the rise in volatility and bifurcation of the market presents the potential for price declines and portfolio losses; for investors who, like us, have significant “dry powder”, it represents future opportunity.

Being There (Reprised)1

President: Mr. Chairman, to stimulate growth, I think we need more aggressive monetary policy rather than fostering growth through temporary incentives!

Fed Chairman: As long as the roots are not severed, all is well. And all will be well in the garden.

President: In the garden?

Fed Chairman: Yes. In the garden, growth has it seasons. First comes spring and summer, but then we have fall and winter. And then we get spring and summer again.

We do not have a strong view on whether economic growth will continue or a recession is imminent. Many investors are also uncertain. Hence, we are seeing a widening disparity in credit quality, which requires a fixed income investor to be increasingly circumspect. For investors who have been less discerning, the rise in volatility and bifurcation of the market presents the potential for price declines and portfolio losses; for investors who, like us, have significant “dry powder”, it represents future opportunity.

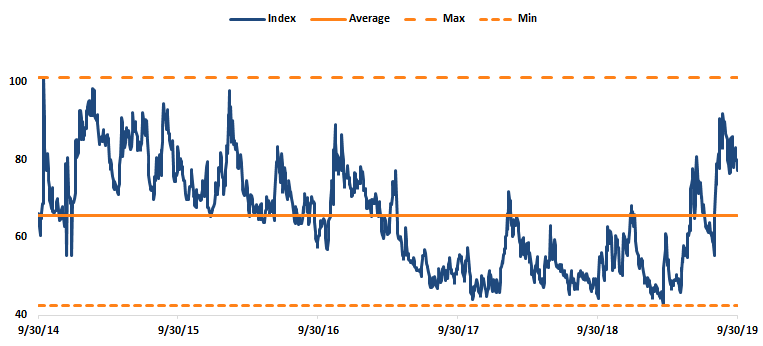

Merrill Lynch Option Volatility Estimate (MOVE) Index2

During 3Q19, Treasury bond volatility3 continued to increase sharply. This appears to reflect investors’ concerns regarding the ongoing lunge and parry of trade negotiations between the U.S. and China as well as the deceleration of the global economy.

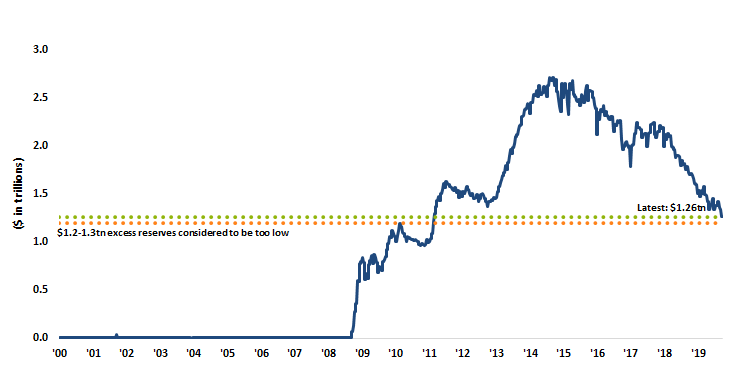

Federal Excess Reserves4

Since the end of 2015, the Fed’s efforts to normalize policy, shifting from Quantitative Easing to Quantitative Tightening, may have pushed natural rates beyond neutral.5 In July 2019, the Fed lowered interest rates for the first time since 2008. This reversal in policy likely reflects concern that escalating trade tensions, combined with continued monetary tightening, might tip the economy into a recession. Toward the end of 3Q19, the Fed was compelled to provide additional liquidity to the repo market 6 when rates spiked, a circumstance that may have been caused by the Fed’s tightening policy.

It remains to be seen whether the Federal Reserve pivot will offset macro headwinds (accelerated by trade skirmishes) and forestall an inevitable recession. We remain fervent in our belief that business cycles are a natural state and that recessions, though painful, are not wholly bad. They serve to reduce the excesses in the system. Today, the greatest excess may be the misallocation of capital enabled by low interest rates.7 At quarter-end, the Greek 10-year government bond yield was 1.32%, the lowest level in more than 20 years, and, for the first time in its history, the country recently issued debt (13-week bills) with a negative yield; the European debt crisis of 2012, when investors were worried about the potential default of the PIIGS,8 appears to be a distant memory.

