In the credit markets, we are seeing a rising incidence of liability management transactions (LMTs), particularly "amend & extends" (A&Es).

In 1971, FRAM1 oil filters launched a TV commercial campaign cautioning car owners to spend a few dollars for a new oil filter now rather than face an expensive engine rebuild down the road.2 The scare tactic, “You can pay me now, or pay me later” effectively went viral (before that was a thing). The phrase has entered our lexicon to mean that it would be better to head off or resolve problems today rather than allow them to grow and become more costly in the future.

In the credit markets, we are seeing a rising incidence of liability management transactions (LMTs), particularly “amend & extends” (A&Es). Over 28% of leveraged loans and high yield bonds are scheduled to mature within three years.3 In response, leveraged loan investors have increasingly been willing to extend maturities in exchange for some combination of partial principal repayments, higher coupons, pledges of additional collateral, tighter covenant packages, or other credit enhancements.

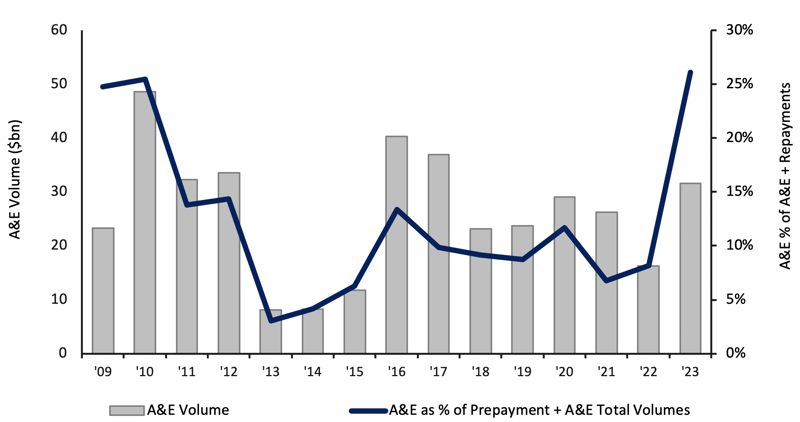

Amend & Extend Transactions4

As shown above, this has led to a sharp rise in the dollar volume of A&Es in 2023, year-to-date, relative to all of 2022, and an increase in A&E’s as a percentage of prepayments plus A&E’s, reflecting borrowers’ desire to extend maturities with existing lenders rather than try to refinance in a tough market. The last period when a significant increase in A&E’s occurred was subsequent to the Great Recession of 2008-09.

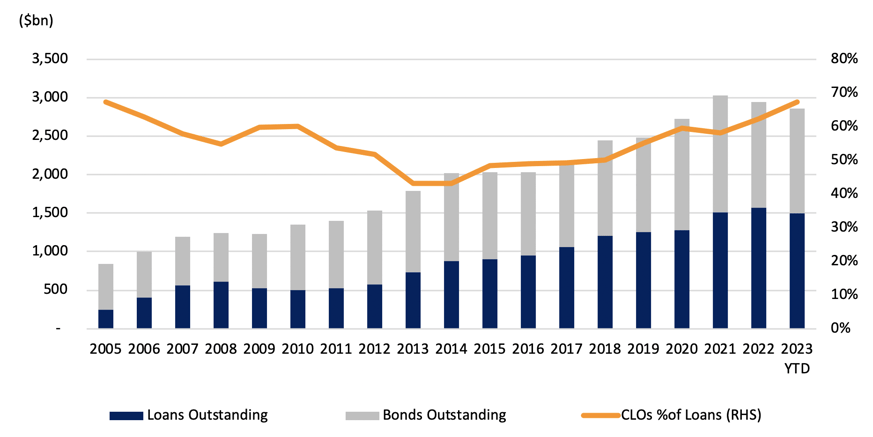

U.S. High Yield Corporate Debt Market5

Leveraged loans are approximately 53% of the U.S. high yield corporate debt market at 2Q23, versus only 29% in 2005.6 Collateralized loan obligations (CLOs)7 are the primary purchasers of leveraged loans which have been the underlying capital flow to support this growth. Per the graph above, loans held by CLOs are currently 67% of the leveraged loan market. Although CLOs are not usually required to mark their underlying holdings to market, they have stringent rules governing the composition of their underlying portfolios and may only purchase loans during their investment period. Sometimes these requirements lead to uneconomic behavior by CLO managers.

