households, providing temporary peace of mind for those with limited savings and living paycheck to paycheck. Approximately 70-75% of households used their stimulus checks to cover daily expenses; for others, it was a windfall.4 Nine months later, a second round of stimulus checks was distributed with less than 30% of recipients using the cash to cover expenses, almost a mirror opposite of the first stimulus check; others used the proceeds to increase savings or pay down debt. A year later, in March 2021, President Biden signed the American Rescue Plan, which broadly distributed $1.9 trillion to those deemed to be in need. The portion of households using the stimulus cash for expenses had declined further and a greater portion was used to reduce debt, providing a boost to household net worth. Thus, while the first stimulus distributions were, for many, “life savers,” the most recent allocations of government funds were much more akin to the Biblical jubilee.

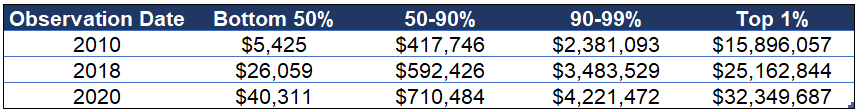

Average Household Net Worth by Wealth Percentile5

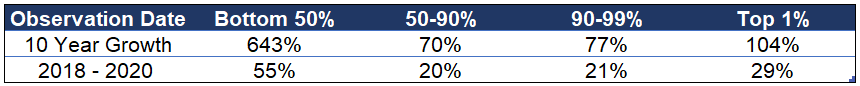

Household Net Worth Cumulative Growth

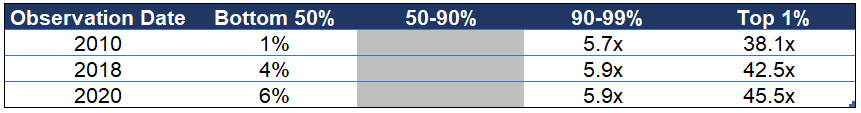

Household Net Worth Relative to 50-90%

Since the Great Recession (in 2008), income inequality has been an increasing topic of discussion. In January 2014, Pew Research issued a report, Most See Inequality Growing, but Partisans Differ Over Solutions, in which 54% of surveyed respondents “favor(ed) taxing the wealthy to expand aid to the poor.”6 It is not surprising that the topic came to the forefront during the 2020 Democratic primaries. Candidates offered proposals to narrow the wealth gap including student loan forgiveness, guaranteed minimum income7 and a wide range of tax code changes. Just as COVID accelerated the rise of on-line retail to the detriment of traditional brick & mortar stores, it also increased the willingness of central bankers and politicians to address income inequality.8 We believe that the seeds have been sown and that we are likely to see a series of new policies intended to reduce the wealth gap. Thus, we are “bullish” on the American household.

It is notable, as shown previously, that all segments of the population have seen growth in average household net worth since the Great Recession with the bottom 50% seeing the largest increase by percentage over the last 10 years.9 Although households in the 50-90% range have seen growth in net worth, it has been at a lower rate than the other segments and far below that experienced by the bottom 50%. Thus, the advance of Trumpism may partly be attributable to this portion of the population feeling that they are falling behind relative to other groups. At the upper end, among the 1%-ers, net worth growth is more likely a reflection of assets appreciating faster than consumption rather than income growth; the rich have gotten richer because their money is working for them.

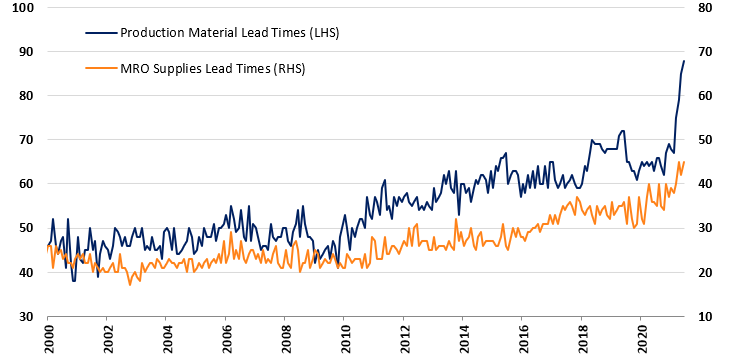

ISM Lead Times (Days)10

Source: Haver, JEF Economics. MRO: Maintenance, Repair and Operating supplies

The massive influx of stimulus, both monetary and fiscal, has led to widespread discussion of the level and duration of inflation: is it only transitory (the collective view of the Federal Reserve) or is it likely to become more lasting? As shown in the table above, since the Great Recession, lead times for production materials and industrial goods have been lengthening. This has likely been caused by economic growth outstripping working capital as corporations were reluctant to build inventories, concerned about modest growth and the potential for deflation. Recent trade disputes with China aggravated the situation, further pushing out lead times. Most recently, the reopening of the global economy following the COVID-related shutdowns has been hampered by bottlenecks in production and transport, as well as labor shortages, affecting a wide range of industries including food, apparel, packaging and medical products.11 Resulting shortages, coinciding with rising demand, have caused prices to rise, giving way to the “transitory” inflation acknowledged by the Federal Reserve.

