It’s the season when companies, investors and financial gurus look into their crystal balls to predict the economic and market path for the new year. During our morning coffee ritual, we were excited to read TheDailyMail.com headline: “A time for transformation, freedom... and PROSPERITY! Astrologers reveal why 2023 could be your BEST year yet for money and romance.

Qué Será, Será – The Future’s Not Ours to See1

It’s the season when companies, investors and financial gurus look into their crystal balls to predict the economic and market path for the new year. During our morning coffee ritual, we were excited to read TheDailyMail.com headline: “A time for transformation, freedom... and PROSPERITY! Astrologers reveal why 2023 could be your BEST year yet for money and romance.”2 We agree whole-heartedly! However, this runs in stark contrast to the CNBC CFO Council Q4 2022 Survey3 in which over 80% of respondents predict a recession in 2023.

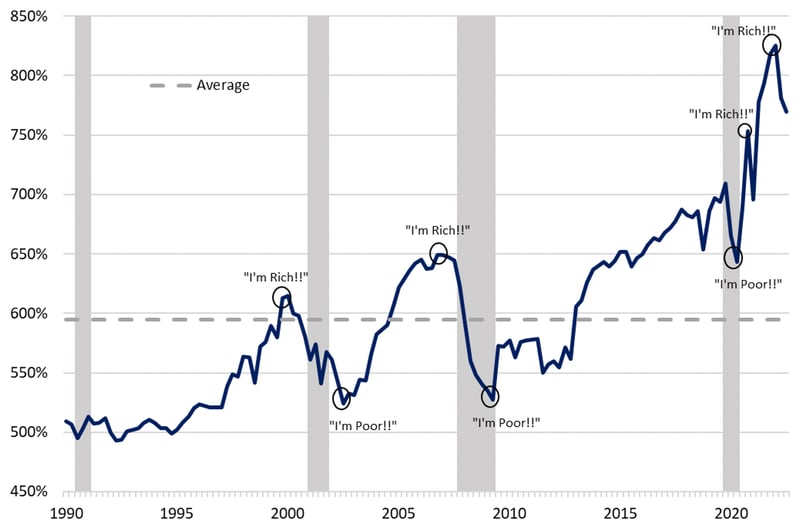

Household Net Worth as a percentage of Disposable Personal Income4

Shamelessly borrowed from the economist David Rosenberg, the graph above illustrates the relationship between household disposable income and household wealth. Basically, when your household wealth grows at a robust pace, you feel “richer” and when net worth declines, you feel “poorer”. This changes behavior which ultimately ripples through the economy.5

As bottom-up investors, we subscribe to the adage: “Return of principal is more important than return on principal.” In 2022, all four CrossingBridge Funds produced positive returns for the year. While returns were exceptional on a relative basis, ultimately investors will judge us on long-term performance.

Although the market is not necessarily cheap, it is also not expensive. Opportunities will arise from uncertainty, volatility, flow of funds and a “day of reckoning” among borrowers. We continue to subscribe to many of the themes we have communicated over the past year. We are optimistic with respect to future absolute performance. That said, we have our work cut out for us in 2023.

THEMES FOR 2023

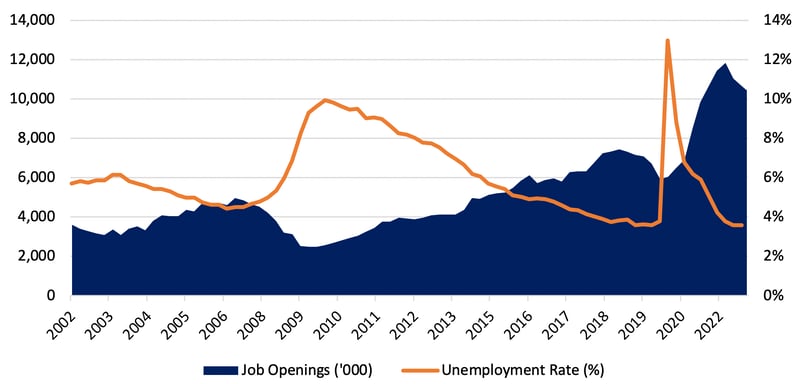

US Job Openings & Unemployment Rate6

Inflation is expected to decline but will remain. The Federal Reserve will continue rate increases. Although it may ultimately pause, the Fed won’t pivot unless systematic risk emerges. Unemployment remains low and employers continue to have difficulty filling job openings; recent layoffs are not sufficient to close the gap.7 This problem may be being exacerbated by the fact that there is a significant disparity between the labor demanded and the skills of the labor supply. Moreover, as noted above, household wealth remains near peak. COVID-related stimulus drove up household wealth as a percentage of disposable income to exceed the giddy days prior to the Great Recession of 2008. Although the market declines of 2022 have caused the ratio to retreat, levels are still elevated, significantly above prior peaks of 2007 and 2019. Consequently, the Fed has determined there is plenty of room to raise rates in an effort to quell inflation even if it risks a recession.