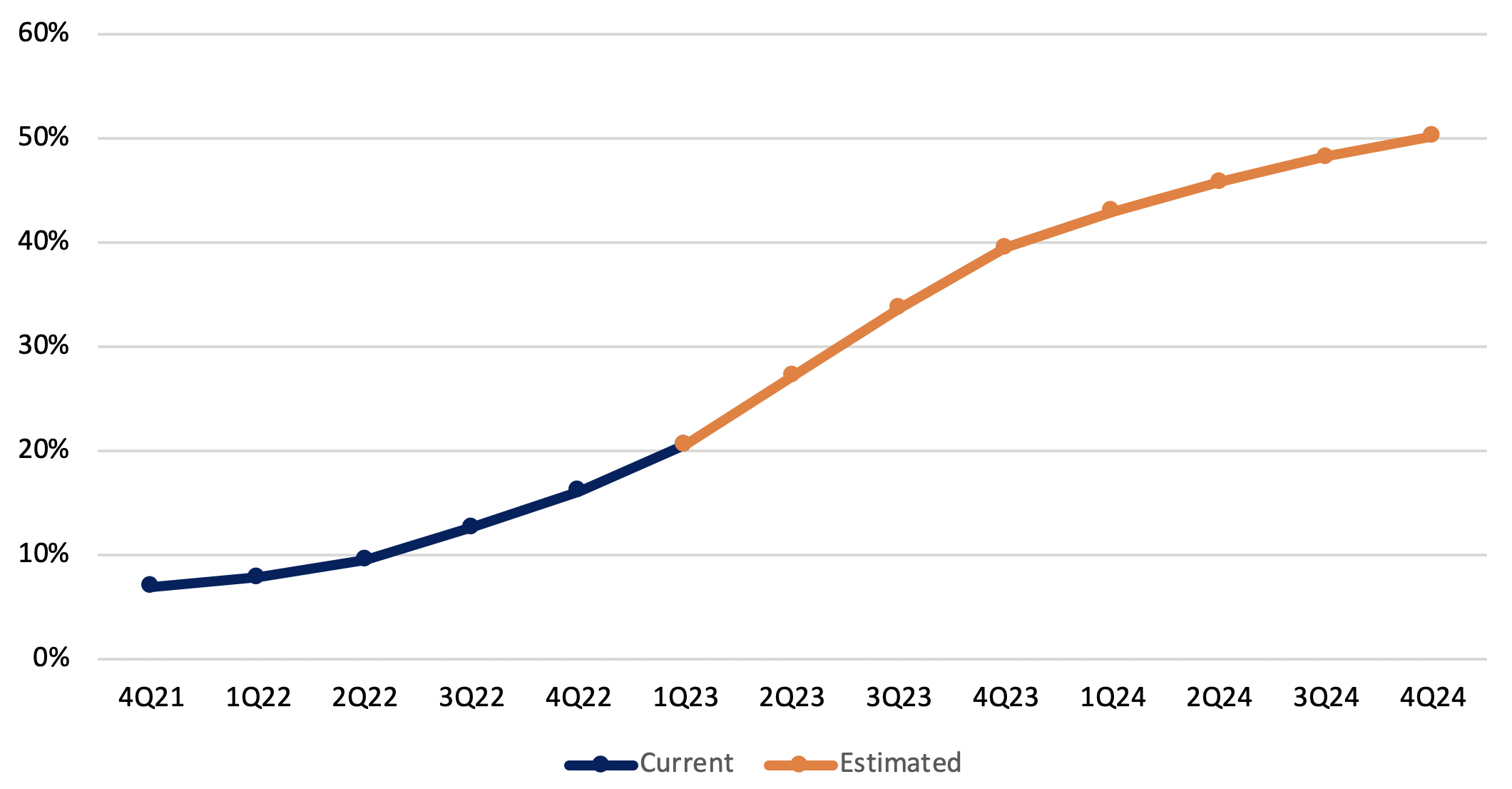

% of CLOs Out of Reinvestment Period8

Typically, a CLO has a maximum life of 13 years including a five-year reinvestment period and an eight-year runoff or harvest period. At the end of 1Q23, industry experts9 estimate that approximately 20.6% of outstanding U.S. CLOs (by dollar value) had reached the end of their investment period.10 By the end of 2023, nearly 40% of existing CLOs are projected to be in their harvest period and, by the end of 2024, over 50% are expected to be limited in this way. Consequently, it is imperative for the health of the leveraged loan market that new CLO issuance remains robust to replace the runoff of existing CLOs. Herein lies the rub.

