Throughout history, pandemics have created structural changes: the fall of empires, the rise of Christianity, the collapse of economic systems, peace agreements among nations and societal introspection

A Change is Gonna Come1

Throughout history, pandemics have created structural changes: the fall of empires, the rise of Christianity, the collapse of economic systems, peace agreements among nations and societal introspection.2 Similarly, COVID-19 has laid bare social and economic inequalities, exacerbated political tribalism and revealed global weakness such as the vulnerability of the international supply chain. COVID-19 has also accelerated technological change affecting the way we work, the way we think and our priorities.

We have been busy during this period of powerful change looking for mispriced investments and have found them in some interesting asset classes.

SPACs (for those interested in a basic primer on SPACs please see the appendix)

During the COVID-19 pandemic, Special Purpose Acquisition Companies (SPACs) have evolved from a backwater niche to a bona fide stand-alone asset class.3 We contend that SPACs purchased below trust value with the intent to hold them to liquidation or redeem upon a business combination (whichever happens sooner) are an attractive short-term fixed income alternative.

According to SPACinformer.com4, there are 461 SPACS with $134 billion of trust value seeking merger partners and 120 SPACs with $35 billion of capital with pending transactions at quarter-end.5

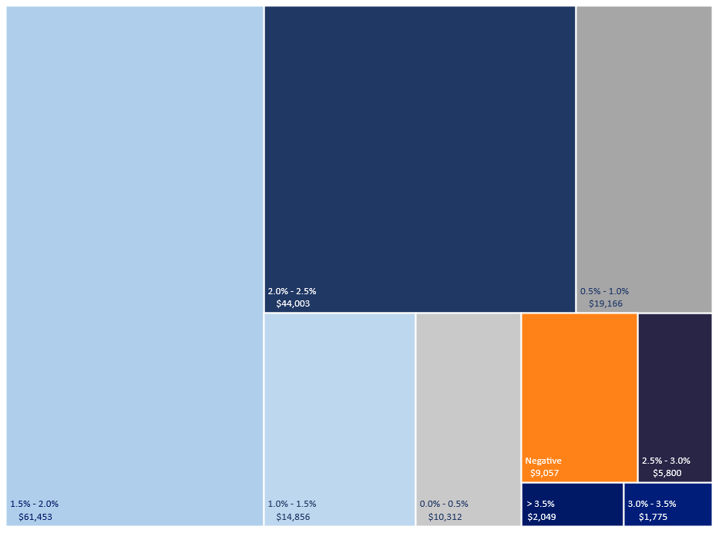

Special Purpose Acquisition Companies (SPACs) Trust Value ($millions) and Yield to Liquidation Date (%) - October 1, 20215

The subset of SPACS with a yield to liquidation greater than 2.0%, referenced in the chart above, is comprised of 229 companies with $53.6 billion of trust value. As a group these SPACS had a 2.4% yield to liquidation and time to liquidation of 1.1 years, which represents a 227-basis point spread to a comparable-maturity U.S. Treasury bond.5

Should a SPAC consummate a transaction substantially sooner than its liquidation date, the realized return will be significantly greater for investors that exercise the redemption right. For example, if all SPACs currently seeking targets closed transactions within the next six months, the yield to redemption date will be in excess of 4.0%. Additional upside may occur should the market become enthusiastic about an announced deal and drive the stock price above the trust value, allowing an exit through the sale of shares instead of redemption.

For example, in March of this year we purchased for the CrossingBridge Low Duration High Yield Fund, a position in Gores Guggenheim, which we exited in July.

Gores Guggenheim Inc. (GGPI, GGPIU)6 – On March 22, 2021, Gores Guggenheim, a SPAC, completed a $750 million IPO by issuing 75 million units, at $10.00 per unit, consisting of one share and 1/5 of a warrant with a strike price at $11.50 per share. Founded in 1987 and with experience in over 120 acquisitions, Gores has an excellent reputation that led us to believe that they would be successful in identifying a strong investment target and completing a business combination. Thus, with investment in SPACs a component of the strategy of the CrossingBridge Low Duration High Yield Fund, we participated in the SPAC’s IPO. In the weeks after the IPO, we sold a small portion of the position at a modest gain. With the units trading around the IPO price, minimal downside versus the liquidation price and optionality in the event that Gores announced an attractive acquisition, we retained the majority of the position. On July 8, there were rumors that Gores Guggenheim was going to merge with Polestar, the Volvo-backed electric vehicle producer, driving the unit price up above the trust value even though investors had no confirmation that a deal would actually occur or, if it did, whether the valuation would be attractive. Opportunistically, we sold more than half our position the next day and the balance the following week. Thereafter, the unit price fell back toward trust value, only briefly bouncing back toward the July high on September 27 when the deal with Polestar was officially announced. Subsequently, the unit price has fallen back below the prices at which we sold. Our belief is that many SPACs continue to be mis-priced and consequently represent a significant allocation in both funds.