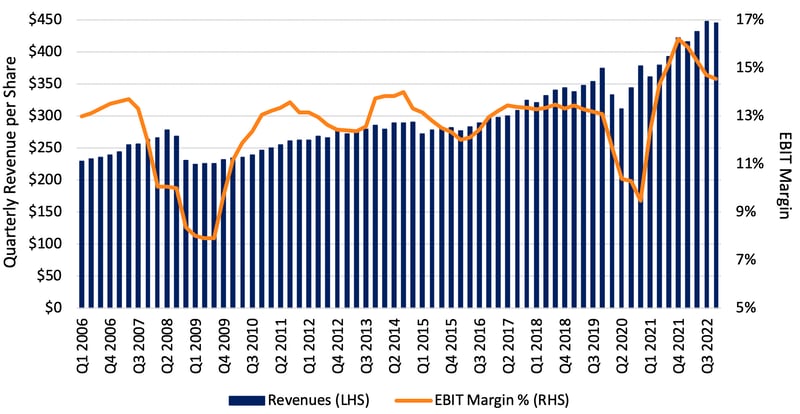

S&P EBIT Margins & Revenues8

Corporations are in pretty good shape, but the differences between the “haves” and the “have nots” are likely to widen. Maturity profiles for high yield issuers have been pushed out with 85% of bonds maturing three years out and beyond. Corporations are de-risking their balance sheets by using cash balances to repay obligations at or before maturity.9 Regardless, profit margins will narrow. Inflation in the cost of raw materials and labor, as well as the Fed’s efforts to reduce demand, will pressure profit margins. The possibility exists that margins may decline to the trough levels seen in the recessions of 2008-9 and 2020 as shown above.

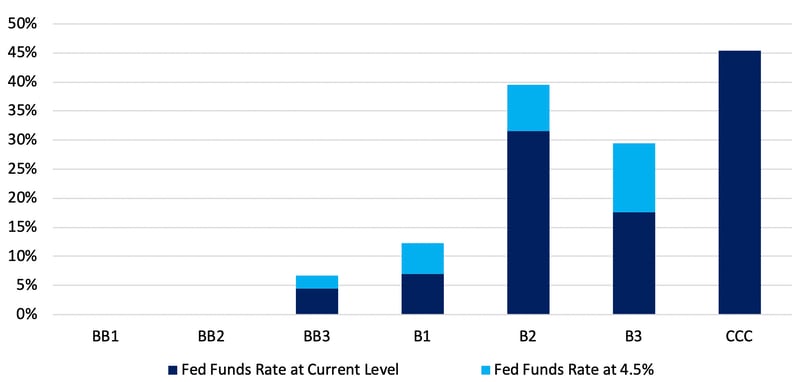

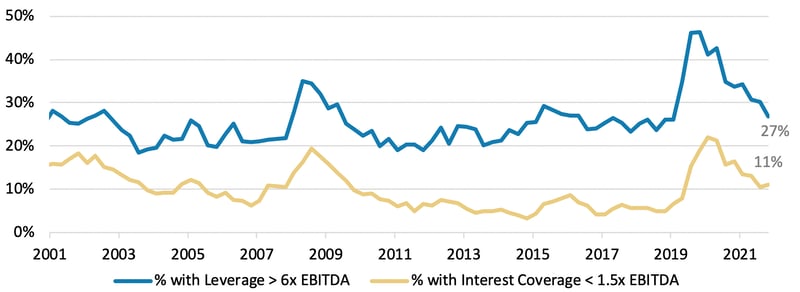

Percentage of Companies with Fixed Charge Coverage Less than 1.5x10

Higher interest rates have increased the cost of debt and reduced asset valuations. Corporations with lower leverage will feel less impact from rising interest rates and will be better able to withstand a decline in profitability caused by a reduction in revenues or narrowing margins. That said, higher interest rates will increase the incidence of distress among over-levered companies, those with bad business models and corporate “zombies”11, all of which have benefitted from cheap money. Moreover, the slowdown in the residential real estate market and the decline in the stock market are directly tied to the increased cost of capital and the lower present value of future cash flows that result from higher interest rates.

