The U.S. government’s aggressive stimulus in response to the COVID-19 crisis, while necessary, has been like drawing a bubble bath for the financial markets. The $1.9 trillion American Rescue Plan and an anticipated $2.0 trillion infrastructure program will keep the water warm, the suds fluffy and “…make bath time lots of fun”.1 Awash in investible cash and abundant confidence in a post-COVID economy, investors have driven financial markets to new heights and new issuance to record levels.

Rubber Ducky: Ode to Sesame Street

The U.S. government’s aggressive stimulus in response to the COVID-19 crisis, while necessary, has been like drawing a bubble bath for the financial markets. The $1.9 trillion American Rescue Plan and an anticipated $2.0 trillion infrastructure program will keep the water warm, the suds fluffy and “…make bath time lots of fun”.1 Awash in investible cash and abundant confidence in a post-COVID economy, investors have driven financial markets to new heights and new issuance to record levels.

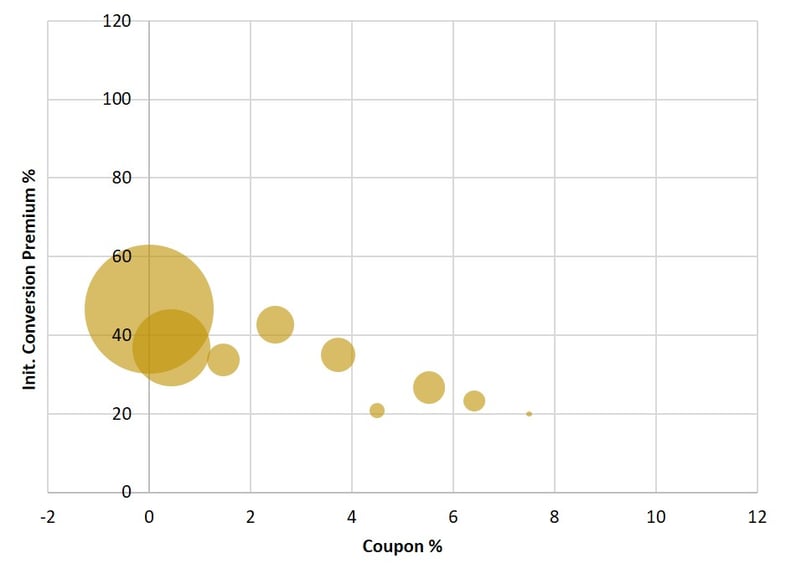

Conversion Premium and Coupon of 2021 Convertible Bond Issuance2

The convertible bond market provides an example of this liquidity. In 2020, convertible bond issuance was approximately $110 billion, nearly double the prior historical high.3,4 In the first quarter of 2021, issuance continued to accelerate. More startling, investor appetite has driven pricing to new lows, a boom for corporate issuers, but not so much for investors. The two major pricing components of a convertible bond are coupon and the imbedded call option.5 In 1Q21, 55% of convertible bonds were issued with a 0% interest rate and an imbedded call option at a 50% premium above the issuers’ stock price.6 We scratch our heads when thinking about this pricing. As a lender, the bondholder is senior to the equity but is not receiving a return on capital unless the stock price rises significantly. At that point, we would just rather own the common stock.

