Perception of a post-COVID economic rebound and 2021 optimism became a financial market reality in 2020, with robust bullishness across most asset classes from stocks to bonds to bitcoin. This is a classic illustration of “reflexivity” in which a feedback loop between expectations and economic fundamentals causes price trends to overshoot. The belief that the “Fed Put” will provide liquidity at all costs has been and continues to be the catalyst for the market rebound.

Perception is Reality1

Perception of a post-COVID economic rebound and 2021 optimism became a financial market reality in 2020, with robust bullishness across most asset classes from stocks to bonds to bitcoin. This is a classic illustration of “reflexivity” in which a feedback loop between expectations and economic fundamentals causes price trends to overshoot. The belief that the “Fed Put” will provide liquidity at all costs has been and continues to be the catalyst for the market rebound.

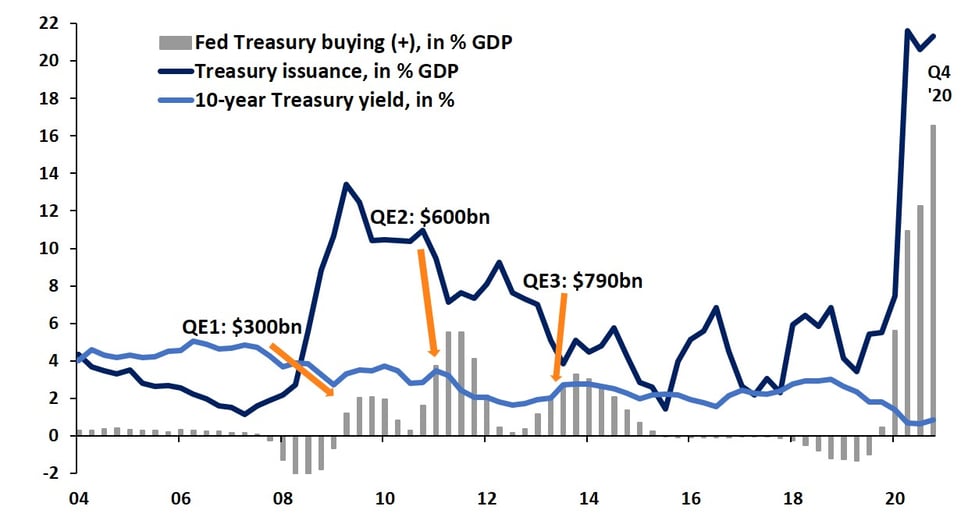

The Fed Put2

Cooperation between the Fed and US Treasury pushed interest rates to historic lows creating an incentive for investors to search for returns and blur the lines between investing and speculation. For comparison purposes, rates are lower than those seen during the Great Recession or post the Great Depression.3

