Government intervention often results in unintended consequences. Thomas Hoenig, former president of the Kansas City Federal Reserve Bank, in his just-published book, The Lords of Easy Money: How the Federal Reserve Broke the American Economy, argues that

Think Positive, but Test Negative

Attributed to Richard Fisher, former president of the Dallas Federal Reserve, in his December 30, 2021 appearance on CNBC’s Squawk Box. Unfortunately, the referenced video clip ends before he makes the statement, but David Sherman, who was listening to CNBC in his car, swears he heard Fisher say it. More importantly, we think the statement is an appropriate mantra for 2022 and we wholeheartedly agree with Fisher’s comments in this interview.

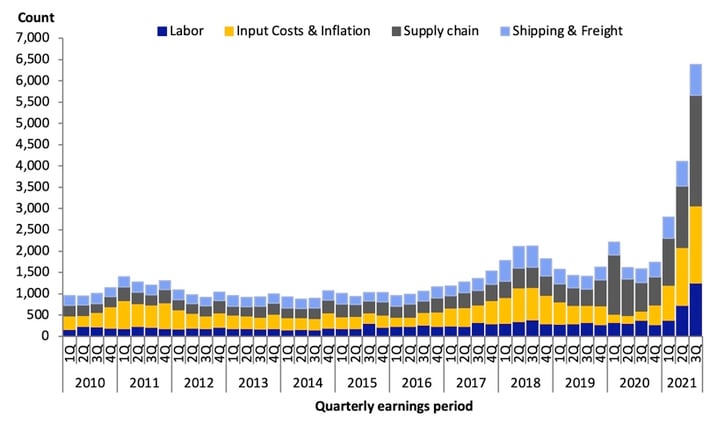

Word Count Mentions in Corporate Earnings Calls & Presentations1

Government intervention often results in unintended consequences. Thomas Hoenig, former president of the Kansas City Federal Reserve Bank, in his just-published book, The Lords of Easy Money: How the Federal Reserve Broke the American Economy, argues that the accommodative monetary policy initiated during the 2008 Great Recession “poured (money) through the veins of the financial system and stoked demand for assets like stocks, corporate debt and commercial real estate bonds, driving up prices across markets.”2 Hoenig warned that the Central Bank’s actions would create a trap that would be difficult to escape with harmful economic, social and political ramifications. COVID, combined with the stimulative actions of the Fed and Congress over the past two years, has brought new meaning to the phrase “unintended consequences.” The chart above reflects the fact that corporate executives have become fully aware of some of these outcomes. The concepts of “inflation,” “supply chain bottlenecks,” “labor costs” and “shortages” have become part of national headlines that are now permeating our daily lives.

After several years when the Federal Reserve held down interest rates and pumped in liquidity to stimulate the economy -- but struggled to achieve the target 2% inflation rate -- we are now experiencing inflation at levels unseen in the U.S. in 40 years. The Federal Reserve has now concluded that inflation may not be “transitory,” and has begun to taper its purchase of Treasury and mortgage-backed securities. Further, there is some cause for concern that additional monetary contraction may be necessary. The Federal Open Market Committee’s (FOMC) consensus in the December 2021 “dot plot”3 implies that the Fed may be teeing up three interest rate increases in 2022. Regardless, we believe real interest rates for many securities are likely to remain negative4 for the foreseeable future.

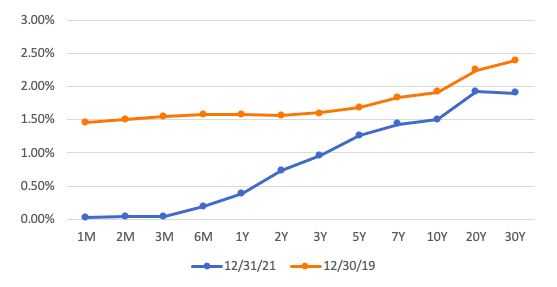

U.S Treasury Yield Curve5

Impact of an Increase in Interest Rates

How do we think will markets react to an increase in short term interest rates? Equity markets will likely have a negative reaction to the rise in rates, particularly among growth stocks, especially those with over-optimistic expectations6, as well as cyclicals and financials. Similarly, fixed income markets would weaken but the underlying yield will partially offset the impact depending on duration and credit sensitivity to expectations for growth and the future cost of financing. Above, we show the yield curve at YE21 as well as at the end of 4Q19, shortly before the pandemic began. Assuming that the Fed raises short term rates to attempt to harness near-term inflation, the yield curve is likely to flatten – short term rates rising while long term rates rise more modestly. Thus, the yield curve may end up looking a lot like that from 4Q19.

