“If someone wants to accuse the National Football League of promoting offense to make the game more exciting, [the committee] believes the league should plead guilty.” 1,2

Through an ongoing series of rule changes related to illegal contact, primarily intended to protect players, the NFL has also made the game more exciting. As a result of more stringent pass interference regulations, the game has tilted in favor of the offense3 with a steady rise in attempted passes, pass completions, yardage gained from penalties and a decline in interceptions.4 Clearly, rule changes have fundamentally changed the game.

Similarly, actions taken by the Federal Reserve during the COVID-19 crisis have fundamentally changed the financial markets. Having learned from the experience of the Great Financial Crisis, the Fed acted rapidly and in massive scale5 to give investors and the capital markets confidence.

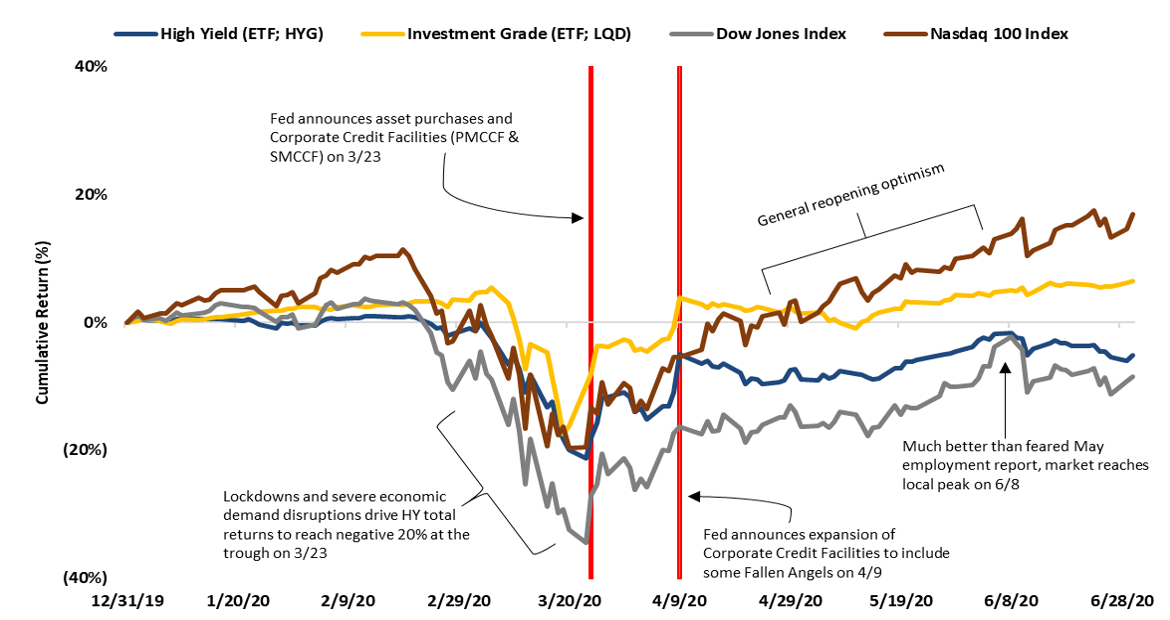

Market Indicies Performance6

In the preceding graph, the Fed’s efforts, as well as trillions of dollars in fiscal programs designed to support businesses that were forced to close and individuals who lost their jobs, created confidence in the capital markets, which fueled a dramatic rebound since the March trough. The NASDAQ’s outperformance has been remarkable as the COVID crisis underscored the growth prospects of the leaders of the “digital revolution”7 and their importance to end-users. The recovery in the Dow Jones Industrial Average, though not quite as spectacular, reflects the fact that the Fed has achieved its goal of preserving access to the capital markets. Even Boeing, plagued by the grounding of the 737 Max and then further harmed by disarray in the travel industry, was able to issue $25 bn of new unsecured debt in April to avoid a federal bailout.