Historical US Treasury Rates4

| UST | 12/31/2020 | 12/31/2019 | 12/31/2009 |

| 1M | 0.030% | 1.430% | 0.030% |

| 3M | 0.058% | 1.544% | 0.048% |

| 6M | 0.081% | 1.578% | 0.186% |

| 1Y | 0.104% | 1.566% | 0.435% |

| 2Y | 0.121% | 1.569% | 1.135% |

| 3Y | 0.165% | 1.609% | 1.676% |

| 5Y | 0.361% | 1.691% | 2.679% |

| 7Y | 0.643% | 1.831% | 3.384% |

| 10Y | 0.913% | 1.917% | 3.837% |

| 30Y | 1.645% | 2.390% | 4.641% |

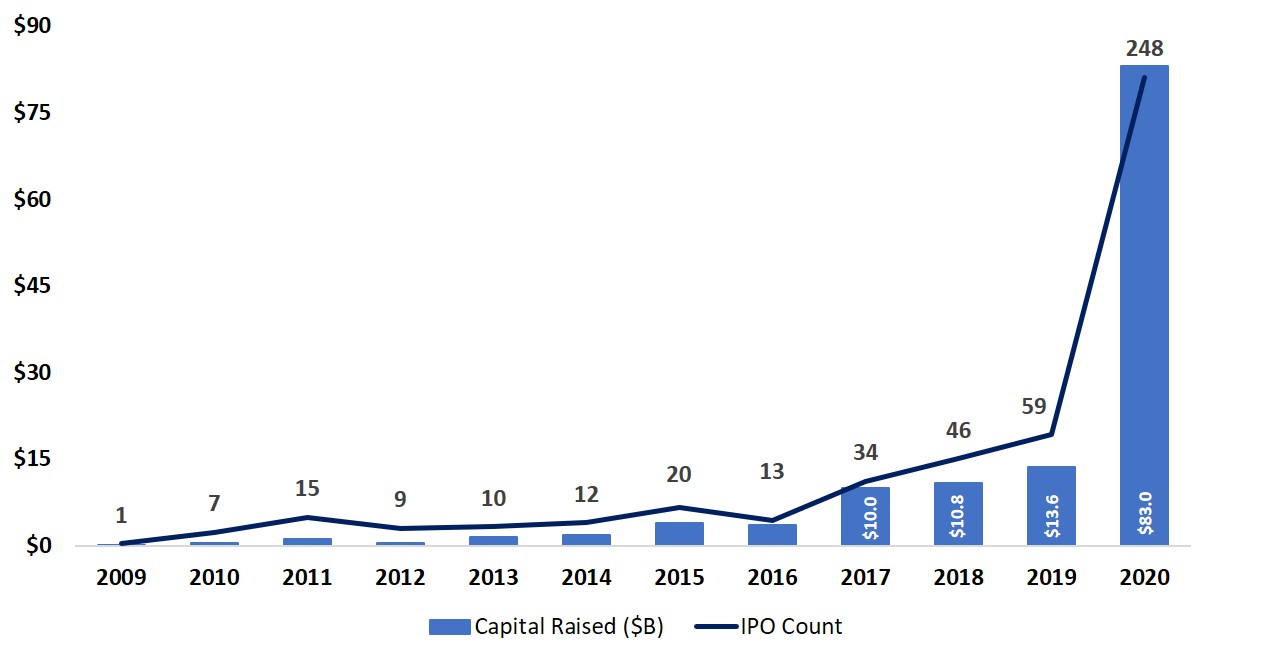

SPAC5 mania is illustrative of investors being pushed to pursue investments outside of traditional parameters and succumbing to speculative fervor. Until recently, SPAC secondary pricing predictably provided yields to the expected liquidation date in excess of equivalent US Treasuries6. This has given way to speculation among SPAC investors focused on buying a call option on a “hot” post-merger opportunity, effectively a publicly traded venture capital or private equity investment, in hope of outsized capital gains. As a result, it has become common to see SPAC IPOs7 trade at premiums to collateral NAV8 , resulting in negative terminal yields.

U.S. Listed SPAC IPO Activity: 2009 - 4Q 20209

![]()

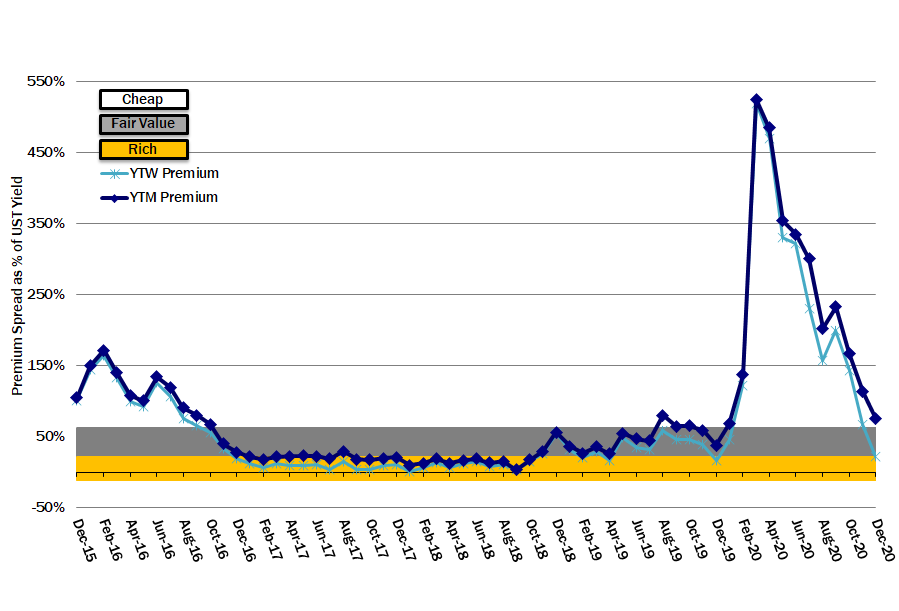

That said, overall, the high yield market reflects reasonable pricing and value. Investors may bristle at the 4.24% yield-to-worst10, but, after adjusting for future defaults and associated losses, the net credit spread remains attractive relative to the 10-year US Treasury rate; if one takes offense, the fault lies in the low “risk-free” rate of US Government bonds.

