The recently-enacted Inflation Reduction Act (IRA) includes a 1% excise tax on stock repurchases by corporations that takes effect in January 2023. The impact for SPACs remains subject to guidance from the US Treasury. We are monitoring the situation and considering the potential implications for the CrossingBridge Pre-Merger SPAC ETF (SPC).

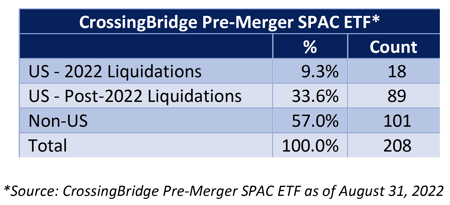

As shown above, the excise tax on SPC holdings should only affect 89 positions, representing 33.6% of the portfolio as of August 31, 2022. If the new tax affected the SPC portfolio to the fullest extent, the yield on the CrossingBridge portfolio would decline by approximately 70 basis points1. That said, depending on Treasury’s interpretation of the law, it may be less severe than the worst-case scenario. Moreover, as discussed below, the market has adjusted to reflect the impact of the excise tax, providing the opportunity to invest in US-domiciled pre-merger SPACs at higher expected yields that may not be reduced at all, depending on Treasury’s interpretation of the excise tax provision.

Below we provide several observations regarding the impact of the new IRA on SPACs:

The tax only applies to stock repurchases that take place beginning in 2023. SPACs that have liquidation dates in 2022 will be unaffected by this law.

The tax only applies to US-domiciled SPACs. Approximately 45% of all pre-merger SPACs currently outstanding in the market were issued by non-US companies and will, thus, be unaffected by the new law.

Redemptions may be subject to the tax while liquidations may not be. This is a nuance of the law that needs clarification. If Treasury determines that liquidations are not considered share repurchases, it should further limit the law’s impact on the SPC portfolio as SPAC sponsors that do not complete a merger may choose to simply “let the clock run out” to avoid the tax.

The SPAC market has already adjusted. According to Cantor Fitzgerald, the difference in yield for US-domiciled SPACs versus non-US SPACs before and after enactment of the IRA has increased by, on average, 89 basis points. Thus, the markets have already adjusted to provide the tax-adjusted rate of return that SPAC investors are requiring of US-based SPACs. To the extent that the tax ultimately does not apply to some of the US-based SPACs, investors may be able to keep a portion of this higher rate of return rather than having it be offset by the

excise tax.

Disclosures

ANY TAX OR LEGAL INFORMATION PROVIDED IS MERELY A SUMMARY OF OUR UNDERSTANDING AND INTERPRETATION OF SOME OF THE CURRENT INCOME TAX REGULATIONS AND IS NOT EXHAUSTIVE. INVESTORS MUST CONSULT THEIR TAX ADVISOR OR LEGAL COUNSEL FOR ADVICE AND INFORMATION CONCERNING THEIR PARTICULAR SITUATION. NEITHER THE FUND NOR ANY OF ITS REPRESENTATIVES MAY GIVE LEGAL OR TAX ADVICE.

INVESTING INVOLVES RISK. PRINCIPAL LOSS IS POSSIBLE. THE FUND INVESTS IN EQUITY SECURITIES AND WARRANTS OF SPACS. PRE-COMBINATION SPACS HAVE NO OPERATING HISTORY OR ONGOING BUSINESS OTHER THAN SEEKING COMBINATIONS, AND THE VALUE OF THEIR SECURITIES IS PARTICULARLY DEPENDENT ON THE ABILITY OF THE ENTITY'S MANAGEMENT TO IDENTIFY AND COMPLETE A PROFITABLE COMBINATION. THERE IS NO GUARANTEE THAT THE SPACS IN WHICH THE FUND INVESTS Will COMPLETE A COMBINATION OR THAT ANY COMBINATION THAT IS COMPLETED Will BE PROFIT ABLE. UNLESS AND UNTIL A COMBINATION IS COMPLETED, A SPAC GENERALLY INVESTS ITS ASSETS IN U.S. GOVERNMENT SECURITIES, MONEY MARKET SECURITIES, AND CASH. PUBLIC STOCKHOLDERS OF SPACS MAY NOT BE AFFORDED A MEANINGFUL OPPORTUNITY TO VOTE ON A PROPOSED INITIAL COMBINATION BECAUSE CERTAIN STOCKHOLDERS, INCLUDING STOCKHOLDERS AFFILIATED WITH THE MANAGEMENT OF THE SPAC, MAY HAVE SUFFICIENT VOTING POWER, AND A FINANCIAL INCENTIVE, TO APPROVE SUCH A TRANSACTION WITHOUT SUPPORT FROM PUBLIC STOCKHOLDERS. AS A RESULT, A SPAC MAY COMPLETE A COMBINATION EVEN THOUGH A MAJORITY OF ITS PUBLIC STOCKHOLDERS DO NOT SUPPORT SUCH A COMBINATION.

The fund's investment objectives, risks, charges, and expenses must be considered carefully before investing. The statutory and summary prospectus contains this and other important information about the investment company, and may be obtained by calling 914-741-1515. Read it carefully before investing.

CROSSINGBRIDGE ADVISORS, LLC IS THE ADVISER TO THE CROSSINGBRIDGE PRE-MERGER SPAC ETF, WHICH IS DISTRIBUTED BY FORESIDE FUND SERVICES, LLC.

[1] A basis point is one one-hundredth of 1%, i.e.70 basis points equals 0.70%.