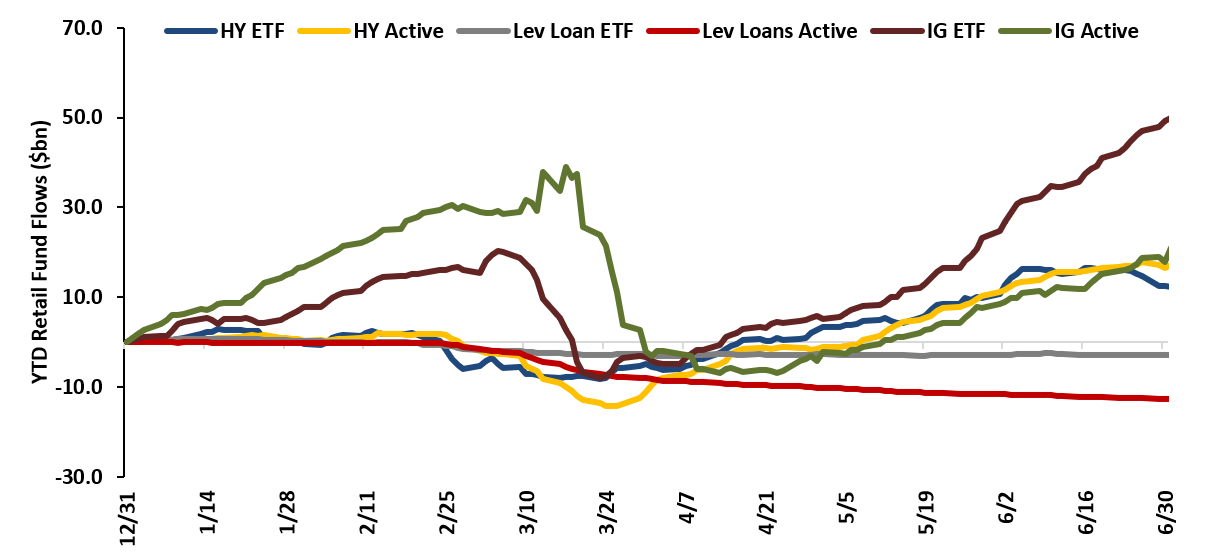

YTD Retail Fund Flows8

The Fed’s influence on investor confidence is also reflected in retail inflows into investment grade and high yield fixed income funds, sectors that are receiving direct support from the Fed’s purchase programs. Notably, the leveraged loan market, unaddressed by the Fed, has not seen similar inflows. Despite the significant increase in downgrades and defaults, we have not yet seen the breadth and depth of price declines in the leverage loan market we would expect; the significant share of the loan market held by Collateralized Loan Obligations (CLO) is likely affecting the mark-to-market price mechanism.9