Risk Adjusted, After-Tax Premium Spread of High Yield over 10-year UST11, 12

At this juncture, it is worthwhile to review several factors impacting the credit markets in 2020 and implications for 2021.

Capital Flows – COVID lockdowns spurred investors to pull approximately $1.2 trillion from the bond and equity markets into money market funds from the end of March through May 2020. Subsequently, around $450 billion of the capital returned. Consequently, high yield bonds had record inflows from retail investors13 with over 50% directed to actively managed mutual funds, a reversal of the trend since 2014. That said, a significant amount of cash remains “on the sidelines,” an expected $650 billion, likely to return in 2021 to support further gains. 14

Upgrades and Downgrades – 2020 was a record year for credit downgrades, both by number of issuers and dollar volume, with the lowest ratio of upgrades to downgrades since 2009.15 “Fallen angel”16 volume rose to a record, over $231 billion in principal value, with 61 separate credits worldwide being downgraded to high yield.17 Without the addition of these fallen angels, the high yield market would have shrunk in 2020 rather than growing from $1.42 trillion to $1.64 trillion.18 We are now seeing a reversal as management teams focus their attention on balance sheets and businesses experience improving economic conditions. In 2021, we expect that identifying candidates for upgrade will be as important as identifying downgrade risks.

Defaults – Through November, there have been over 105 defaults or distressed exchanges related to over $135 billion (par amount) of U.S. corporate debt, an amount that ranks second to that seen in 2009.19 Looking forward, we believe that restructurings will continue, but it is likely to be in the form of a “steady drizzle” over the next several years rather than the “downpour” experienced as a result of the COVID-19 epidemic.

Default Losses – Defaulted high yield bonds experienced their worst recoveries of 18% in nearly 40 years, due to the high concentration of defaults among failing “brick-and-mortar” retailers and highly levered energy companies faced with a sharp decline in energy prices.20 Meanwhile, recoveries on leveraged loans of 48% were comparable to those experienced in 2019 but are at the low end of the range over the last 30 years.21 We expect 2021 recovery rates to improve for bonds but continue to deteriorate for leveraged loans due to the ongoing deterioration of lender protections in that sector.

Stressed (not Distressed) Bonds – Of the $121.3 bn of high yield bonds that were added to the CCC portion of the market in 2020, approximately 44% was comprised of newly issued bonds; the remainder consisted of bonds that were downgraded from BB or B.22 Of $110 billion of CCC bonds that left the market, approximately 61% were repaid, while the balance exited as a result of default.23 Thus, there are several observations: 1) CCC issuers had access to the capital markets; 2) there was a significant level of default among CCC issuers and 3) despite high defaults, there were many credits that survived to the point that they were repaid. With the capital markets open and the economy moving toward a post-COVID recovery, CCC issuance should continue and the portion of CCCs that are repaid, either via refinancing or free cash flow, should increase relative to those that default.

Stressed (not Distressed) Loans – Approximately $20 billion of retail capital flowed out of the loan market in 2020.24 At the same time, collateralized loan obligations (CLOs) struggled to meet credit quality requirements as a result of downgrades and defaults among loan issuers. As a result, loans finished the year with credit spreads at 430 basis points25 versus 382 basis points for high yield bonds.26 Loan default rates increased from 1% at the end of 2019 to 4.7% at the end of 2020,27 so, while loans are likely to provide a yield advantage, investors will need to select specific loans carefully to avoid defaults and losses.

Calls and Tenders – Approximately 268 high yield companies called all or a portion of 412 bond issues during the year, a record high $195 billion, exceeding the previous peak in 2017.28 This provided a steady flow of investment opportunities that fit our short-term high yield strategies. With rates likely to remain low in 2021, we expect the higher-than-normal volume of called bonds to continue.

