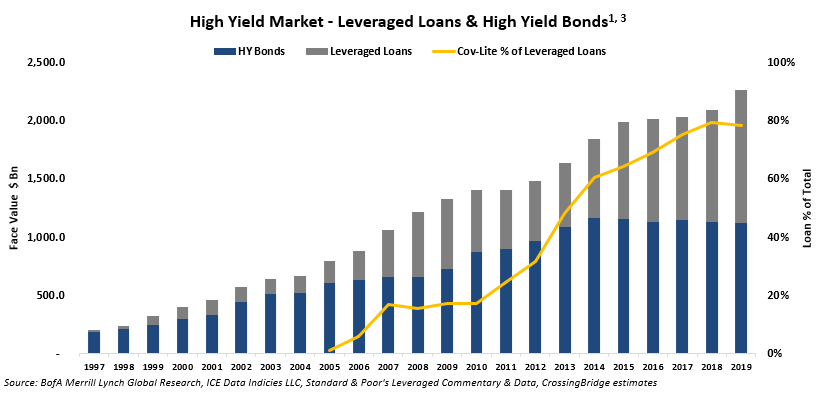

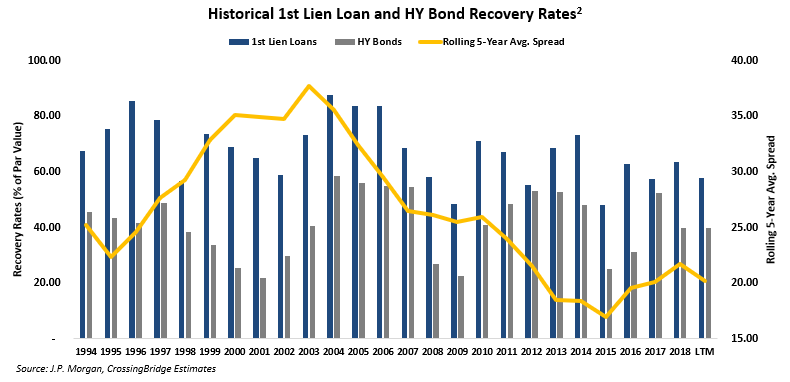

Historically, leveraged loans have been considered higher quality and more secure investments than their junk bond counterparts due to their collateral, covenant protection, and seniority in the capital structure. In fact, this premise was initially substantiated by distressed recovery rates of leveraged loans versus bonds. In 2006, the recovery rates for loans were approximately 84% of par value versus 55% for high yield bonds, and the spread between the two has since compressed to only 20 points.[1] Robust growth of collateralized loan obligation (CLO) products and floating rate loan funds increased the demand for leveraged loans to the point that loans now comprise over 50% of the high yield market.[2] This surge in investor demand for yield allowed borrowers to secure looser lending standards known as "cov-lite". As of March 31st, the total face value of leveraged loans was $1.2 trillion of which 78% are cov-lite.[3]

Covenants are features embedded in a loan's credit agreement designed to protect lenders. Among other things, covenants may limit borrowers' ability to incur additional debt, sell assets, or pay dividends. Further, leveraged loan collateral packages and protection afforded by debt ratios have been diluted. In the past, businesses deemed investment grade have been the primary beneficiary of cov-lite credit agreements.

The line between leveraged loans and bonds has become increasingly blurred. Loans may no longer be the safe haven investors have been conditioned to expect. Some leveraged loan investors would contend that the credit characteristics of cov-lite loan issuers are of such quality that they are worthy of a lower standard of investor protection. We tend to believe that argument is faulty. The analogy would be a wealthy individual getting married without a pre-nuptial agreement under the guise of true love.

[1] BofA Merrill Lynch Global Research, ICE Data Indicies LLC, Standard & Poor's Leveraged Commentary & Data, CrossingBridge estimates

[2] J.P. Morgan, CrossingBridge estimates

[3] BofA Merrill Lynch Global Research, ICE Data Indicies LLC, Standard & Poor's Leveraged Commentary & Data, CrossingBridge estimates