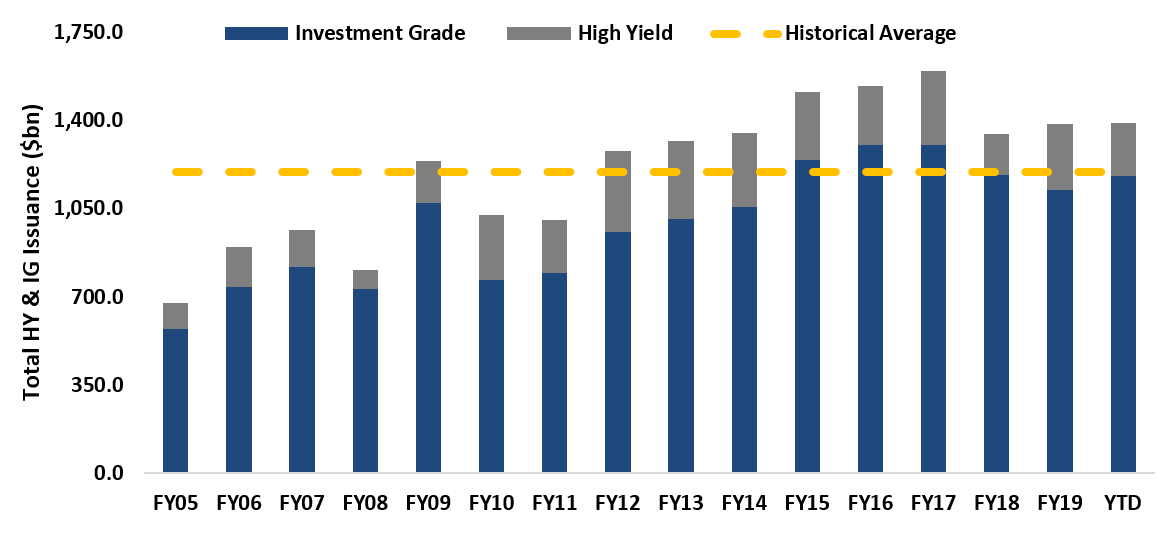

High Yield and Investment Grade Issuance10

Strength in retail flows into the corporate fixed income market has allowed a high level of issuance among both investment grade and high yield borrowers. Year-to-date total corporate bond issuance through June is above the full year average going back to 2005 and is greater than total issuance for all but three years over that period. The impact of the COVID crisis has varied by company and industry, leading to an array of motivations for new issuance:

-

- Fund cash flow shortfalls resulting from COVID-related shutdowns

- Increase working capital

- Enhance liquidity to use as a “rainy day fund” or “war chest”

- Push out debt maturity schedules by refinancing debt maturing in 24-36 months11

Unlike the Great Financial Crisis (2007-08), even lower rated companies12 have had access to the capital markets to refinance debt in line with that enjoyed over the last 10 years. Once again, this reflects the confidence generated by the Fed’s programs to ensure the smooth functioning of the capital markets.

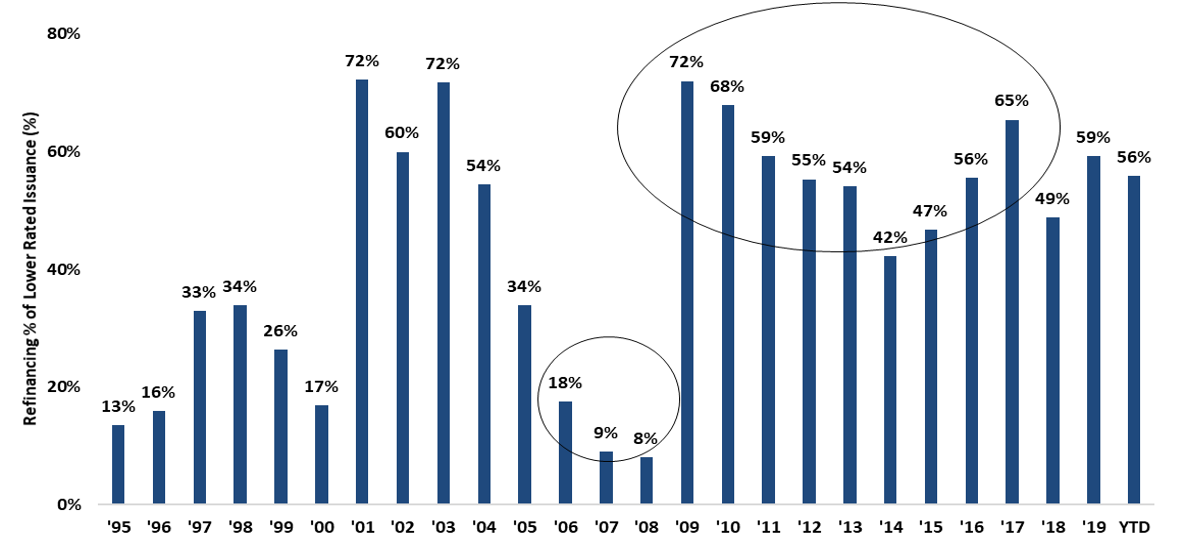

Refinancing as a Percentage of Lower Rated Issuance13

Despite stable access to capital for low-rated issuers, high yield pricing has become quite bifurcated, with a large portion of higher rated “haves” trading at yields below that of the index while a large segment of lower quality “have-nots” are trading at yields substantially above the index.