The table below shows the estimated impact on various fixed income asset classes of a flattening of the yield curve from that at YE21 to one similar to that at YE19. These calculations assume no change in credit spreads and are not a prediction of expected total return. It is notable in this scenario that short term corporate bonds, investment grade bonds and the 10-year U.S. Treasury would lose money, but high yield may provide a positive return due to its lower duration and higher coupon.7

| Modified Duration8 | Yield to Worst9 | Price Change | Calculated Annual Return | |

| ICE BofA 1-3 Year Corporate Bond Index |

1.46 |

0.55% | -1.48% | -0.93% |

| ICE BofA U.S. High Yield Index | 4.04 | 4.32% | -2.18% | 2.14% |

| ICE BofA U.S. Corporate Bond Index (Investment Grade) | 8.34 | 2.36% | -3.34% | -0.98% |

| 10-Year U.S. Treasury Bond | 9.15 | 1.51% | -3.72% | -2.21% |

Shorter duration strategies such as the CrossingBridge Ultra-Short Duration Fund (CBUDX) and CrossingBridge Low Duration High Yield Fund (CBLDX), which had durations of 0.49 and 0.85 at year-end, respectively, should experience less of an impact from the rise in rates and, because of a high proportion of near-term repayments, should have the opportunity to reinvest in the rising rate environment.

With respect to corporate credit spreads, we can look to a study conducted by UBS in which they asked the question: “How much Fed tightening can US corporate credit withstand?”10 Their conclusions suggest:

- Based on previous bouts of rate increases, a 50-basis point increase in the 5-year Treasury rate (similar to the rise suggested above) should lead to a 22-basis point increase in high yield spreads. This would result in an additional loss to the high yield bond index of less than 0.90%, reducing total return to 1.24%. For the investment grade bond index, the credit spread evidence indicates a 4-basis point increase in spreads, negatively impacting total return by about 0.34%, reducing total return to -1.32%.

- The degree of change in credit spreads related to a rise in interest rates is, to some degree, dependent on prevailing credit quality at the time the rates are rising. At present, high yield credit quality is very strong with leverage and debt to enterprise value significantly lower than in past periods of rate increases. Thus, a rise in rates is likely to have a lesser impact on credit spreads than we have seen in the past.

UBS also expressed the view that credit spreads are already pricing in the potential impact of a growth slowdown resulting from a rise in rates; thus, any impact from a rise in rates should be further mitigated.

Below, we discuss the factors that influenced the credit markets in 2021 and our expectations for 2022.

Capital Flows – In 2021, high yield bonds and leveraged loans were the best performing fixed income asset class in the U.S., with total returns of 4.8% and 4.6%,11 respectively. In comparison, investors holding U.S. Treasury and investment grade bonds lost money during the year. Interestingly, during the year, high yield had net outflows of $3 billion while investment grade bonds saw inflows of $132 billion. Investors steadily increased positions in leveraged loans, most likely attracted to the floating interest rate, adding $31 billion during the year.12 Of course, the Federal Reserve remained the largest single investor in U.S. Treasuries, purchasing nearly 54% of net issuance in the 24 months ended December 31 202113 -- a trend that could have long-term unforgiving outcomes. Looking forward, investors’ concerns regarding rising rates will likely drive continued flows into the leveraged loan market as well as fixed income alternatives with short duration, low credit risk and significant yield spread advantage, such as SPACs.

Credit Quality -- Despite the challenges presented by the pandemic, the U.S. economy grew in 2021, positively impacting credit. During the year, there were approximately $40 billion of rising stars and less than $10 billion of fallen angels.14 Further, Corporate America continued to fortify their balance sheets and retain large cash balances. As a result, high yield gross and net leverage declined to levels not seen since 2005-06, and investment grade leverage, both gross and net, fell to levels last seen in 3Q15.15 Naturally, with this improvement in credit quality and a robust capital market, defaults declined. In sharp contrast to 2020, when there were 109 defaults and restructurings totaling $141.4 billion16, there were only 21 defaults and restructurings totaling $13.0 billion in 2021, the lowest level since 2007.17 Looking forward, defaults are likely to remain contained as the amount of distressed bonds and loans18 is at a seven-year low at $33 billion.19 The current level equates to about 1.1% of the total high yield and leverage loan universe. Furthermore, the high yield maturity “wall of worry”20 has been pushed out to begin four years from now through 2028. Still, caution will be required to avoid credits that are vulnerable to dislocation from rising labor costs, inflation, supply chain bottlenecks and, of course, new entry disruptors.