Loan Issuers with High Leverage and Low Interest Coverage12

Leveraged loan market will present opportunistic investments. As shown in the graph above, credit quality has improved significantly since mid-2020. This should provide us with the opportunity to invest in leveraged loans that provide both better credit quality and higher yields, given the rise in rates. Moreover, in contrast to the past two years, during which collateralized loan obligations (CLOs)13 have accounted for more than 50%14 of new loan purchases, CLOs are likely to have a reduced presence in the market as over 40% of them, by assets under management, will have reached the end of their investment period.15 Thus, with less competition for these investments, borrowers will have less power, likely leading to higher yields, lower leverage and better terms. “Cov-lite”16 deals, which afford lenders much less protection in the case of credit deterioration, comprised over 91% of the leveraged loan issuance over the past two years;17 this should begin to reverse as non-CLO lenders are likely to demand better covenant packages to fund new loans.

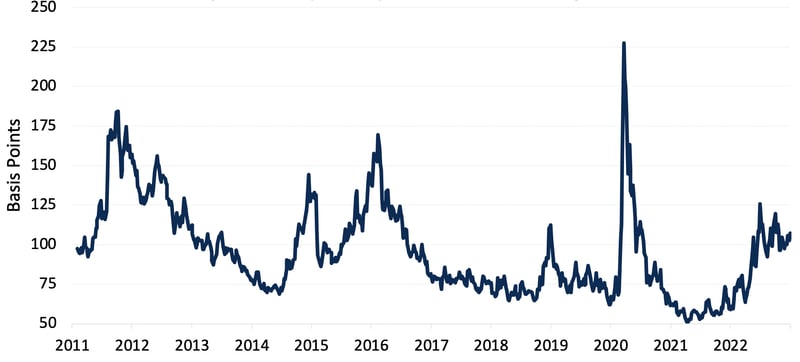

High Yield Spread per Turn of Leverage18

Bond spreads are “middle of the road” – not cheap, not expensive – but provide improved return versus risk. At 481 basis points, the average credit spread for high yield bonds19 is nearly at the long-term median of 489 basis points. However, the credit spread per turn of leverage, a reflection of compensation for taking on additional credit risk, has increased since the beginning of 2022. At 107 basis points, it is above the long-term median, 89.5 basis points, a level not seen, but for brief periods in 2019 and 2020, since prior to 2017. It has been a common complaint among high yield bond professionals that, in the environment of low rates experienced in recent years, investors have bid down credit spreads to capture yield seemingly with little regard for credit risk. With the rise in high yield spread per turn of leverage, high yield investors are being paid better for taking on risk.

Investment Approach and Portfolio Positioning

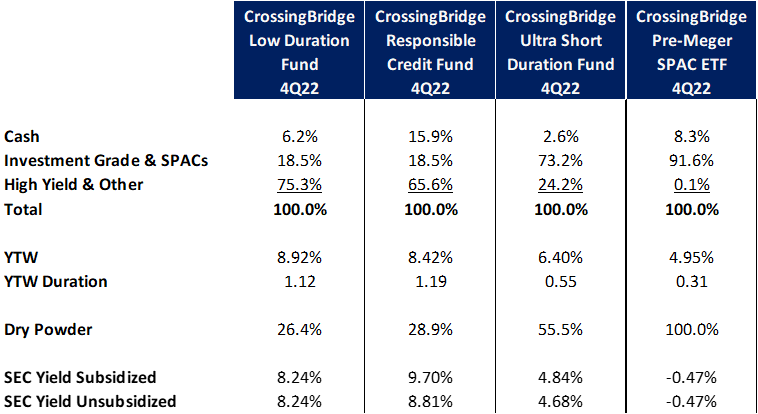

Note: the Yield to Worst (YTW) of the Pre-Merger SPAC ETF is represented by its expected Yield to Liquidation.

At year-end, the portfolios remain defensively positioned, maintaining attractive yields while keeping duration relatively low and holding significant “dry powder”20 to take advantage of opportunities as they arise.

In the song, Qué Será, Será, Doris Day asks the question, “Will we have rainbows day after day?” We answer – definitely not, but the attractiveness of the high yield and leverage loan market have improved. Over the past year, many fixed income investors were hurt by the sharp increase in rates. In contrast, we protected our investors by keeping duration low to reduce interest rate risk, focusing on near term events when selecting specific credits. Now, with the end of the rate rise cycle in sight sometime over the next year, risk in the fixed income market has largely shifted from interest rates to credit. In the current environment, we feel well-equipped as bottom-up investors to choose investments that will pay off as expected while capturing the higher yields that prevail in the market.