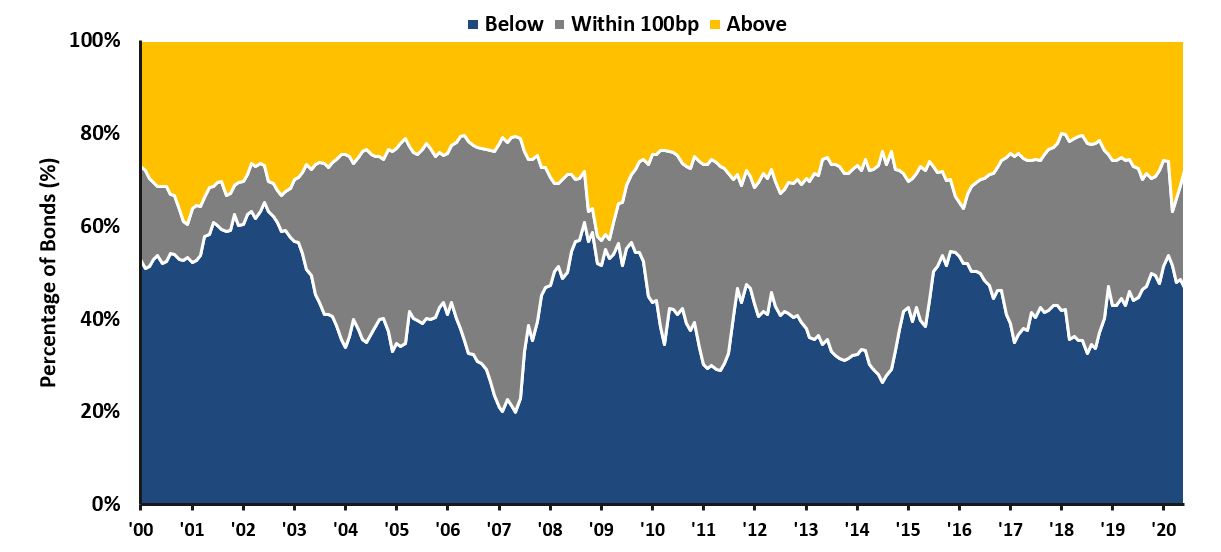

Percentage of Bonds Trading Above and Below Index14

As shown above, this tends to happen at times of increasing stress in the corporate credit market. Included among higher quality high yield bonds are “fallen angels”.15 Those that were downgraded on or after March 22, 2020 are eligible to be purchased by the Federal Reserve under the SMCCF program.16 Investors have been willing to purchase these bonds at narrower yields with the expectation that the Fed is in the market supporting them.