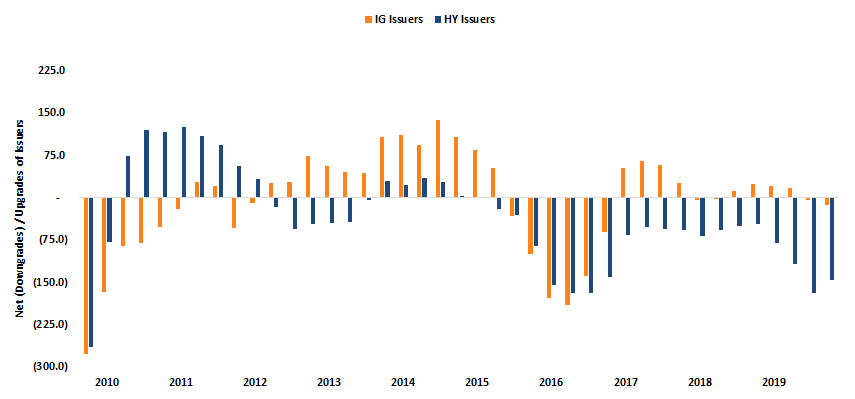

Net IG and HY Issuer Downgrades - Rolling LTM9

We have also seen misallocation of capital in corporate credit. Companies have been all too willing to take advantage of cheap financing and lenient terms to make acquisitions, pay dividends and fund large share repurchases. These excesses in corporate debt are beginning to “come home to roost”. Over the last several quarters, net high yield downgrades have approached the levels last seen in 2016. In 2018, there was a modest level of net upgrades among investment grade issuers, but, in the most recent quarter, downgrades began to outnumber upgrades. Unlike 2015-16, the current period of high yield downgrades has been nearly evenly split between energy-related and non-energy credits 10 suggesting the deterioration has taken place in a broader portion of the U.S. economy. In the trenches, we have observed multiple examples of credit deterioration in industries ranging from chemicals to boilers, lumber to printing equipment; the most common theme is economic uncertainty and trade tensions.11

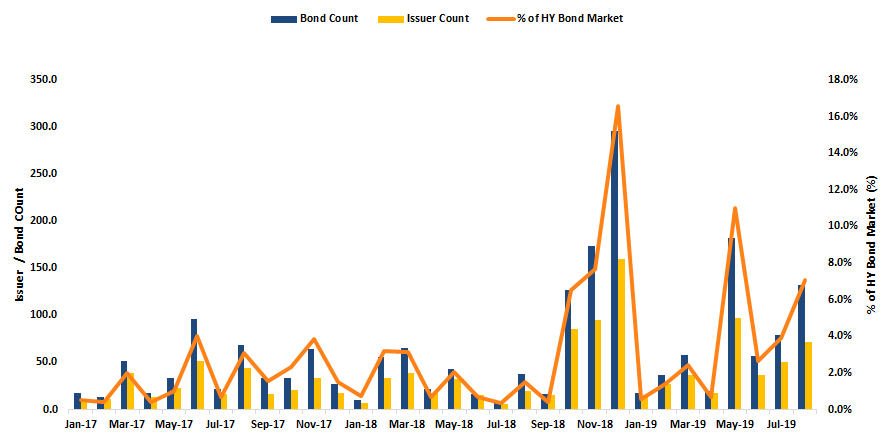

High Yield Bonds with 5pt+ Monthly Declines12

Concurrent with this increase in net credit downgrades in the high yield market, there has been a sharp increase in bonds experiencing monthly price declines of five points or more. Taking a “shoot first and ask questions later” approach, investors have increasingly sold bond positions as soon as companies reported shortfalls in performance or were perceived to be subject to the increasing risk posed by the potentially toxic combination of elevated leverage and a slowing economy.