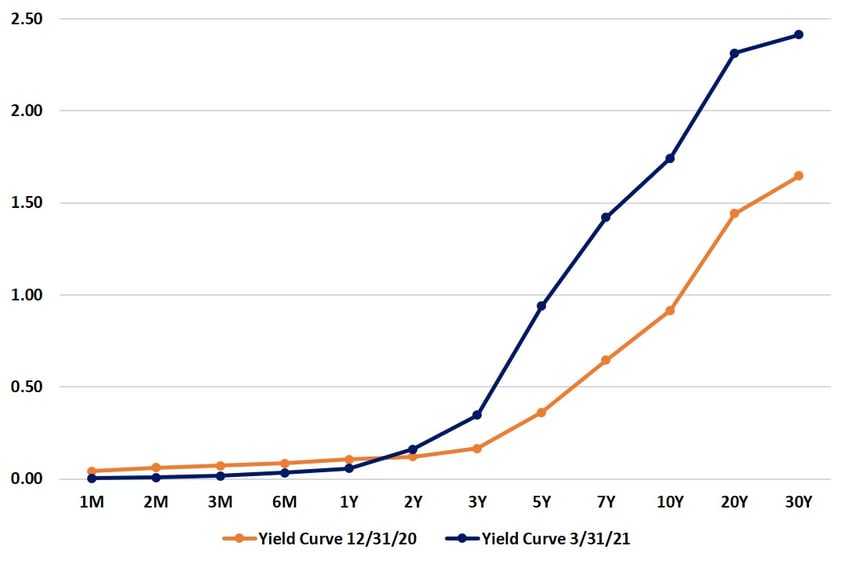

U.S. Treasury Yield Curve7

Beginning in mid-February, the market appeared to recognize the risk of ongoing stimulus funded by Government debt and the specter of inflation with yields for the 3- to 10-year U.S. Treasury bonds nearly doubling during the quarter. The Investment Grade Corporate Bond Index8 had a negative total return for each month during the quarter, culminating in a -4.95% quarterly total return. This was the worst quarterly performance since 3Q08 and the second worst quarter over the last 40 years. We do not have a crystal ball as to future interest rate movement, but a government policy that favors unnaturally low interest rates is not sustainable. We have been and continue to be defensive in our portfolio duration and see market normalization as an opportunity.