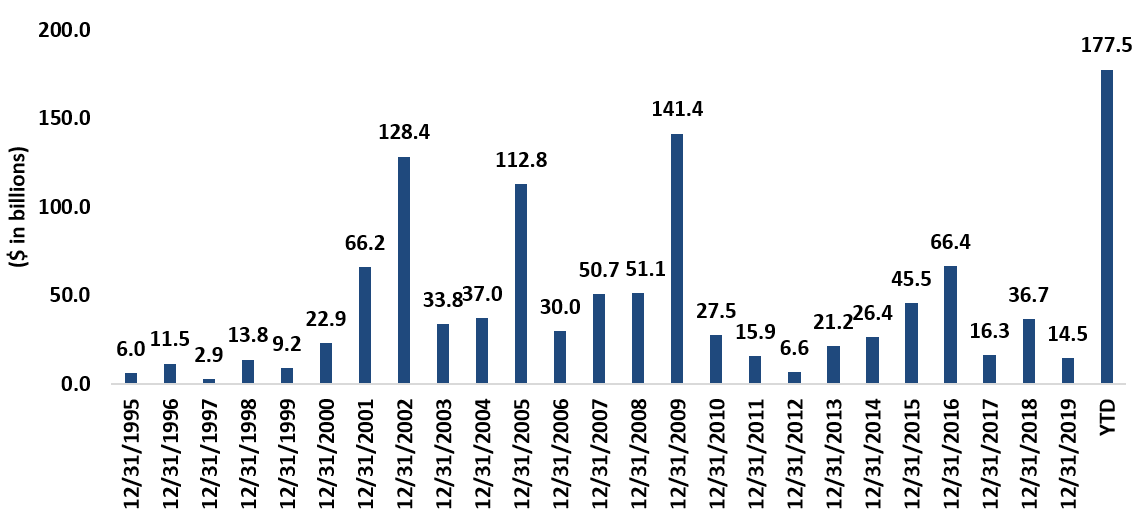

YTD Domestic Fallen Angel Volume17

As shown in the previous graph, fallen angels are becoming an increasing component of the high yield market as the dollar volume (at par) of fallen angels in the first half of the year is greater than that for any full year going back to 1995. However, after a sharp increase in the incidence of fallen angels in late March, the pace declined in 2Q20. With economic recovery more “front-loaded” than they previously expected, Goldman Sachs reduced its forecast18 for U.S. fallen angels for 2020 from $550 bn to $416 bn. Still, this is more than double the level for all of 2009 during the Great Financial Crisis – and there is a lot more to come.

Admittedly, this leaves us puzzled. As Société Générale put it: “…unconventional monetary policy in the form of marshalling massive direct asset purchases appears to have desensitized financial markets from underlying economic woes, leading to the Great Disconnect whereby markets surge as economies crumble.”M19 Arguably parts of the market are over-valued, disconnected from the stricken business climate, while other areas, virtually abandoned by most investors, may represent opportunities. Two examples reflect the degree to which the equity markets have entered speculative bubbles:

Hertz, the global car rental company filed Chapter 11 bankruptcy on May 22, 2020. It was patently obvious to anyone familiar with credit and bankruptcy that the equity was highly likely to be wiped out in the restructuring. However, after the stock leapt from less than $1.00/share to over $5.00 in early June, the company and its bankruptcy advisors filed documents to issue new common stock at elevated market levels, despite the fact that any proceeds were likely to go to creditors, providing them with a windfall, while shareholders were likely to experience a 100% loss. Correctly, the SEC stepped in to prevent this from happening.

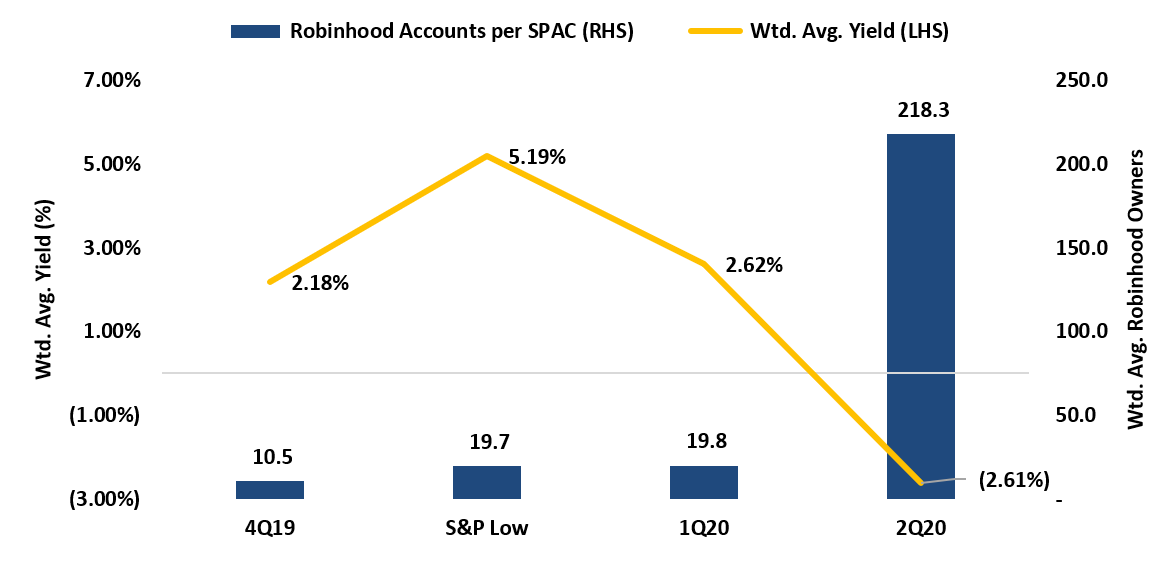

Analysis of Domestic, Pre-Deal SPAC Market20

Speculation has also come to the SPAC21 market. As we have discussed in previous investor letters, we have regularly invested in late-stage SPACs, those that are reaching the end of the period in which they may make an acquisition and, per provisions in their formation documents, are nearing the time when investors may put their shares back to the company for cash including accrued interest.