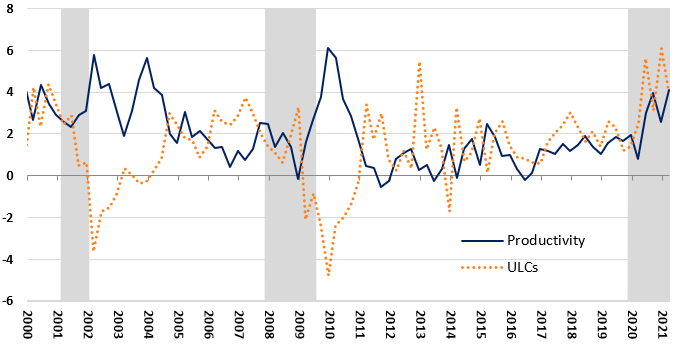

Lead Nonfarm Productivity & Union Labor Costs(Y/Y%)12

Source: Haver, JEF Economics

Folks may forget, but, prior to the onslaught of COVID, the U.S. was experiencing a strong economic expansion with a tight labor market reflected above in the rise in unit labor costs (ULCs). Moreover, ULCs were advancing at a rate slightly greater than productivity.8 The ULC increase accelerated during COVID, but this may be misleading because lower cost, labor-intensive service jobs were lost while higher paid workers were able to work from home. Further, technology advances that have enabled remote work have also enhanced productivity. Upon re-opening, government relief programs have created disincentives for many lower paid workers to return to work, which may be partly responsible for ongoing labor shortages. Higher wages may be required to bring them back. With respect to inflation, an increase in wages that leads to an increase in demand without a similar increase in the supply of goods may cause inflation to be more permanent. This effect may be more muted if higher wages are, to some degree, directed toward debt reduction and increased saving as was seen with the latest rounds of stimulus. Inflation may also be held back if increased use of technology increases productivity or reduces the cost of goods.

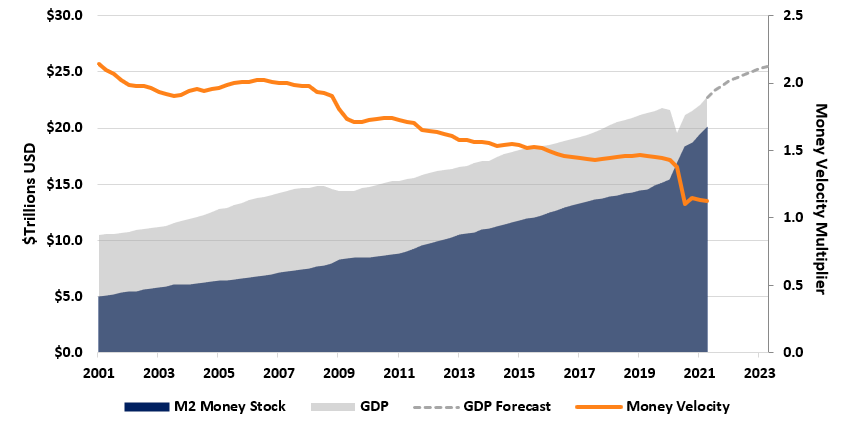

M2 and GDP Growth14

Money supply15 and GDP16 growth are generally correlated. Historically, “pump-priming” in the form of fiscal and monetary stimulus has been a precursor to a rise in inflation when it spurs an increase in spending reflected in increased money velocity.17 The devil is in the details; an increase in the money supply that only flows into savings will not increase the velocity of money in the economy, contradicting the belief that simulative policies always spur inflation. As illustrated above, money supply has been steadily growing but the primary concern since the Great Recession (in 2008) has been deflation. Supporting this concern is the significant decline in money velocity. Unlike the first COVID stimulus checks, the subsequent disbursements have been directed toward debt repayment and savings, of which, we believe, a substantial portion has found its way into real estate and financial assets (as well as crypto currencies). Thus, whether inflation will be transitory or ongoing will partly hinge on the velocity of money – will the population continue to pad savings accounts or will increased cash flow be used for consumption? There is no consensus among financial pundits.