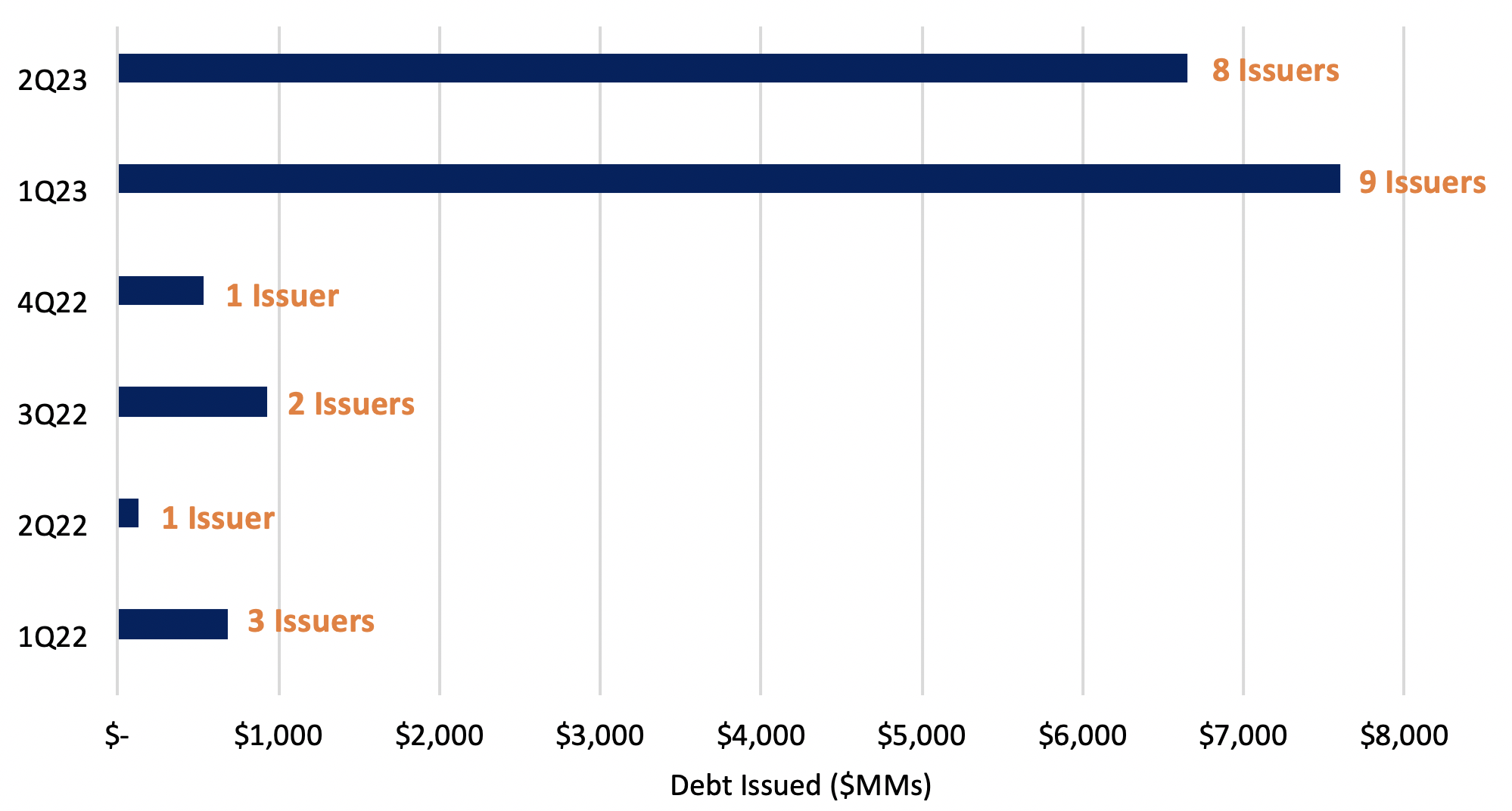

Bond Issues to Paydown Bank Debt11

As more CLOs are entering their harvest periods, we are seeing an increasing number of LMTs among leveraged loan borrowers in which they issue bonds to partially repay loans. In some cases, the lenders’ requirement that the LMT include a partial repayment of the outstanding loan may be risk mitigation as they may want to reduce exposure to a deteriorating credit. In other cases, CLO lenders may require repayment as they may be unable to extend the maturity because of their own reinvestment period coming to an end. As an example, in May 2023, Heartland Dental12 completed an A&E with respect to its $2.35 bn loan due in April 2025. In this transaction, the lenders agreed to extend the maturity on $1.38 bn of first lien loans to April 2028, while $426 mm of the original loan stayed outstanding. As a concession to the lenders, the company repaid over $540 mm of the original loan with proceeds from a $535 mm 10.35% first-lien bond, due April 2028, as well as issuance of new equity.13