As shown in the graph on the above22, the SPAC market had a weighted-average yield-to-maturity of 2.18% at the end of 2019. SPACs sold off in late March with the rest of the market, causing the yield to rise to nearly 5.20% on March 23. As a consequence of the Fed’s intervention, the SPAC market rallied to yield about 2.60% at the end of the first quarter. For the first time in history, by the end of 2Q20, this yield declined to a negative rate of return. A major contributing factor is that small investors, represented by the average number of Robinhood accounts invested in each pre-deal SPAC, have increased their participation in the SPAC secondary market by more than 20-fold. In doing so, they bid up SPAC share prices to premiums over cash value on the speculation that they might be investing in the next Nikola, Draft Kings or Virgin Galactic, all of which saw their share prices multiply upon announcement of a deal.

Even when the COVID crisis is only a horrible memory, it will have permanently left its mark on American business. Beyond the capital needed to withstand the sharp economic decline and support the eventual restart, significant levels of funding will be required.23

-

- Shutdowns in Chinese manufacturing facilities (as well as other parts of the world) caused shortages in raw materials, components and finished goods causing corporate leaders to rethink the risk to supply chains. In response, many corporations are spending capital to onshore capacity or shorten supply lines. This should also afford these companies the ability to safeguard their intellectual property that has been put at risk by the drive to outsource, particularly to China.

- Shutdowns also exposed bottlenecks in the name of “just-in-time” efficiency. Yet, without sufficient inventory, many companies were unable to meet customer demand as the economy began to reopen. Thus, companies are likely to rethink their working capital needs.

For decades, corporate finance has emphasized capital efficiency targeted at maximizing cash generation and shareholder returns. However, the sudden decline in revenues brought on by the pandemic-driven shutdowns revealed the lack of “cushion” in corporate balance sheets that would permit companies to withstand a crisis. As a result, draws on revolving credit facilities taken to ensure liquidity may have become permanent, resulting in a higher level of debt, but a greater ability to “sleep at night” for many corporate leaders.

RECENT INVESTMENTS

Eldorado Resorts (ERI)24 – On June 23, 2019, Caesars Entertainment agreed to be acquired by Eldorado Resorts for $18 billion in stock and cash. Despite anti-trust challenges and regulatory hurdles in many states, the transaction was expected to close in 1Q20. As financing for the deal was dependent on raising capital via sale-leasebacks of company properties, which were prohibited by the term loan credit agreement, it was our view that the term loan would, by necessity, be repaid when the deal closed. We also concluded that, were the deal to fail to close, Eldorado would still need to repay the term loan in the near term as it would need to raise capital from sale-leasebacks to fund the $835 million break-up fee due to Caesars. The advent of the COVID crisis delayed many of the approval processes, and the shutdown of both companies’ hotels & casinos in response to the pandemic began to cast doubt on the completion of the deal. This caused the price of Eldorado’s term loan to decline. With management of both companies continuing to express confidence in the deal, we began to buy the company’s 1st lien term loan, due April 2024, for the CrossingBridge Low Duration High Yield Fund at $97.50. Confidence in the deal further increased when the company announced completion of several asset sales required by regulators and agreement on terms of sale-leasebacks, ultimately leading to the successful issuance of over $6.0 billion in unsecured bonds and secured term loans in mid-June. With the offering memoranda for these financings specifically stating that the company’s bonds would be redeemed following the transaction, we began buying the company’s 7.00% bonds due August 2023 for a 3.91% yield to an expected call date of August 1, 2020; if the company redeemed the bonds sooner, additional premium would be paid. The merger of the two companies closed on July 20, 2020.