Mergers & Acquisitions – Total U.S. M&A activity was over $1.6 trillion in 2020, the 9th highest total on record. Such transactions accounted for over $310 billion of high yield issuance during the year, the 7th highest on record.29 With private equity investors holding significant “dry powder” and the capital markets wide open, M&A is likely, again, to spur greater high yield issuance.

It is noteworthy that acquisitions by BBB rated companies declined as compared to the prior two years and that, when these companies made acquisitions, the portion that was financed with 100% equity was significantly higher than in 2018 or 2019.30 We suspect that this was due to management reticence to take on increased leverage given the turbulent times, but, as we move beyond the COVID crisis, we would expect greater willingness to increase leverage, via greater issuance of bonds and loans, to accomplish strategic imperatives.

Equity Issuance – Public equity issuance in 2020 was over $315 billion, far surpassing the previous record set in 2013.31 Notably, IPOs of SPACs accounted for over half of this. 32High yield issuers accounted for over $56 billion of IPOs, the second highest total after peak issuance in 2015. With respect to our strategies, we expect SPACs to provide an ongoing opportunity set for us (while remaining steadfast to purchasing at or below collateral value). Meanwhile, equity issuance by high yield companies should pave the way for credit improvement and capital appreciation.

These observations will shape the way we invest in 2021. Several investments made in 4Q20 reflect these views put into action:

• Hertz and JZ were our two largest investments in 4Q20.

• Paysafe is an example of a leveraged loan benefitting from SPAC mania.

Hertz Corp (HTZ)33– Hertz Corp operates Hertz, Dollar and Thrifty vehicle rental brands worldwide. Through its Donlen subsidiary, it also provides vehicle leasing and fleet management services. The COVID-19 crisis had a devastating impact on the travel industry, particularly Hertz given its reliance on airport car rentals. In April 2020, the first full month of the crisis, Hertz’s global revenue declined by 73%34 versus the prior year. Faced with dramatically diminished cash flow and obligations with respect to its corporate debt and fleet financing, Hertz filed for Chapter 11 on May 22, 2020. In October 2020, the company requested that the bankruptcy court approve a $1.65 billion delayed draw Debtor-in-Possession (DIP) term loan, due December 31, 2021, to provide it with enough liquidity to continue operations during the bankruptcy. The loan has a superpriority lien on all of the company’s assets and pays interest at a rate of LIBOR plus 7.25% on amounts drawn and 3.75% per annum on unused commitments. Proceeds of a sale of specified assets, including the Donlen subsidiary, must be used to repay the pre-petition first lien obligations, but all other asset sale proceeds must be used to repay the DIP. We purchased a portion of the Hertz DIP for the CrossingBridge Low Duration High Yield Fund in 4Q20 with the expected yield-to-maturity, including commitment fees, of approximately 7.9%.

JZ Capital Partners (JZCPLN)35 JZ Capital Partners is a closed-end investment company listed on the London stock exchange that invests directly in U.S. and European private equity stakes and U.S. real estate. In August of 2019, the company had a net asset value of $748 million. Fast forward a year later, the net asset value deteriorated over 50% to $356 million triggering a violation of its loan agreements; the loss primarily attributable to its real estate portfolio has been substantially written off. In October 2020, the company announced an agreement to sell a portion of its U.S. microcap portfolio for $90 million, with $70 million of the proceeds used to repay a portion of the approximately $150 mm senior secured loan facility, bringing the balance to approximately $80 million. As part of this announced transaction, the CrossingBridge Low Duration High Yield Fund participated in purchasing a piece of a $40 million subordinate tranche of the senior secured loan at par. In exchange for a subordinate position to the remaining first lien loan, the coupon to be received was increased 525 basis points to LIBOR plus 11.00%.36 Subsequent asset sales have further reduced the portion of secured debt that has priority over our loan. Based on our analysis, the collateral securing the loan is worth $250-300 million versus approximately $69 million of total senior secured debt now outstanding, giving us a high level of comfort that our loan is well covered. We expect continued asset sales, with our debt being repaid from the proceeds. In 2021, the company’s $120 million of subordinated debt and preferred stock will need to be addressed. Although this may require our involvement, we are being paid a 12% coupon, with potential additional fees, for a 30% loan-to-value investment.