We have no idea whether inflation will be transitory or long-term. We have no idea what level of sustained economic growth will be realized. That said, we strongly believe the following:

-

- For more permanent inflation to take root, we need rising income that turns into increased spending.

- Central bankers and politicians are going to pursue policies that will decrease the economic disparity by broadening household wealth.

- Central bankers and governments have strong incentives to keep interest rates low. As such, the yield curve is likely to remain steep (but if it flattens, pick up the phone and call us for an update).

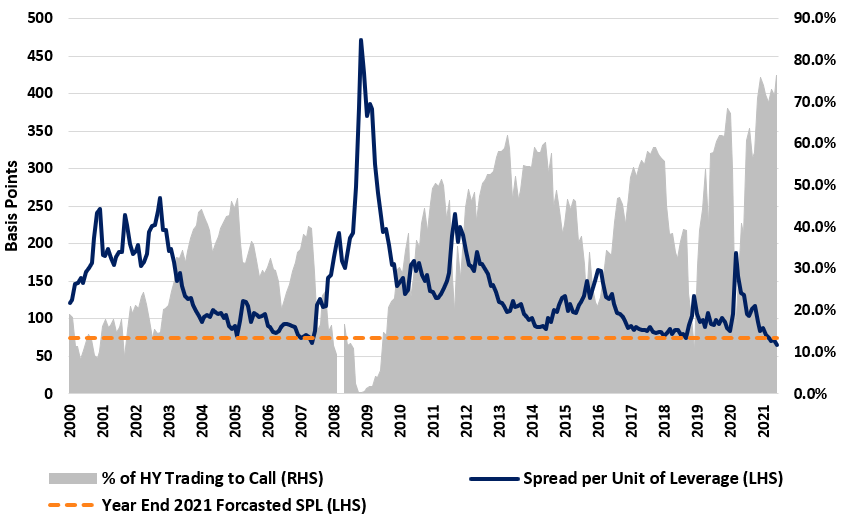

High Yield Spread Per Unit of Leverage (SPL) and % of High Yield Bonds that are Trading to Call18

The historically low interest rate policy (sometimes referred to as “the Fed put”) and the highly anticipated rebound in the economy have driven asset prices to new heights as investors fear missing out. As illustrated above, the portion of the high yield market trading at a yield-to-call rate is at a 20+ year high as capital markets are wide open and any CFO who can refinance debt at a lower rate is taking advantage of the market. Concurrently, investors have become more complacent in their required compensation for credit risk. As shown above, the high yield spread per unit of leverage has fallen to match the lows seen over the last 20 years. In such an environment, it is as important as ever to be a “bottom up,” credit-specific investor. The good news is that the universe of investment candidates is growing as turbocharged investment bankers feed the market with refinancings, mergers & acquisitions and access for first-time debt issuers. In this spirit, we provide several examples of investment commitments made in 2Q21 below:

Dell Technologies Inc (DELL)19 – Dell Technologies is a global technology company that develops, sells and supports various computer products including personal computers, data storage, servers, and networking devices. In 2016, the company acquired EMC Corp with a focus on data storage, cloud computing, and virtualization. While acquiring EMC, Dell obtained an ~80% stake in VMWare. Since then, Dell has been committed to reducing debt while delivering record profitability, with a $20.9 billion reduction in core debt since the EMC acquisition closed. This de-leveraging has resulted in a core leverage ratio of 2.3x as of the first quarter of Dell’s 2021 fiscal year. On April 14th, 2021, Dell announced a spin-off of VMWare in which VMware agreed to pay a special dividend of $11.5-$12.0 billion to shareholders. Dell committed to further debt reduction in the fiscal year, including proceeds from the special dividend, and is targeting achievement of an investment grade rating after completion of the VMware spin-off. In the second quarter, Dell redeemed the 5.875% senior notes due 6/15/21; the CrossingBridge Low Duration High Yield Fund has been a long-term holder of these bonds. The Fund purchased the 7.125% senior notes due 6/15/24 in 2Q21 based on the view that this bond is likely to be redeemed with the proceeds from the VMware spin-off in 3Q21. If the company chooses to wait, we will benefit from the higher yield to the next call as well as possible spread compression resulting from a likely credit upgrade.