Trico Group (TRICO)25 – Trico is a privately held manufacturer of automotive parts with emphasis on repair and maintenance items including windshield wipers, oil and air filters, spark plugs and pumps. Since the FRAM acquisition, the company far exceeded projected cost savings and synergies and rapidly reduced leverage ahead of expectations. In conversation with the company’s CFO in mid-April, he acknowledged that the COVID-related economic shut-down had forced many of its retail customers to shut a large portion of their stores and the reduction in miles-driven had reduced demand for the company’s products. This led the company to shut some plants and reduce output at others. The CFO also pointed out, however, that the pandemic would likely cause people to shift from public transportation to private cars, ultimately leading to greater demand for replacement parts. During the conversation we told the CFO that we were pleased with the company’s performance and that, if there were a need, we would have an interest in providing additional financing to the company. On May 21, 2020, the CrossingBridge Low Duration High Yield Fund participated in a $93 million add-on to the existing first lien term loan due February 2024. At the end of June, the term loan was yielding approximately 9.49%. Based on the CFO’s remarks, we anticipate that the loan will be refinanced within the next nine to eighteen months.

CONCLUSION

The aphorism “Never let a good crisis go to waste” is widely attributed to Winston Churchill. Painful as it has been for us all, the COVID crisis has precipitated and will continue to provide many opportunities to invest at attractive yields with a greater degree of confidence.

-

- The pandemic finally tipped many corporate zombies into default and bankruptcy. Often these companies require debtor-in-possession (DIP) financing to support cash needs during bankruptcy. Typically afforded a super-priority position in the capital structure, DIPs often provide attractive rates of return with a high degree of safety. Recently, capital markets experts estimated that $560 billion of corporate debt would need to be restructured over the next year with the need for $80 billion26 of DIP financing, an opportunity for future investment.

- Companies exiting Chapter 11 often arrange exit financing to provide recovery to creditors. These instruments are usually designed to trade at par to allow creditors to sell them to capture their expected recovery. However, traditional investors often shy away from these post-bankruptcy securities. Unlike new issues that have a “road show” that educates buyers and creates excitement, post-bankruptcy debt is often tainted by its past and has a limited audience willing to consider purchase. This creates an opportunity as these post-bankruptcy companies have newly de-levered balance sheets, tightened operational focus and are no longer constrained in their ability to pursue growth initiatives.

- Companies with lower leverage and access to the capital markets are pursuing strategic initiatives including investment in new, more efficient capacity and acquisitions. We anticipate the opportunity to lend to these companies at good yields and enjoy the benefit of improving credit quality as they achieve their objectives in a re-opening economy.

- Over $81 billion of outstanding high yield bonds are trading above their upcoming call prices27, making it attractive for issuers to redeem these securities prior to maturity.

- Despite a recovery that may look more like a “W” than a “V” or a Nike swoosh, we are bullish on the opportunities that will present themselves as the world recovers from the COVID crisis and the recession. That said, we believe there is a disconnect between the market and our current economic state. We expect increased volatility in the second half of the year. Further, continued strained relations with China, protests reflecting socio-economic discontent and the increasingly factious election season are likely to increase uncertainty. Thus, we intend to be disciplined with particular consideration to mark-to-market risk and long-term preservation of capital.

In closing we offer this real-world experience that says a lot about the current state of the markets. We recently re-opened our office in Pleasantville with partial staffing. Looking to treat those in the office to an afternoon snack, I went to the local bakery where I am friendly with the owner. The baker told me that he recently opened his first brokerage account with $30,000 and it was now worth $80,000, his largest investment was in an emerging markets airline about which he admitted no fundamental knowledge other than that planes would eventually fly and that the stock was moving up. He added that he was now considering selling the bakery and starting a hedge fund. I congratulated him on his nice win, but suggested he stick with what he knows.

Skeptical but optimistic,

David Sherman and the CrossingBridge team

1 2012 NFL Competition Committee report “Offensive/Defensive Balance: An Historical Perspective” https://operations.nfl.com/the-rules/evolution-of-the-nfl-rules/ In 1974 the NFL first restricted contact defenders could have with receivers with further rule changes through 2019.