Paysafe (OPAYLN)37 – Paysafe is an integrated payments platform, enabling consumers and merchants worldwide to complete transactions via payment processing, digital wallet and online cash solutions. The company was taken private in 2017 and has grown organically and through several acquisitions since that time. Financing for the original acquisition included a $200 million Second Lien Term Loan due January 1, 2026 with a coupon of LIBOR plus 7.25%.38 On December 7, 2020, the company agreed to be acquired by a SPAC, Foley Trasimene Acquisition Corp. II (BFT)39, 40. As a result of this event, we saw an opportunity to purchase Paysafe debt with the expectation that it would de-lever from 6.4x to 3.6x net leverage when the deal closed. As such, in mid-December, the CrossingBridge Low Duration High Yield Fund purchased the second lien loan of Paysafe, just above par. Given the high coupon and improved credit quality, it is likely that the company will seek to refinance the loan when the acquisition closes or soon thereafter. Thus, if the deal closes by mid-February, highly unlikely given only 60 days from announcement to completion, and the loan is repaid at that time, the purchase yield would be approximately 6.80%. It seems unlikely that the investment will remain outstanding long enough to achieve the 8.19% yield-to-maturity, but we will be quite content to collect the 8.25% coupon for as long as the company permits.

Looking ahead…

The interest rate and market climate should support strong relative performance. We expect robust opportunities from refinancings and corporate events, as well as continued issuance of DIP (debtor-in-possession) financing. A dichotomy of socio-economic and market forces in 2021 is likely to produce short periods of volatility and investment opportunity. These may be driven, for example, by conjecture among economic pundits regarding inflation and its relationship to interest rates or the expectation that the return to “business as usual” will go smoothly. Although we remain “bottom up” analysts, macro factors that we anticipate impacting the financial markets in 2021 include:

- Continued negative real interest rates

- A steepening yield curve

- Ongoing political disruption mitigated by significant steps toward cooperation

- Additional stimulative fiscal policy measures

- Increasing merger and acquisition activity

- The day of financial reckoning for many overleveraged corporations and municipalities will be pushed out

- Less corporate financial engineering and more emphasis on strengthening operations and growth investment

- Value-added employees pressing for better working conditions and higher wages

Reflective with optimism,

David K. Sherman and the CrossingBridge team

1 “Perception is reality” is a phrase coined by Lee Atwater, deputy director of President Ronald Reagan’s 1984 re-election campaign, campaign manager for George H.W. Bush’s 1988 Presidential campaign and former Chairman of the Republican National Committee. He aroused controversy in discussing the “Southern Strategy” for Republican success in national elections, his approach to politics vividly portrayed in the 2008 Frontline (PBS) documentary, Boogie Man. Considered one of the originators of modern day political strategy, Atwater’s creed was well summarized in Perception is reality: The facts won’t matter in next year’s general election, Independent, October 30, 2014, (https://www.independent.co.uk/voices/comment/perception-reality-facts-won-t-matter-next-year-s-general-election-9829132.html) as follows: “Forget the facts: if you can make people believe something, it becomes, if you like, a de facto fact.”

2 RobinBrooksIIF Twitter, January 2, 2021 10:10am https://twitter.com/RobinBrooksIIF

3 The 3-month Treasury Bill rate was lower, 0.023% and 0.014% at the end of 1939 and 1940. Other than these two instances, as well as at the end of 2009 when 1-month and 3-month Treasury Bill rates were the same or lower than as the end of 2020, U.S. government bond/bill rates have never been lower, at the end of a calendar year than they were at the end of 2020.

4 CrossingBridge and Bloomberg

5 A special purpose acquisition company (SPAC), sometimes called a “blank-check company”, is a shell company that does an initial public offering to raise capital with the specific intent to use the proceeds acquire or merge with a private company. The cash is held in an interest-bearing account until needed to make an acquisition. When an acquisition is identified, investors have the choice of keeping their equity investment in the newly acquired company or put their shares for cash plus accrued interest. Typically, if a SPAC has not completed an acquisition within 2 years, it must return the capital to shareholders. Upon request, we would be happy to share with you David Sherman’s September 24, 2020 presentation on SPAC investing to NYU Stern Business School’s Global Value Investing Class, which he is co-teaching.