Credit Spreads – At year-end, the high yield option-adjusted credit spread was 310 basis points over Treasuries with an effective duration of 4.0421, and the investment grade option-adjusted credit spread was 98 basis points with an effective duration of 8.34.22 Although high yield spreads are tight with little room for error, the current spread reflects the bottom of our fair-value range whereas investment grade spreads represent reasonable value. Our concern with bond yields is the paltry returns of U.S. Treasuries, as well as the level of investor speculation throughout the markets. For example, the increase in credit spread achieved by stepping down in quality from BB to B and from B to CCC for both bonds and loans is at or near the lowest level since the end of 2014.23 Thus, with spread levels near lows and reduced market compensation for taking on added credit risk, the high yield and leveraged loan market will be a “picker’s” market in 2022. The good news is we are building a pipeline of interesting opportunities from existing and new issuers.

Calls & Tenders – Called and tendered high yield bonds totaled approximately $342.4 billion, exceeding the 2020 level of $271.5 billion.24 As we projected in our 4Q20 investor letter, this provided significant investment opportunity for our short-term strategies. However, the universe of bonds that are ripe for redemption has been reduced. That said, with C-suites worries of potentially rising interest rates, there may be greater urgency for issuers to refinance longer-dated bonds. Opportunities among called and tendered high yield bonds will depend on interest rate expectations, corporate actions and investor appetite for new high yield bond issuance.

SPACs – The SPAC market grew in 2021. Today, there are 692 SPACs with $185 billion in trust.25 Given the fixed income aspects of pre-merger SPACs, this has provided a good source of short-term fixed income alternatives. At YE21, the weighted average yield to liquidation was 2.2% with a weighted average period to liquidation of 1.1 years.26 This is 5.7x the yield of the comparably dated U.S. Treasury bond. Further, we believe SPACs' total returns are likely to be higher as most are expected to close transactions sooner than their liquidation date, and there will be some SPACs that announce well-received transactions allowing investors to sell above liquidation value. For illustrative purposes, a SPAC with a liquidation yield of 2.2% and a maturity of 14 months that closes a transaction within 7 months would achieve a simple annualized return of 4.4%, assuming the investor redeems at that time.

Additional Thoughts

Economies and markets are cyclical by nature and governments’ ability to prevent downturns or permanently limit their severity is a misconception.

In order to lift the U.S. economy out of the Great Recession of 2008, the Government lowered interest rates and employed new tools to pump liquidity into the economy. In the face of the COVID-induced economic decline, Congress and the Fed doubled down and expanded on this policy:

- Lowering the Fed Funds interest rate by 150 basis points to 0.25%, within a matter of weeks in March 2020, where it remained at YE21.

- More than doubling the Federal Reserve balance sheet from $4.2 trillion at YE19 to $8.8 trillion at YE2127 and expanding debt purchases to include investment grade corporate and asset-backed debt as well as high yield ETFs.

- Establishing a $798 billion Small Business Administration forgivable loan program commonly referred to as the Paycheck Protection Program (PPP).

- Remitting direct payments to individuals in excess of $865 billion.

As reflected in GDP growth (estimated at over 5.5%) in 2021 and the performance of the U.S. equity market, many would assert these measures have been a success. However, some individuals and business owners may disagree. Further, market psychology has embraced the belief that the Government will come to the rescue in times of need and limit investor pain as reflected in the common use of the “Fed Put.”28 We believe the markets may be misallocating capital based on an underappreciation of risk. We are keeping close at hand our copy of Liquidity Black Holes,29 published in 2003 following the bursting of the internet bubble.

The political divide that began building during the 2004 Presidential election has only grown wider and more contentious. This will make it more difficult for politicians and policy makers to enact solutions that will encourage economic growth while broadening political, social and economic equality.

Concerns about the level of inflation are likely to be more extreme than the actual outcome. However, these fears will give businesses an excuse to raise prices and some of these increases are likely to stick permanently.

The labor shortage, started by pandemic-driven lockdowns, but exacerbated by immigration policies30 and an aging populace, is driving a shift in power from management to workers. This is likely to lead to increased wages and disposable income, which may factor into a more permanent level of inflation.