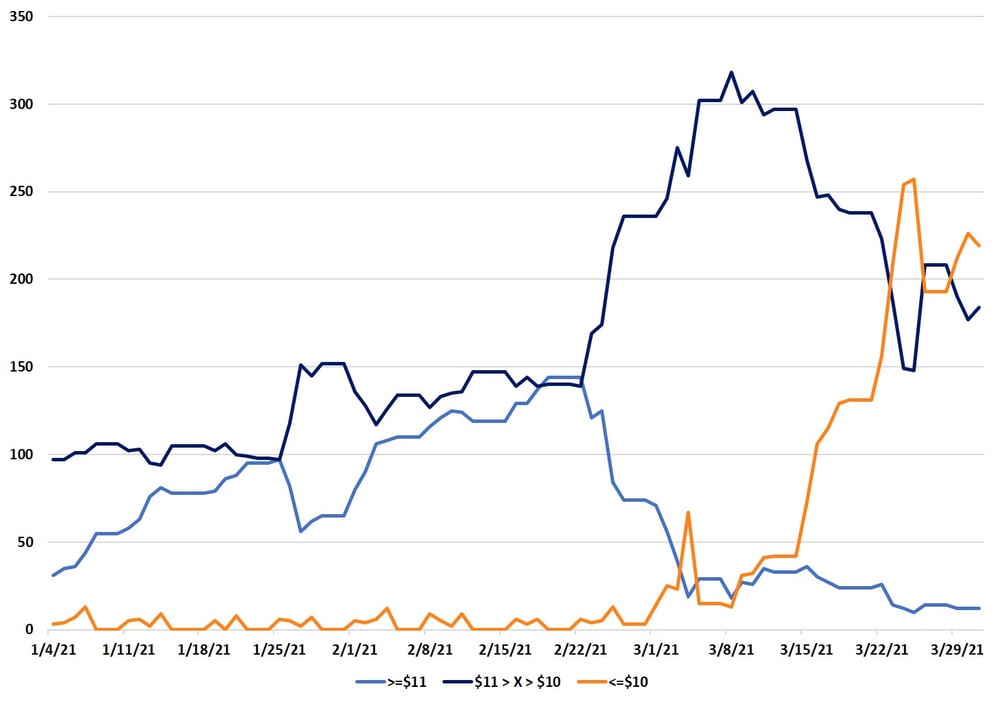

1Q21 SPAC Market Price Distribution9

Activity in the SPAC market reflects the decline in investor speculation as rising rates began to throw cold water on the market. Similar to the convertible bond market, SPAC issuance has been robust with over $97 billion in “blank check” capital raised in 1Q21; this amount exceeds all of the SPAC capital raised in 2020. As highlighted in previous letters, in 2H20 and early in 1Q21, a large portion of SPACs traded at a premium to their collateral trust value, an anomaly for the asset class. In late February, the rise in interest rates caused investors’ speculative fervor to fade and a renewal of rationality with respect to pre-merger SPAC pricing.11 As a result, with the majority of SPACs trading much closer to their $10.00 per share trust value and some SPACS with announced deals trading below trust value, we are seeing many more opportunities to invest in SPACS in keeping with our fixed-income oriented discipline.

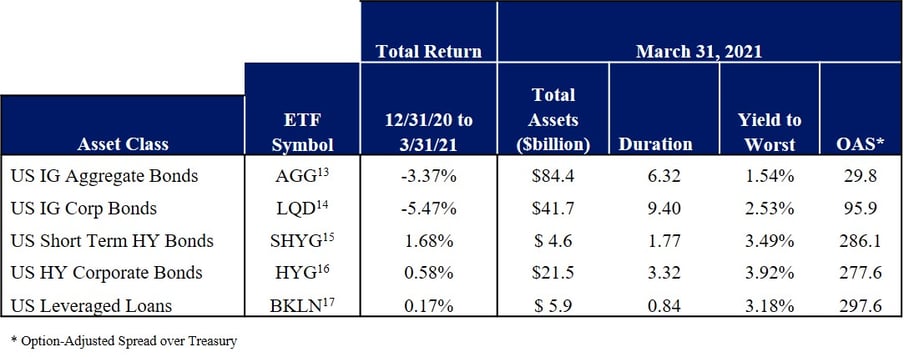

1Q21 Fixed Income Market Performance12

When interest rates go up, fixed income prices go down. This is exactly what happened in 1Q21. The table above provides several observations:

-

- The longest duration assets, IG Aggregate Bonds (AGG) and IG Corporate Bonds (LQD), performed the worst as, by definition, these are the most sensitive to a rise in interest rates. Conversely, shorter duration high yield bonds (SHYG) outperformed the broad high yield market (HYG).

- Price changes for less credit-worthy debt, such as high yield bonds and leveraged loans, were cushioned by wider credit spreads.

- The Option-Adjusted Spread for all corporate segments narrowed with the credit spreads for high yield bond declining the most. This likely reflects an increase in investor confidence in the economic outlook and expected improvement in corporate profitability.

- Floating rate securities benefit when short-term rates increase. However, the fixed nature of the credit spread causes a negative offset.

- Corporate spreads, in both investment grade and high yield, are now back to the levels seen just before the pandemic. Given investor appetite for yield and the positive economic outlook, we are unlikely to see a significant widening in credit spreads until market liquidity begins to decline, interest rates continue to rise, or economic expectations disappoint.

In our 4Q20 investor letter,18 we outlined several macroeconomic factors that we expected to impact the financial markets in 2021. Thus far, these views have been correct: negative real interest rates, a steeper yield curve and significant additional fiscal stimulus. We also expressed the view that investment opportunities would continue to arise from refinancings, corporate events and bankruptcies. Several examples of 1Q21 investments bear out these expectations:

Brazos Electric Power Cooperative (BRELPO) – Brazos is a Texas electrical power cooperative that provides generation and transmission services by wholesaling power to its members who then pass along the costs to retail customers. The cooperative has maintained an A credit rating for 80 years. As a direct result of the catastrophic generation and transmission failures caused by the winter storm that blanketed Texas in mid-February 2021, power prices sky-rocketed causing Brazos to build up an estimated $2.1 billion in charges19 over the seven-day freeze. Far exceeding its ability to make this payment, Brazos filed for Chapter 11 on March 1, 2021. Shortly after the bankruptcy filing, we were presented with the opportunity to purchase 503(b)(9) claims against Brazos, the debtor, which we purchased for the CrossingBridge Low Duration High Yield Fund at a price of 90. Although unsecured claims, they have administrative status as they are obligations that stem from the sale of goods (in this case, natural gas) to the debtor within 20 days of the bankruptcy filing. Unless the debtor is administratively insolvent, a rare occurrence, administrative claims must be “paid in full” as a requirement for confirmation of the Plan of Reorganization. Thus, we expect these claims to be paid at 10020 when Brazos exits bankruptcy. The timing of the company’s exit from bankruptcy is uncertain, which will impact the return of this investment. If the case takes one year from the time of our investment, the simple rate of return will be approximately 11.1%, which will decline to 5.4% if it takes two years (and so on).

UpHealth (GIX) – In November 2020, GigCapital2, a SPAC sponsored by GigCapital Global, announced that it had entered into agreements to combine with UpHealth Holdings and Cloudbreak Health, two leaders in digital/tele-medicine, to form a publicly-traded global digital healthcare company. The GigCapital2 investment values the combined company at approximately $1.55 billion, about 7.0x 2021 estimated revenue. At the time the transaction is completed, expected in 2Q21, the new company will issue $225 million of 6.25% Convertible Senior Notes due 2026 which will convert to common shares at a price of $11.50 per share, a 15% conversion premium to the price being paid by SPAC investors. Upon consummation of the de-SPAC-ing transaction, cash on the balance sheet is expected to exceed total debt, including the convertible notes. The CrossingBridge Low Duration High Yield Fund committed to participate in this issue that we believe to be creditworthy with equity upside.

SPAC-related Short-Term High Yield Opportunities – Some SPAC sponsors have sought mergers with private equity companies that may provide attractive short-term high yield opportunities in the target’s debt. In such cases, the company may be required to repay the debt, at the lenders’ option, due to a change of control provision in its legal documents. Further, should the merger be consummated, the cash provided by the SPAC is likely to result in a deleveraging event and an improvement in credit quality. During 1Q21, the CrossingBridge Low Duration High Yield Fund made several investments, following announcement of an issuer’s merger agreement with a SPAC, in anticipation that these obligations will be repaid upon consummation:

-

- Tempo Acquisition (TEACLL) (a.k.a Alight Solutions) - On January 25th, 2021 the Foley Transimene Acquisition Corp SPAC (Ticker: WPF) announced an agreement to acquire Alight Solutions for a pro-forma enterprise value of approximately $7.3 billion, in a deal that is expected to close in 2Q21. A slide presentation distributed at the time of the merger announcement indicates that the 6.75% Senior Notes due 2025 are expected to be repaid, while the Secured Notes will remain outstanding. We began purchasing the Senior Notes in March at a 2.88% weighted-average yield to the call price step-down date of 6/1/21, the likely take-out date. While leverage through the Senior Notes is over 6x, we are happy owning the securities regardless of the deal outcome due, in part, to their leading position in the health benefits management space, as well as the pre-deal trading levels of the Notes that were similar to where we acquired them.

- Hillman Group (HILCOS) – January 25, 2021, the Landcadia Holdings III SPAC (Ticker: LCY) announced an agreement to acquire the Hillman Group for an implied enterprise value of approximately $2.64 billion. Expected to close in 2Q21, the transaction is expected to include repayment of all Hillman debt, including the 1st Lien Term Loan due 2025 and the 6.375% Senior Notes due 2022. We purchased the Term Loan in late January at a 3.70% approximate yield to the estimated 4/30/21 close date and began to purchase the Senior Notes in February at a weighted average yield of 4.12% to the same date. The company, a leading distributor of specialty hardware, has been performing well, with 2020 estimated sales up 12% and estimated EBITDA up 24%.