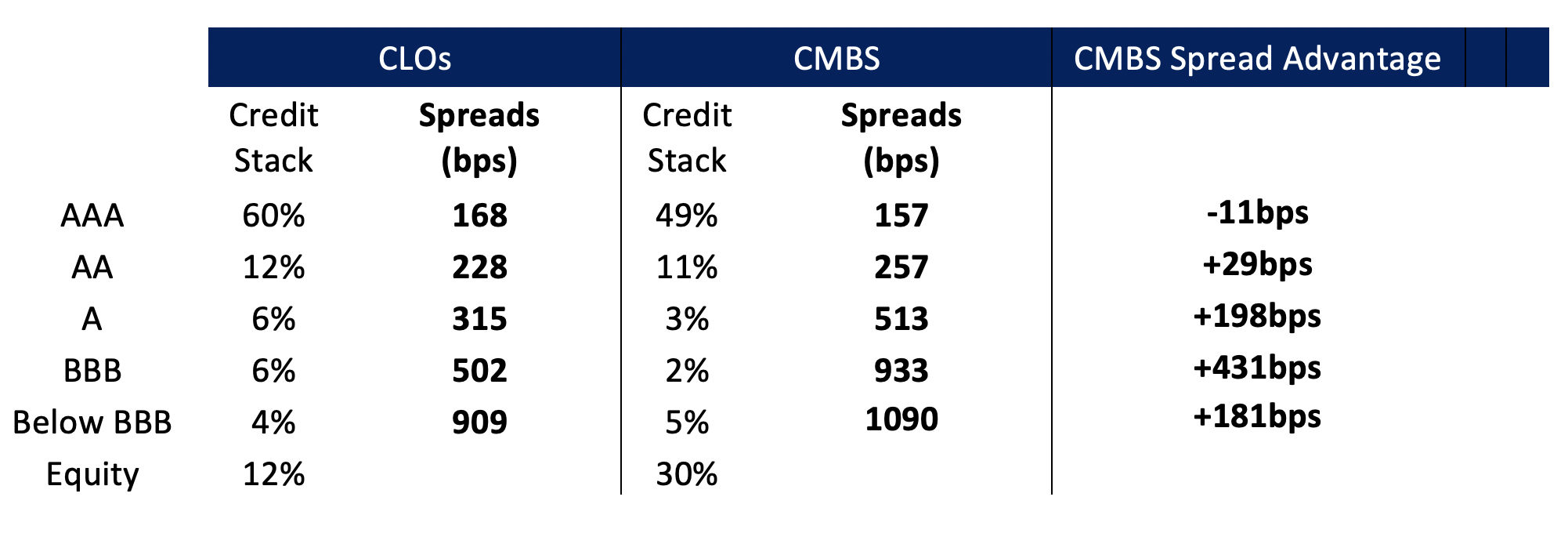

New Issue Comparison14

As discussed in our 1Q23 letter, capital flows favor assets with the highest risk-adjusted returns. Investors that have been large buyers of investment grade CLO debt are now able to earn significantly better yields in newly issued commercial mortgage-backed securities (CMBS)15 debt of comparable quality. In the AAA tranche, CMBS debt offers slightly less spread for much higher credit quality based on loan-to-value (LTV). For tranches below the AAA tranche, CMBS yields are, on average, significantly higher with better LTV. CLO debt investors may react to this by demanding higher spreads, which is likely to put significant pressure on returns to CLO equity investors.