We have entered a new wave of technological innovation. Electric and autonomous vehicles, cloud computing, cost-competitive renewable energy, gene-based medicine and commercial use of outer space are just a sampling of our future. As these advances progress from the lab and the garage into our daily lives, the capital markets will need to continue to step up to fund their commercialization (perhaps, at more realistic valuations).

We believe that entrepreneurs, scientists, engineers and hard-working individuals will continue to pursue their endeavors. We are hopeful that the capital markets will be supportive. We are deeply concerned that policy makers and politicians may screw it up. Once again, on his car radio, David Sherman, claims he heard CNBC financial pundit, Jim Cramer say that in order to beat inflation, they may have to destroy the economy. We prefer to think positive but will be on guard for the negative.

Prepared for 2022 while hopeful for a happy and healthy new year,

David K. Sherman and the CrossingBridge Team

Endnotes:

1Credit Notes: 2021 in retrospect: Strong fundamentals, reduced premium, Goldman Sachs, December 17, 2021

2The Fed’s Doomsday Prophet Has a Dire Warning About Where We’re Headed, Politico, 12/28/21 https://www.politico.com/news/magazine/2021/12/28/inflation-interest-rates-thomas-hoenig-federal-reserve-526177

3Summary of Economic Projections, Federal Reserve, December 15, 2021 https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20211215.htm

4Bloomberg

5The real rate of interest is the market rate of interest adjusted for the inflation rate (i.e. If the 10-year interest rate is 3.0% and inflation is 2.0%, the real rate of interest is 1.0%). If the real rate of interest is negative for a certain instrument, this means that inflation is greater than the market interest rate and investors in this security are losing purchasing power versus inflation. To earn a return greater than inflation, investors may need to purchase a security with higher credit risk, such as high yield bonds.

6Per Bank of America, 79% of companies going public in 2021 (through October) were unprofitable (the highest level going back at least to 1992). Source: SMID Cap Focus Point – IPOs: Party like its 2021, Bank of America, November 29, 2021.

7Enthusiasm for equities in 2021, is reflected by inflows into the equity market of an estimated $1.1 trillion, an amount which exceeds the cumulative inflows over the previous 19 years. Source: BofA, Bloomberg and Mehlman, Castagnetti, Rosen & Thomas.

8Bloomberg

9Bloomberg

10How much Fed tightening can US corporate credit withstand? UBS, December 16, 2021

11CS Credit Strategy Daily Comment, Credit Suisse, January 4, 2022

12CS Credit Strategy Daily Comment, Credit Suisse, January 4, 2022

13Oxford Economics

14CS Credit Strategy Daily Comment, Credit Suisse, January 4, 2022. Rising stars are high yield credits that are upgraded to investment grade. Fallen angels are investment grade credits that are downgraded to high yield.

15Morgan Stanley, Bloomberg, S&P Capital IQ

16High Yield Bond and Leveraged Loan Market Monitor, J.P. Morgan, January 3, 2022

17Default Monitor, J.P. Morgan, January 3, 2022

18Distressed bonds are defined as those trading below 70; distressed loans are defined as those trading below 80.

19Default Monitor, J.P. Morgan, January 3, 2022

20The “wall of worry” in the fixed income market is the projected annual level of bond maturities stretching out into the future. A high level of near-term maturities in a constricted capital market is particularly concerning as it could cause an increase in financing costs and/or lead to a higher default rate. With the wall of worry pushed out, refinancing concerns are deferred.

21ICE BofA U.S. High Yield Index, Bloomberg

22ICE BofA U.S. Corporate Index, Bloomberg

23High Yield Bond and Leveraged Loan Market Monitor, J.P. Morgan, January 3, 2022, Morgan Stanley, Bloomberg, S&P Capital IQ

24High Yield Bond and Leveraged Loan Market Monitor, J.P. Morgan, January 3, 2022

25www.SPACinformer.com SPACinformer.com is owned by eBuild Ventures, an affiliate of CrossingBridge Advisors, LLC.

26www.SPACinformer.com SPACinformer.com is owned by eBuild Ventures, an affiliate of CrossingBridge Advisors, LLC.

27Federal Reserve, https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

28The belief that the Federal Reserve would provide the monetary stimulus necessary to support the financial markets.

29Liquidity Black Holes: Understanding, Quantifying and Managing Financial Liquidity Risk, edited by Avinash D. Persaud, Risk Books, 2003

30Without Immigration, U.S. Economy Will Struggle to Grow, Federal Reserve Bank of Dallas, April 9, 2020 https://www.dallasfed.org/research/economics/2020/0409