Hertz (HTZ)20 – Hertz is a global car rental company that filed Chapter 11 in May 2020 after COVID shut down virtually all domestic and international travel. The CrossingBridge Low Duration High Yield Fund participated in the debtor-in-possession (DIP) financing, due December 31, 2021, priced at LIBOR + 725 bp. Issued to ensure liquidity during the bankruptcy, this loan was secured by all assets other than the Donlen vehicle leasing and fleet management operation, expected to be sold during the bankruptcy, and vehicles that were reserved as collateral for fleet financings. This loan had super-senior priority for repayment at the conclusion of the bankruptcy. As the impact of COVID began to fade in late 2020 and early 2021, operating performance began to improve, leading to several private equity firms making competitive proposals to repay creditors and fund the company’s exit from Chapter 11. As this process developed, it became apparent that the 7.625% Second Lien Notes would be repaid in full including post-petition interest calculated at the coupon rate. In April 2021, the Fund began to purchase these bonds at a price of 108, with the expectation that they would be repaid, with interest, when the Plan of Reorganization went effective, likely by the end of 2Q21 or early in 3Q21. Hertz exited Chapter 11 on June 30, 2021 and, as part of its exit, repaid the DIP at par and paid off the bonds.

At Home (GRIDGE)21 - At Home is a big-box home furniture and decor retail chain. Like most other retailers, the company was forced to shut virtually all of its stores due to COVID beginning in late March 2020. In August 2020, the company issued a $275 million, 8.75% senior note to ensure sufficient liquidity. The CrossingBridge Low Duration High Yield Fund participated in the initial offering. In March 2021, the CrossingBridge Low Duration High Yield Fund began purchasing this bond based on At Home’s improving performance resulting from favorable quarantine-driven consumer behavior trends and our recognition that the bond had “cushion”22 characteristics that made it a likely near-term refinancing candidate. In May 2021, Hellman & Friedman, a private equity firm, announced plans to take At Home private at a $2.8 billion valuation, the change in control requiring early retirement of the bond. Based on our expectation that the entire capital structure would be refinanced when the acquisition closed, likely by the end of 3Q21, we added to our position in the bonds.

BuzzFeed (ENFA)23 - BuzzFeed is a new-age internet media company that distributes digital content across social media channels and 3rd party platforms. Its brands include BuzzFeed, Tasty, Huffpost, and many others with massive reach and engagement, especially among Millennials and Gen Z-ers. The company is going public via a merger with a SPAC24 , 890 5th Avenue Partners. Revenue has been flat while EBITDA has grown over the last two years; both are expected to increase through growth in advertising sales and monetization of commercial relationships. Capital from the SPAC and a PIPE25 is being used to complete the acquisition of Complex Networks, a content producer that will deepen Buzzfeed’s engagement with portions of its existing demographic and expand the company’s reach into several new audiences. The CrossingBridge Low Duration High Yield Fund committed to participate in the PIPE, a 5-year 7% convertible note with a conversion price of $12.50 per share. With 3.25x projected leverage, we are comfortable with the credit and believe there is potential for equity appreciation to further enhance returns. The transaction is expected to be completed in 3Q21.

Surely, in certain geographies in the U.S. and in many countries, COVID remains a danger. Yet with the success of vaccination efforts in the U.S., there are signs of a jubilee.26 Life is beginning to return to normal: people are able to attend baseball games, travel to see loved ones and go back to their offices. Moreover, the series of massive government stimulus packages and the policies of the Federal Reserve have permitted the U.S. economy to rebound rapidly, producing economic growth not seen since the 1950’s.

Shouting for joy27,

David Sherman and the CrossingBridge team

1 For an interesting modern perspective see a thesis presented by Matthew Joseph Melazhakam in April 2021 entitled Economic Growth, Social Justice, and the Bible: The Search for a New System, Union Theological Seminary, https://academiccommons.columbia.edu/doi/10.7916/d8-0qff-tj73

2 For an interesting modern perspective see a thesis presented by Matthew Joseph Melazhakam in April 2021 entitled Economic Growth, Social Justice, and the Bible: The Search for a New System, Union Theological Seminary, https://academiccommons.columbia.edu/doi/10.7916/d8-0qff-tj73

3 Federal Reserve Bank of St. Louis. Federal Reserve conducted June 11-16, 2020, January 6-18, 2021 and March 17-29, shortly after each of the COVID-related stimulus distributions began.

4 The CARES Act survey excludes the Paycheck Protection Program, which provided up to $349 billion in guarantees for forgivable business loans.

5 Federal Reserve Bank of St. Louis

6 https://www.pewresearch.org/politics/2014/01/23/most-see-inequality-growing-but-partisans-differ-over-solutions/

7 Guaranteed minimum income is the concept of providing cash payments to specific, targeted groups of people, mostly those living below the poverty line, to address income inequality. Such programs have been tried in Newark, NJ, Tacoma, WA, Jackson, MS, Denver, CO, Cambridge, MA and Los Angeles, CA among other places.