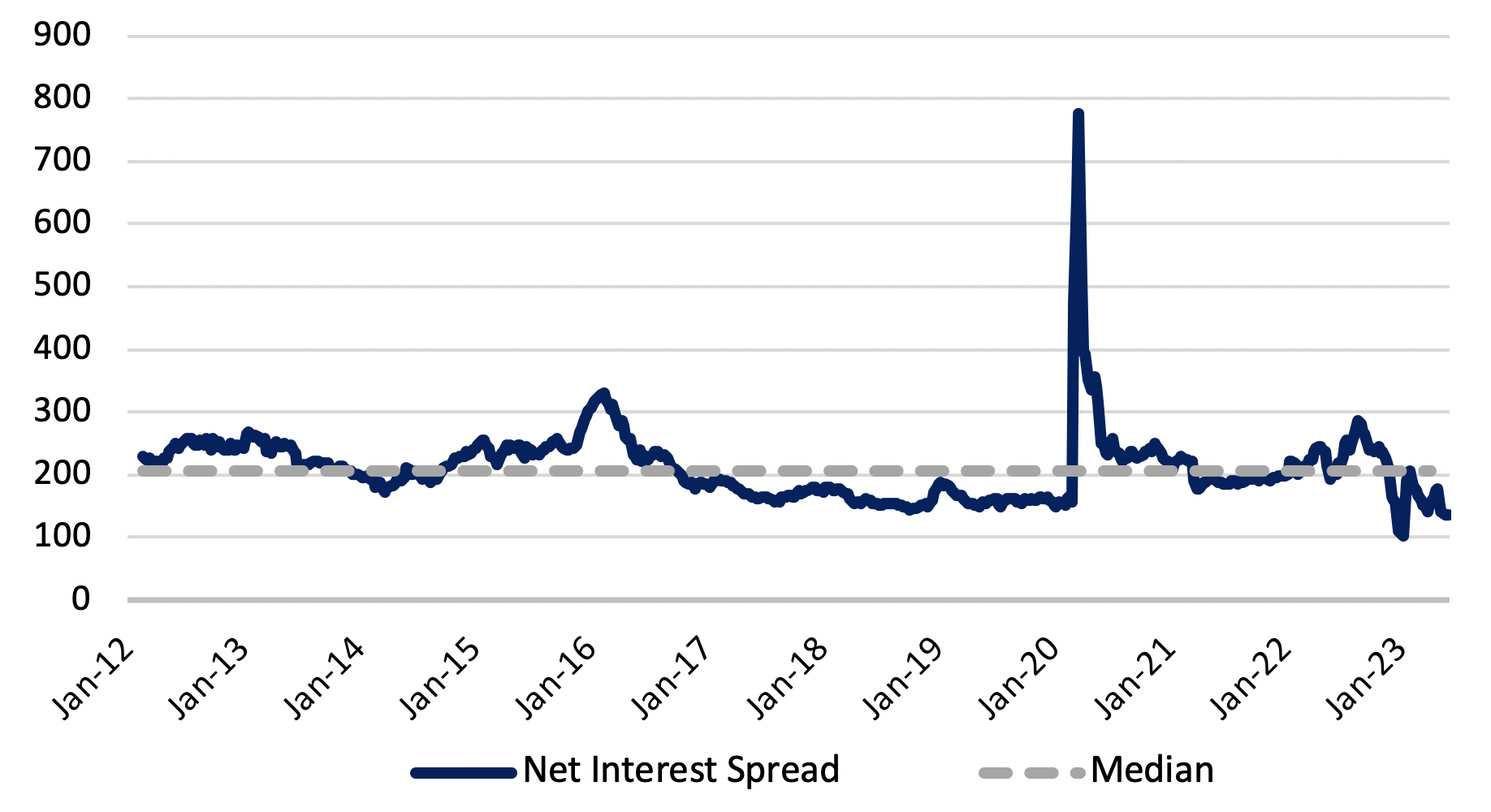

CLOs Net Interest Spread16

CLO net interest spread is the difference between the funding cost of a CLO’s debt and the yield earned on its underlying assets. As shown above, current net interest spread is tight at 135 bp in comparison to the median spread of 207 bp and the recent high of 280 bp in September 2022.17 Simplistically, a CLO equity investor’s return is the net interest spread less future net portfolio losses multiplied by the structure’s inherent leverage, typically 8.3x. This implies an 11.2% return on equity18 before inclusion of the impact of future credit losses. Considering that market pundits are waiting for the recession and the next distress cycle, CLO issuance is likely to be less robust in the near future.