Investors desiring a stand-alone fund dedicated to pre-merger SPACs as an alternative to short-term fixed income allocations should consider our recently launched ETF, CrossingBridge Pre-Merger SPAC ETF (SPC).

ESG Fixed-Income Market

According to J.P. Morgan,7 European corporate debt issuers actively pursuing environmental, social and governance (ESG) principals are often rewarded with a lower cost of capital whereas the same phenomenon is not yet prevalent in the U.S. This appears, to us, to be another market mis-pricing and future opportunity.

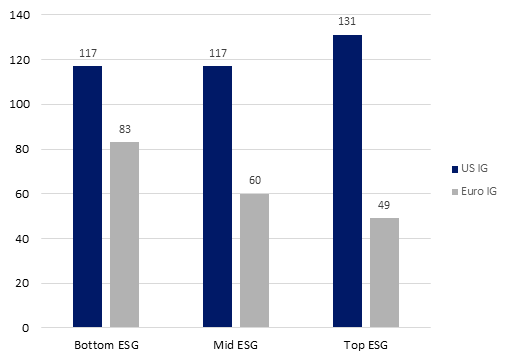

Industrial BBB Credit Spreads vs. ESG Scores7

The graph above illustrates the difference in the pricing of ESG-sensitive credit in Europe versus the U.S. Credit spreads of BBB quality European credits narrow as ESG scores improve. This sharply contrasts with the U.S. where the credit spreads of BBB credits do not appear to be correlated to the ESG score, and counterintuitively, the credits with the best ESG scores in the U.S. yield 14 basis points more than those with lower scores. Although we respect the objectives of ESG-mindful companies and the discipline required to execute these elements, credit quality must also be taken into account when determining the appropriate spread.

Many consider the Nordic financial markets as leaders in adopting ESG principals and standardization as well as a model to observe investor behavior. As one of the largest U.S. investors in the Nordic corporate credit market, we have witnessed firsthand the tightening in credit spreads for ESG-friendly companies when investors emphasized adherence to ESG standards.

Leroy Seafood Group (LSG NO, LSGNO)8 – Founded in 1899 and publicly traded in Norway, Leroy Seafood Group is a leading farmer of salmon and trout and producer of wild-caught whitefish, primarily cod. The company’s fish farms are primarily located along the coast of Norway and Scotland, with value-added processing and distribution in nine other European countries, Asia and North America. The company holds the second largest salmon farming license in Norway and 30% of the total quota license for the Norwegian wild-catch whitefish trawler fleet. The company is benefitting from growing consumer interest in fresh salmon and cod throughout Europe. Demonstrating its alignment with the Green Bond Principals published by the International Capital Markets Association in June 2021, the company established its Green Finance Framework in August 2021 and received a certification of its dedication to sustainability from DNV Business Assurance Norway. With pro-forma net leverage less than 1.8x, a BBB rating from the Nordic Credit Rating Service and endorsement of the company’s dedication to “green” principals, the company, in September 2021, issued NOK 500 million of 3.35% senior unsecured bonds due 2031 to fund investment in new and ongoing “green” projects. At this yield, the bond provided a yield-to-maturity that was 200 basis points in excess of the Norwegian 10-year government bond and 80 basis points greater than a U.S. BBB corporate bond with, in our view, better credit quality. The CrossingBridge Responsible Credit Fund participated in this new issue.

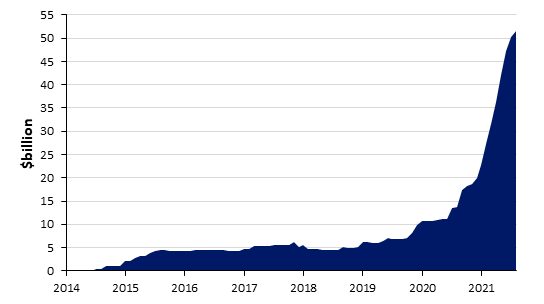

ESG Global HY Issuance9

Globally, ESG equity funds have grown from $299 billion at the end of 2017 to approximately $1.6 trillion in August 202110, a cumulative annual growth rate of approximately 67%. However, the global fixed income market has been slower to adopt ESG strategies with assets growing from approximately $350 billion in early 2018 to an estimated $500 billion in early 2021 for a cumulative average growth rate of less than 13%.11 As shown above, growth of global high yield issuance of ESG bonds has been robust over the last two years, although the issuance amount has been quite small relative to the whole high yield market. Generally, the U.S. has lagged Europe in ESG adoption, and the ESG-friendly high yield debt market is even further behind and in early stages. We are hopeful that ESG standardization and independent scoring will encourage broader mindfulness among corporate issuers rather than simply be a catalyst for one-off “green” projects. Then, the market should boom.