2 The Evolution of Passing in the NFL, Miami Dolphin News, January 10, 2012 https://www.thephinsider.com/2012/1/10/2696454/the-evolution-of-passing-in-the-nfl

3 https://www.si.com/nfl/2016/09/29/nfl-defensive-pass-interference-penalties-blanket-coverage, http://conormclaughlin.net/2018/10/nfl-penalty-trends/

4 https://www.pro-football-reference.com/years/NFL/

5 Programs most directly impacting the corporate fixed income markets included the Primary Market Corporate Credit Facility (PMCCF), intended to purchase corporate bonds at time of initial issuance, and the Secondary Market Corporate Credit Facility (SMCCF), designed to buy corporate bonds and corporate bond exchange-traded funds in the secondary market. The Fed has allocated $75 bn of equity capital to be supplemented by $675 bn of borrowed funds.

6 Bloomberg and Credit Outlook – Mid-year update, Goldman Sachs, June 24, 2020

7Apple, Microsoft, Facebook, Alphabet comprised 46.3% of the NASDAQ 100 at mid-year.

8 EPFR and CS Credit Strategy Daily Comment, Credit Suisse, July 21, 2020

9 See 1Q15 and 1Q16 Investor Letters found on commentary tab

10 Dealogic, Deutsche Bank, S&P/LCD and Credit Outlook – Mid-year update, Goldman Sachs, June 24, 2020

11 Typically, corporations focus on refinancing debt maturing in 12-18 months, but they have been locking in low-cost long-term financing by redeeming intermediate term debt as well.

12 Companies rated B, CCC and Not-Rated (NR)

13 Default Monitor, JP Morgan, July 1, 2020

14 Tuesday Credit Call, Barclays, July 7, 2020

15 “Fallen Angels” are companies that had been rated investment grade but have been downgraded to high yield.

16 Fallen angels eligible for purchase by the SMCCF include bonds with maturities of four years or less and ratings no lower than BB-/Ba3. Fallen angel issuers include Ford Motor Co., Occidental Petroleum, Delta Airlines and Apache Corp. among others.

17 Default Monitor, JP Morgan, July 1, 2020

18 Credit Notes: Fallen angels: Lower, but not low, Goldman Sachs, July 7, 2020

19 The Practical Quant Investor- Fed balance sheet expansion, the new game in town, Societe Generale, July 13, 2020

20 Cowen, SPACInsider, Bloomberg, Robintrak.net and SEC filings

21 A special purpose acquisition company (SPAC), sometimes called a “blank-check company”, is a shell company that does an initial public offering to raise capital with the specific intent to use the proceeds acquire or merge with a private company. The cash is held in an interest-bearing account until needed to make an acquisition. When an acquisition is identified, investors have the choice of keeping their equity investment in the newly acquired company or put their shares for cash plus accrued interest.

22 2Q20 data reflects the universe of 82 U.S. SPACs, with total market capitalization of $19.8 bn, that were yet to announce an acquisition as of June 30, 2020 and have split their units into freely tradeable common shares and warrants. SPACS in prior periods are those that existed at those prior dates and were yet to announce an acquisition as of June 30, 2020. Excluded are those SPACs that liquidated or completed an acquisition prior to the end of 2Q20. Yield is the weighted average yield for all SPACs included at each point in time. The weighted average number of Robinhood accounts reflects the total number of brokerage accounts is if they invested in each individual SPAC.

23 Even prior to the COVID crisis, trade tensions were causing companies to look inward and consider changes to operations.

24 As of 3/31/2020 our position in the Eldorado Resorts Term Loan represented 0.00% of the CrossingBridge Low Duration High Yield Fund and represented 1.23% of the Fund as of 6/30/2020.

25 As of 3/31/2020 our position in Trico Group represented 0.48% CrossingBridge Low Duration High Yield Fund and represented 2.03% of the Fund on 6/30/2020.

26 It’s Not Time for a Government Bankruptcy Facility, Elliot Ganz and David Smith, RealClearMarkets.com, June 15, 2020 https://www.realclearmarkets.com/articles/2020/06/15/its_not_time_for_a_government_bankruptcy_f

27 High Yield Market Signals $81.4 Billion of Potential Calls, Bloomberg July 24, 2020