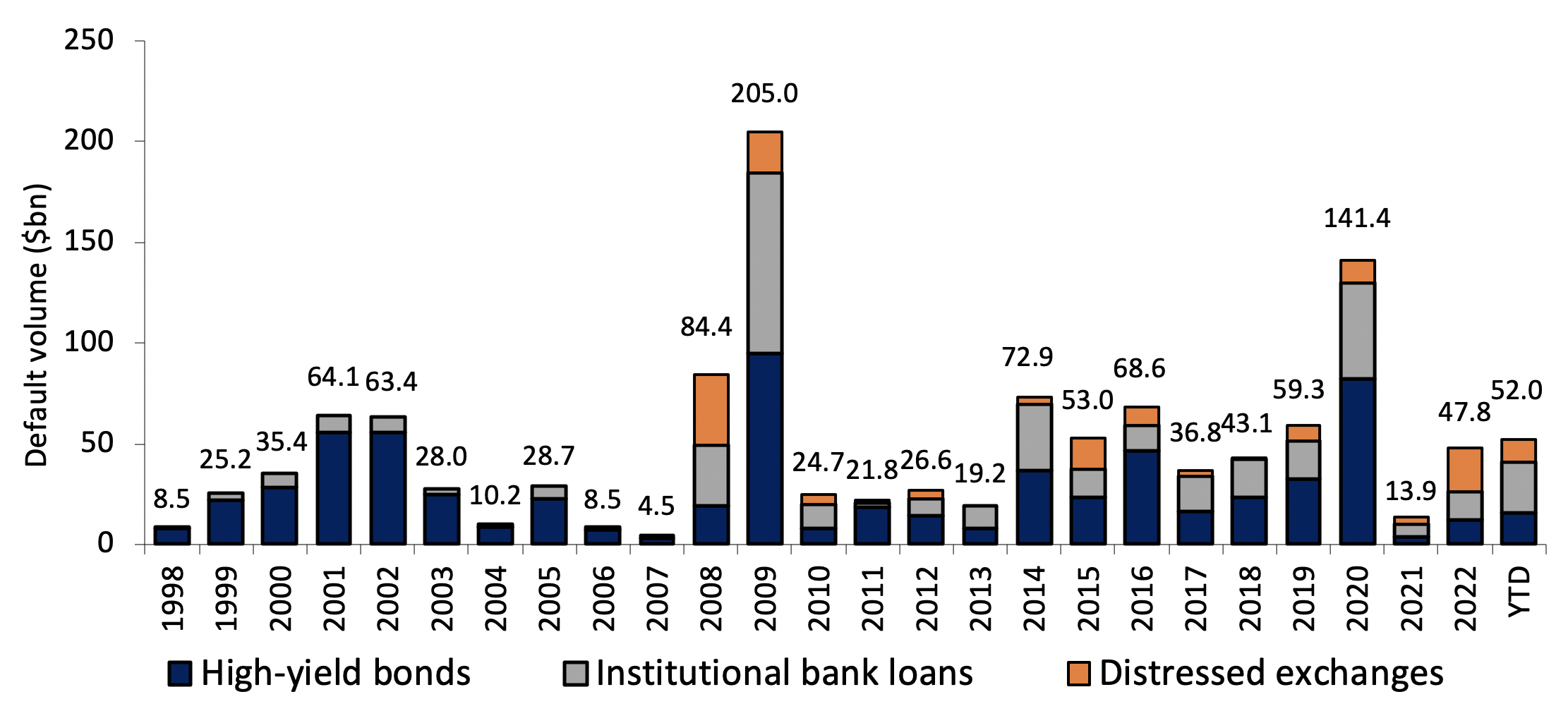

The graph below illustrates an increase in the distressed cycle, which we believe is likely to be slower moving and last longer than previous cycles – think “slow burn.”

Annual Default Volume19

Historically, LMTs have often been unable to resolve credit stress. Recently, Fitch Ratings20 examined 29 issuers that completed LMTs between 2014 and February 2023, of which seventeen were deemed to be defaults. The Fitch study brings to light the downside of “pay me later”:

- 14 of the issuers had ratings of CCC or below, showing no improvement in credit quality.

- 4 of the issuers were no longer rated.

- 2 of the issuers had minor credit upgrades.

- 9 of the issuers were rerated to single-B, but 5 of these were upgraded only after going through bankruptcy.

Further, according to the Fitch study, the largest lenders often crafted terms advantageous to themselves to the detriment of other lenders. This “creditor on creditor violence” is reaching extreme levels, twisting the bankruptcy process in a perverse way in opposition to its original intent.21 Sidebar – For the distressed investor, this adds a whole new element to caveat emptor.

Considering all of the above, we offer the following observations:

Leveraged loans are currently attractive:

- Demand for leveraged loans is down due to a decline in CLO formation.

- Floating rate loans are providing high yields due to the dramatically inverted yield curve. We continue to believe that rates will remain higher and for longer than implied by the forward interest rate curve, allowing us to take advantage of the mispricing relative to fixed rate debt.