“Whatever will be will be”,

David K. Sherman and the CrossingBridge Team

Endnotes:

1 Qué Será, Será (Whatever Will Be, Will Be), is a song written by Jay Livingston and Ray Evans, first published in 1955 and popularized after Doris Day sang it in the 1956 Alfred Hitchcock film, The Man Who Knew Too Much. Although the Spanish-like spelling and Italian-like form suggest a non-English origin, the saying is a mis-translation of a 16th century English heraldic motto which has no origin in either Spanish or Italian.

2 A time for transformation, freedom... and PROSPERITY! Astrologers reveal why 2023 could be your BEST year yet for money and romance, DailyMail.com, December 26, 2022, https://www.dailymail.co.uk/femail/article‐11533617/Astrologers‐reveal‐whats‐store‐star‐sign‐2023.html

3 Dow headed back below 30,000, slim chance for soft landing for economy in 2023: CNBC CFO survey, www.CNBC.com, December 28, 2022

4 Special Report - The 2023 Outlook: The Year of the Rabbit Means Hopping Back to the Bond-Bullion Barbell, Rosenberg Research, January 5, 2023, Haver Analytics, FRED Economic Data, Federal Reserve Bank of St. Louis (chart end-date: 9/30/22)

5 It may seem obvious that whether one feels rich or poor is dependent on one’s net worth relative to disposable income and that, after a year in which both bonds and equities experienced significant declines, we might be feeling poorer. However, as shown in the graph above, even after such draw-downs, aggregate wealth relative to disposable income is just below the peak and above every other period over the last 30+ years.

6 FRED Economic Data, Federal Reserve Bank of St. Louis (chart end-date: 9/30/22)

7 For those who want to better understand the relationship between unemployment and job openings, known as the Beveridge Curve, this can be examined in more detail on the website for the Bureau of Labor Statistics at https://www.bls.gov/charts/job-openings-and-labor-turnover/job-openings-unemployment-beveridge-curve.htm .

8 Bloomberg (chart end-date: 12/30/22)

9 Capital Allocation: Thinking Like a CFO, BofA Securities, November 15, 2022

10 State of the Credit Markets and Best Ideas, BofA Securities, January 6, 2023

11 We discussed “zombie” credits in our 2Q19 investor letter, Rise of the Living Dead. Zombie companies are defined as non-financial companies that are over 10 years old and unable to cover their interest expense from current operating income for three consecutive years. Typically, they survive on expanding borrowings facilitated by low interest rate environments.

12 Fundamentals – Bracing for Earnings Damage, Morgan Stanley, January 6, 2023 (chart end-date: 9/30/22)

13 Collateralized Loan Obligations are securitized pools of syndicated loans that are sold in tiered tranches of debt and equity so that CLO investors may choose to invest in specific tranches that meet their desired level of risk and associated rate of return.

14 BofA Securities

15 CLO Outlook: JekyLL vs Hyde, BofA Securities, November 22, 2022

16 “Cov-lite” loans are loans that are issued with fewer restrictions on the borrower and less protection for the lender due to their lack of covenants. Some leveraged loan investors have made the point that cov-lite loans protect the borrower and lenders in times of stress since lenders have limited ability to force a “day of reckoning”, allowing the company breathing room to work through their issues. Generally, we prefer loans that are not cov-lite and have made the analogy that cov-lite loans are similar to an uber-wealthy person getting married without a pre-nup.

17 High Yield Bond and Leveraged Loan Market Monitor, J.P. Morgan, January 3, 2023

18 HY Credit Chartbook, BofA Securities, January 4, 2023

19 ICE BofA US High Yield Index

20 “Dry powder”, in the context of our portfolios, is defined as cash and investments that are expected to be repaid within 90 days as well as pre-merger SPACs that can be sold at or close to liquidation value. The liquidation value is the amount of cash and short-term securities held in a SPAC’s trust that is to be invested in a target company, distributed to shareholders who elect to redeem their shares for cash rather than invest in a proposed transaction or returned to shareholders at the liquidation date if the SPAC fails to find a merger partner. The “dry powder” category includes securities such as called bonds and debt maturing in less than 30 days. Called or maturing bonds with an ultra-short period to redemption may provide a misleading representation of portfolio metrics due to the potential large impact on yields from minor pricing variances versus the upcoming redemption price. Investments represent a snapshot of a specific point in time and may not reflect future positioning.