6 Refer to our 2Q20 investor letter, “Pass Interference”

7 Initial Public Offerings

8 Net Asset Value

9 SPAC IPO Transactions: Summary by Year, https://spacinsider.com/stats/

10 ICE BofA High Yield Index. Yield-to-Worst (YTW) is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting.

11 Reflects the ratio of the after-tax credit spread of the ICE BofA US High Yield Index, after deducting 200 basis points of annual losses, divided by the 10-year Treasury yield. We consider the high yield market “Cheap” or undervalued if the after-tax, loss-adjusted credit spread is 60% or more of the Treasury yield, “Fair Value” between 20% and 60% and “Rich” or overvalued if less than 10% of the Treasury rate. Yield-to-Worst (YTW) is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. Yield-to-Maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures.

12 Source: CrossingBridge, BofA Merrill Lynch, Bloomberg

13 CS Credit Strategy Daily Comment, Credit Suisse, January 5, 2021

14 CS Credit Strategy Daily Comment, Credit Suisse, January 5, 2021

15 2020 High-Yield Annual Review, J.P. Morgan, December 23, 2020

16 “Fallen Angels” are companies that had been rated investment grade but have been downgraded to high yield.

17 2020 High-Yield Annual Review, J.P. Morgan, December 23, 2020

18 Deutsche Bank U.S. Credit Strategy Chartbook, January 5, 2021

19 2020 High-Yield Annual Review, J.P. Morgan, December 23, 2020

20 2020 High-Yield Annual Review, J.P. Morgan, December 23, 2020

21 2020 High-Yield Annual Review, J.P. Morgan, December 23, 2020

22 High Yield Insights: Top Charts for 2020, Goldman Sachs, January 5, 2021

23 High Yield Insights: Top Charts for 2020, Goldman Sachs, January 5, 2021

24 CS Daily Strategy Comment, Credit Suisse, January 6, 2021

25 CS Daily Strategy Comment, Credit Suisse, January 6, 2021

26 US Credit Strategy Chartbook (Excel spreadsheet), Deutsche Bank, January 5, 2021

27 CS Daily Strategy Comment, Credit Suisse, January 6, 2021

28 2020 High-Yield Annual Review, J.P. Morgan, December 23, 2020

29 2020 High-Yield Annual Review, J.P. Morgan, December 23, 2020

30 Situation Room – Will you BBB mine?, BofA Securities, December 16, 2020

31 2020 High-Yield Annual Review, J.P. Morgan, December 23, 2020

32 US Weekly Kickstart – Year of the SPAC, Goldman Sachs, December 14, 2020

33 As of 9/30/2020 our position in Hertz Corp. represented 0.00% of the CrossingBridge Low Duration High Yield Fund and represented 2.71% of the Fund on 12/31/2020.

34 Declaration of Jamere Jackson in Support of Debtor’s Petitions and Requests for First Day Relief, Docket #28, May 24, 2020, In re The Hertz Corporation, et al. Chapter 11 Case No. 20-11218 in the United States Bankruptcy Court for the District of Delaware

35 As of 9/30/2020 our position in JZ Capital Partners represented 0.00% of the CrossingBridge Low Duration High Yield Fund and represented 3.84% of the Fund on 12/31/2020.

36 The loan has a LIBOR floor of 1.0% so the minimum coupon is 12.00%.

37As of 9/30/2020 our position in Paysafe represented 0.00% of the CrossingBridge Low Duration High Yield Fund and represented 0.56% of the Fund on 12/31/2020.

38 The loan has a LIBOR floor of 1.0% so the minimum coupon is 8.25%.

39 As part of our SPAC strategy, we purchased BFT on its IPO in August 2020. As part of our disciplined approach to investing in SPACs, we sold off the warrants when the units split which is unfortunate because, within weeks, BFT announced its purchase of Paysafe.

40 As of 9/30/2020 our position in Foley Trasimene Acquisition Corp. II represented 0.37% of the CrossingBridge Low Duration High Yield Fund and represented 0.00% of the Fund on 12/31/2020.

Definition: A call option is the right, but not the obligation, to buy a stock, bond, commodity or other asset or instrument at a specified price within a specific time period.