LMTs will be used increasingly as the influence of CLOs declines:

- In some circumstances, an LMT will result in a full or partial repayment ahead of maturity, increasing the rate of return on an investment that was purchased at a discount to par.

- The “wall of worry” of maturities in the loan market will increasingly be met by the issuance of new bonds. These bonds are likely to have higher yields, better collateral, and covenant protections similar to leveraged loans.

The current interest rate environment will spur corporate events that are likely to present opportunities:

- Companies with significant portions of floating rate debt are beginning to show signs of stress. In-depth analysis of these situations can reveal attractive investments.

- Debt issued as part of restructuring or recapitalization often has higher yields and good covenant packages but is overlooked or misunderstood by many high yield investors.

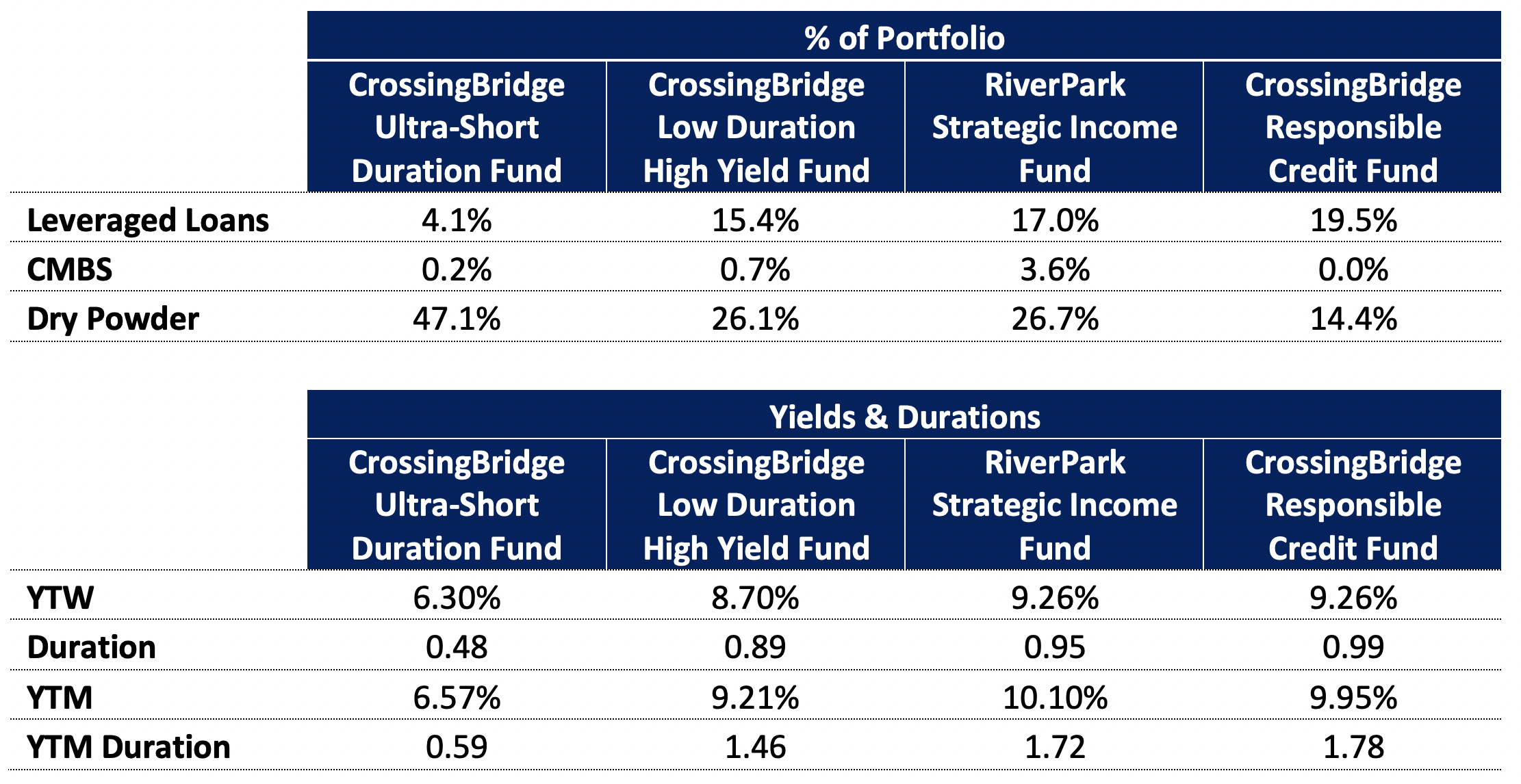

With respect to the portfolio, we remain nimble. At the end of 2Q23, we had elevated levels of “dry powder”22. If high yield spreads tighten and the market rallies, we may increase our level of dry powder to take advantage of what we believe will be a correction thereafter. We had a healthy position in leveraged loans and are looking to add. At the same time, we are selectively nibbling in the CMBS market. Based on our expectation of increasing volatility, the portfolios are likely to continue experiencing above normal turnover as we adapt to reflect the changing environment.

CrossingBridge Portfolio Summary - June 30, 2023

This letter may be a little “wonky” for some. But, since we are bottom-up investors, it is important to get into the minutiae. We encourage active dialogue with our investors and invite them to call with us.

Focusing on getting paid now, not later,

David K. Sherman and the CrossingBridge Team

Post-script: On 5/12/23, CrossingBridge Advisors, LLC completed the reorganization of the RiverPark Strategic Income Fund from the RiverPark Funds Trust into the CrossingBridge fund family. In turn, CrossingBridge is now the Adviser to the Fund.

Endnotes:

1FRAM is a subsidiary of First Brands. On June 30, 2023, our position in the First Brands 1st Lien Term Loan due 3/30/27 represented 1.40% of the Crossingbridge Low Duration High Yield Fund, 1.75% of the CrossingBridge Responsible Credit Fund and 0.61% of the RiverPark Strategic Income Fund. On the same date, our positions in the First Brand's 2nd Lien Term Loan due 3/24/28 represented 0.32% of the CrossingBridge Low Duration High Yield Fund and 1.15% of the RiverPark Strategic Income Fund.