- Ardagh Packaging (ARGID/ARD) – On February 23, 2021, the Gores Holdings V SPAC (Ticker: GRSV) announced an agreement to acquire the metal packaging business of Ardagh Group at an enterprise value of approximately $8.5 billion in a deal that is expected to close in 2Q21. Ardagh has indicated that it will use the sale proceeds to reduce net leverage, and we believe the 6% Senior Notes due 2025 are a likely target for repayment as they are the nearest bond maturity and the highest coupon in Ardagh’s capital structure. We began purchasing the Notes in late February at a weighted average yield of 2.53% to the 4/30/21 estimated close date.

We end the quarter wondering how long the “warm bath syndrome”21 will go on: Will investors be content to stay in while the water begins to cool or step out into the cold air of reality once the Fed dials back its support, the fiscal stimulus has been spent and growth begins to slow? In the meantime, we are enjoying “tubby-time” with our favorite little pal, Rubber Ducky. “And I've got a big fluffy towel to dry myself when I'm done."22

Reflective with optimism,

David K. Sherman and the CrossingBridge team

1 From Rubber Ducky, a song sung by Muppet character Ernie on Sesame Street, first heard on February 25, 1970. https://www.youtube.com/watch?v=jBy03hCclJY

2 Bloomberg

3 Total convertible bond issuance in 2019 was $56.8 billion.

4 Bloomberg

5 The imbedded call option gives the investor the ability to exchange the bond for a predetermined number of common shares of the issuer with the ratio of the bond’s par value to the number of shares implying a conversion or “strike” price.

6 Bloomberg

7 Bloomberg

8 BofA U.S. Corporate Index

9 A special purpose acquisition company, or “SPAC”, is a publicly traded “blank check” company formed with the intent to purchase an unidentified business in the future. Investors purchase freely tradeable shares collateralized by the cash proceeds, which are escrowed and invested in U.S. Treasury bills. The corporate by-laws require that the accumulated cash be returned to investors at a pre-determined liquidation date (usually two years from issuance) or following a “de-SPAC-ing” event. Such an event occurs when shareholders vote in favor of a merger or acquisition. However, each individual investor can vote to receive its pro rata portion of cash rather than shares in the new entity. Effectively, this mirrors a bond with a stated maturity that is callable sooner upon a de-SPAC-ing event. Yield-oriented investors are attracted to these vehicles because they offer yields similar to T-bills, a “maturity” based on the investor’s ability to redeem at trust value and an embedded call option on a future business combination. Reflecting the amount of capital raised in the SPAC’s initial public offering, the initial offering price, typically $10.00 per share approximates the trust collateral value and demarcates whether the SPAC is trading at a premium or discount to trust value.

10 Citigroup and Bloomberg

11 SPAC shares that trade significantly above trust value prior to announcement of a merger transaction reflect investor speculation that the SPAC sponsor will complete an attractive investment and cause the shares to appreciate.

12 Bloomberg

13 iShares Core U.S. Aggregate Bond

14 iShares iBoxx US Investment Grade Corporate Bond ETF

15 iShares 0-5 Year High Yield Corporate Bond ETF

16 Invesco Senior Loan ETF

17 iShares iBoxx High Yield Corporate Bond ETF

18 https://blog.crossingbridgefunds.com/blog/q4-2020-commentary-perception-is-reality

19 This compares to $774 million in power costs for all of 2020.

20 Holders of 503(b)(9) claims may also receive post-petition interest, usually at the Federal Judgement Rate (FJR), if other unsecured claims are awarded interest as part of the Plan of Reorganization. In this case, the FJR is 0.07% per annum, so any accrued interest is likely to be minor.

21 The “warm bath syndrome” is the concept that people cease to take action when they become comfortable. https://marketersclub.com.au/warm-bath-syndrome/

22 From Rubber Ducky, a song sung by Muppet character Ernie on Sesame Street, first heard on February 25, 1970. https://www.youtube.com/watch?v=jBy03hCclJY