8 The trend continues with more stimulus in the form of proposed multi-trillion-dollar infrastructure plans. Although Democrats and Republicans may disagree on the size and details, proposals from both sides reach beyond “pick and shovel” projects to aid their constituencies and help them narrow the wealth gap.

9 Although Democrats tend to produce the most rhetoric on the topic of wealth inequality, both major political parties have expressed concern on the subject. Nevertheless, during the Trump administration, from the end of 2016 through 2020, the bottom 50% experienced the greatest increase in average household net worth, +115%, triple the rate of the next 49% and more than double the rate of increase for the top 1%.

10 Mid-Year Outlook Update: Stubborn Inflation, Jefferies, June 9, 2021 (Haver Economics, JEF Economics. MRO: Maintenance, Repair and Operating supplies)

11 For example, the shortage of semiconductors has impacted the auto industry (and its suppliers) leading to temporary manufacturing shutdowns, a rise in the price of used cars and a shortage of rental cars.

12 Mid-Year Outlook Update: Stubborn Inflation, Jefferies, June 9, 2021 (Haver Economics, JEF Economics)

13 Productivity is defined in economics as the ratio of the volume of output to the volume of inputs. It measures how efficiently inputs, such as labor, are being used to produce a given level of output.

14 Federal Reserve Bank of St. Louis

15 When discussing money supply, economists are typically referring to M2, consisting of M1 (currency in circulation (notes and coins, travelers’ checks, demand deposits, and checkable deposits) plus small-denomination time deposits (amounts of less than $100,000) less IRA and Keogh balances at depository institutions and balances in retail money market funds less IRA and Keogh balances at money market funds.

16 Gross domestic product (GDP) is the market value of goods and services produced by labor and property located in the U.S. in a specified period.

17 Simplistically, money velocity reflects the number of times that a dollar is used for the purchase of goods and services in a given time period. Technically, it is the ratio of nominal GDP to the average of M2 money stock.

18 High Yield Credit Chartbook, Bank of America, July 1, 2021 and 1Q21 High Yield and Loan Fundamentals, Morgan Stanley, July 6, 2021

19 As of 3/31/2021 our position in Dell Technologies represented 1.25% of the Low Duration High Yield Fund. As of 6/30/2021 our position in Dell Technologies represented 1.81% of the Low Duration High Yield Fund.

20 As of 3/31/2021 our position in Hertz represented 2.74% of the Low Duration High Yield Fund. As of 6/30/2021 our position in Hertz represented 3.16% of the Low Duration High Yield Fund.

21 As of 3/31/2021 our position in At Home represented 0.37% of the Low Duration High Yield Fund. As of 6/30/2021 our position in At Home represented 1.07% of the Low Duration High Yield Fund.

22 A “cushion” bond is a callable bond with a high coupon that provides a higher yield the longer it remains outstanding.

23 As of 3/31/2021 our position in BuzzFeed represented 0.00% of the Low Duration High Yield Fund. As of 6/30/2021 our position in Buzzfeed represented 0.00% of the Low Duration High Yield Fund.

24 A special purpose acquisition company, or “SPAC”, is a publicly traded “blank check” company formed with the intent to purchase an unidentified business in the future. Investors purchase freely tradeable shares collateralized by the cash proceeds, which are escrowed and invested in U.S. Treasury bills. The corporate by-laws require that the accumulated cash be returned to investors at a pre-determined liquidation date (usually two years from issuance) or following a “de-SPAC-ing” event. Such an event occurs when shareholders vote in favor of a merger or acquisition. However, each individual investor can vote to receive its pro rata portion of cash rather than shares in the new entity. Effectively, this mirrors a bond with a stated maturity that is callable sooner upon a de-SPAC-ing event. Yield-oriented investors are attracted to these vehicles because they offer yields similar to T-bills, a “maturity” based on the investor’s ability to redeem at trust value and an embedded call option on a future business combination. Reflecting the amount of capital raised in the SPAC’s initial public offering, the initial offering price, typically $10.00 per share approximates the trust collateral value and demarcates whether the SPAC is trading at a premium or discount to trust value.

25 A private investment in a public equity, or “PIPE”, is the private purchase of shares of a publicly traded stock, often at a discount to the market price. A structured PIPE may take the form of common stock, convertible preferred shares or a convertible bond.

26 For a provocative and timely economic discussion, see It’s Time for a Debt “Jubilee”, Institute for New Economic Thinking, Richard Vague, September 11, 2020, https://www.ineteconomics.org/perspectives/blog/its-time-for-a-debt-jubilee

27 The Latin origin of jubilee is the verb iubilo meaning “shout for joy”.