2The FRAM ads were eventually cited by the National Advertising Review Board as "puffery" and misleading as they unduly raised fears among car owners by emphasizing the cause-effect relationship between failure to use a FRAM oil filter and the probability of costly repairs.

3 Bank of America, as of May 31, 2023

4 Bank of America, as of June 12, 2023

5 Bank of America, as of June 16, 2023

6 Bank of America, as of May 31, 2023

7 A CLO, or Collateralized Loan Obligation, is a structured product consisting of a portfolio of leveraged loans. CLOs raise capital by issuing various tranches of debt and equity with the proceeds used to purchase a diversified pool of syndicated leveraged loans. Cash flows provided by the underlying portfolio's interest and principal payments are distributed to debt and equity tranches according to a priority-based waterfall. Debt tranches (typically, investment grade) are created with various attachment points for potential loss. Tranches at the top of the waterfall have higher credit rating and earn a lower interest rate than lower priority tranches. CLOs have very specific portfolio criteria with respect to underlying investments: credit rating, industry concentration, single issuer exposure, etc.

8 Intex

9 Bank of America, Fitch, JP Morgan

10 CLOs have hard maturities requiring liquidation. In order to meet those maturities, they have specific date after which they are no longer permitted to reinvest their capital.

11 CreditSights

12 No portfolios managed by CrossingBridge Advisor, LLC held positions in debt or equity instruments of Heartland Dental during 2Q23.

13 Bloomberg, CreditSights and company

14 Bank of America, as of June 23, 2023; JP Morgan, as of June 16, 2023.

15 Expanding our view beyond the point that leveraged loans are entering a period of “Amend and Extend”, Bloomberg Businessweek highlighted the much more serious issue in the commercial real estate market appropriately entitled The ‘Extend and Pretend’ Real Estate Strategy Is Running Out of Time By Patrick Clark on June 23, 2023.

16 CLO Factbook, Bank of America June 16, 2023.

17 CLO Factbook, Bank of America June 16, 2023. 135bps on June 9, 2023, and 280bps on September 2, 2022.

18Leverage of 8.3x multiplied by 135 bp, the net interest spread, equals 11.2%.

19JP Morgan, as of June 30, 2023.

20 Most Liability Management Transactions Only Delay Default, Clip Recoveries, Fitch Ratings, April 17, 2023.

21 For a good read on this topic, read The Caesars Palace Group: How a Billionaire Brawl Over the Famous Casino Exposed the Corruption of the Private Equity Industry by Sujeet Indap and Max Frumes (2021).

22 We define “Dry Powder” as cash, cash equivalents, pre-merger SPACs, and securities maturing in less than 90 days.