Final Reflections

In 2012, Samuel K. Cohen, Professor of Medieval History at the University of Glasgow, wrote:

No matter how contentious the underlying social and political circumstances, how high the body counts, how gruesome the signs and symptoms, how fast or slow the spread or course of a disease, pandemics did not inevitably give rise to violence and hatred. In striking cases they in fact did the opposite, as witnessed with epidemics of unknown causes in antiquity, the Great Influenza of 1918–19 and yellow fever across numerous cities and regions in America and Europe. These epidemic crises unified communities, healing wounds cut deep by previous social, political, religious, racial and ethnic tensions and anxieties.12

Anticipating change and prepared to adapt,

David K. Sherman and the CrossingBridge Team

APPENDIX

A special purpose acquisition company (SPAC) is a company with no commercial operations that raises money from investors through an IPO for the sole purpose of acquiring an existing private operating business within a specific period of time (generally up to two years). SPACs are sometimes called ’blank check companies’ because, at the time of the IPO, investors do not know the business in which the sponsor will choose to invest, although the sponsor’s track record of investment in certain industries or stated areas of interest may provide an indication. IPO proceeds are be placed in a trust account, typically invested in U.S. government securities, money markets, and cash. This trust account is held for the benefit of the SPAC’s common shareholders until it is used to fund a successful business combination, or until it is returned to investors once the SPAC is liquidated because it failed to consummate a merger. A unique feature of SPACs is that SPAC common shareholders have the option to redeem their shares for their pro rata interest in the trust should the investor choose not to participate in the newly formed company. In many cases, the SPAC sponsor may overcollateralize the trust at the time of the IPO, meaning that there is more money in the trust than the IPO proceeds raised with the excess cash held for the benefit of SPAC common shareholders in the event of redemption or liquidation. If SPAC common shares are purchased at or below trust value, we believe the opportunity exists to earn an attractive yield to liquidation with minimal principal risk. As a result of the shareholder-friendly redemption feature of SPACs, should a SPAC successfully pursue a business combination, an investor’s realized rate of return will likely be higher due to the shortened maturity of the security. Furthermore, a SPAC pursuing a business combination that is positively received by the market may result in equity upside above the trust value.

SPACs are commonly issued at $10 per unit with a unit consisting of one share and a warrant or fraction of a warrant. The warrant allows its holder to purchase a specified amount of common stock at a specified price for a specified time; typically, the exercise price is $11.50 and the warrant has 5 years until expiration. On average, 55-60 days following the IPO, SPAC unit holders may elect to separate their units into shares and warrants that will trade as standalone securities. Some investors may sell the warrants to reduce their initial cost, thereby enhancing the yield to liquidation or yield to redemption. Other investors may choose to sell their SPAC common shares to create a portfolio of long-term, out-of-the-money options of future business combinations. And, some investors may choose to keep the units, or the combination of SPAC common shares and warrants, to replicate the characteristics of a convertible bond.

Following their IPOs, SPAC units typically trade below their trust value. In the speculative period between Labor Day 2020 and St. Patrick’s Day 2021, SPAC units often traded far in excess of trust value, but that enthusiasm has since diminished.

Endnotes:

1 The song was written and performed by American singer-songwriter Sam Cooke and released in February 1964 on the Ain’t That Good News album. Becoming an anthem of the Civil Rights movement, the song was selected by Rolling Stone magazine in September 2021 as #3 among the 500 Greatest Songs of All Time.

2 For those interested in learning more about these topics, we recommend Pandemics That Changed History, History.com, December 21, 2020 https://www.history.com/topics/middle-ages/pandemics-timeline

3 The SPAC market has grown from 59 SPACs raising $14.0 billion in 2019 to a cumulative 670 SPACs raising over $200 billion in 2020 and 2021 (year-to-date).4

4 SEC and company filings through 9/20/21

5 www.SPACinformer.com SPACinformer.com is owned by an affiliate of CrossingBridge Advisors LLC.

6 The position in the Gores Guggenheim SPAC represented a 0.16% position in the CrossingBridge Low Duration High Yield Fund as of 6/30/21 and a 0.00% position as of 9/30/21.

7 Oceans Apart – Assessing the ESG Cost of Debt in Global Credit, J.P. Morgan, June 9, 2021. ESG Score refer to a numerical measure of how an individual security is perceived to be performing on a wide range of environmental, social and governance (ESG) topics.

8 The position in the Leroy Seafood Group represented a 0.00% position in the CrossingBridge Responsible Credit Fund as of 6/30/21 and a 1.33% position as of 9/30/21.

9 The Sustainable Finance Movement, Deutsche Bank, June 7, 2021

10 ESG Matters – Quant Edge, Bank of America, May 4, 2021

11 ESG Integration for DM Corporate Credit Analysis, Morgan Stanley, August 16, 2021

12 Pandemics: waves of disease, waves of hate from the Plague of Athens to A.I.D.S., Samuel K. Cohn, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4422154/