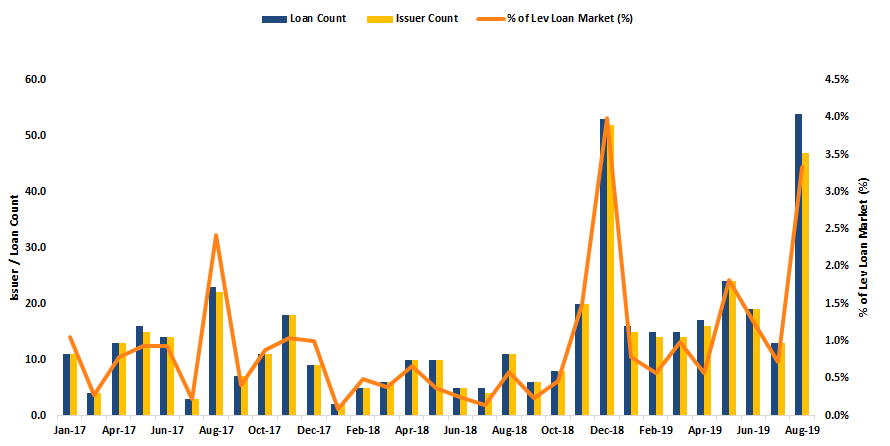

1st Lien Leveraged Loans with 5pt+ Monthly Declines13

As has been the case with high yield bonds, the incidence of leveraged loans experiencing monthly price declines of five points or more has also increased sharply. The buyers of leveraged loans are predominantly14 Collateralized Loan Obligations (“CLOs”).15 Although to date the rise in volatility has been somewhat muted, the diversification and credit quality tests that govern CLOs will typically force CLO managers to sell as credit quality and price deterioration occur, fueling greater volatility.

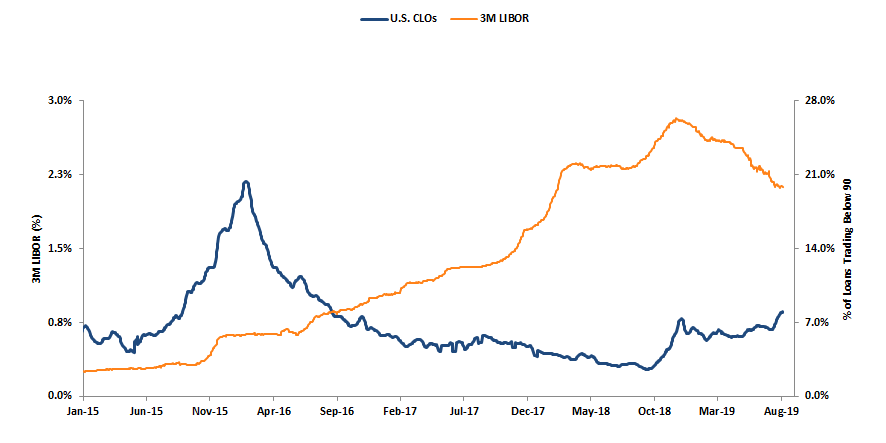

% of Loans Trading Below 90 in US CLO16

The portion of underlying leveraged loans supporting CLOs that are trading below 90 has more than doubled from less than 3% in 2018 to over 8% at present. Since the end of 1Q19, the rise in loans trading at 90 or below has coincided with a decline in LIBOR. Because the interest rate on a floating rate loan can be reset, typically every three months, a decline in LIBOR should have minimal impact on the loan’s price.17 Thus, when a loan falls below 90, it implies that the market credit spread has increased to reflect an increase in risk. Investors in CLOs and leveraged loan mutual funds have taken misguided comfort in the fact that floating rate loans have little sensitivity to movement in interest rates, but these loans still have risks associated with high leverage, future credit deterioration and diminished lender protection (given the prevalence of covenant-lite credit agreements).

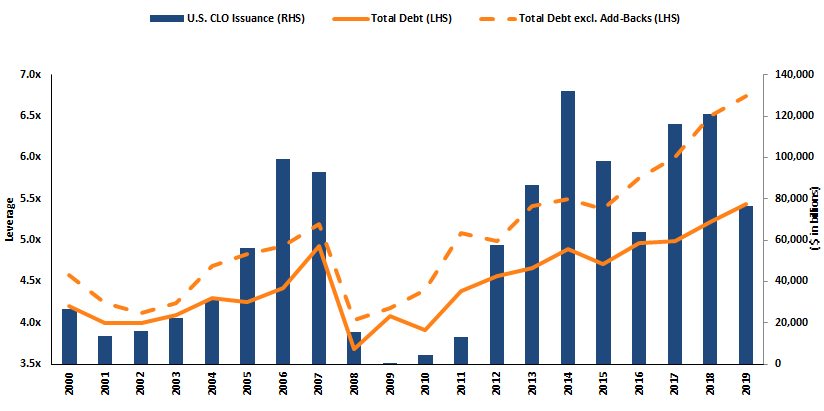

U.S. CLO Issuance and Leverage Ratios18

It is often said that it is the job of bankers to “feed the dogs what they’ll eat.” With the steady issuance of CLOs and the growth of leveraged loan funds, their portfolio managers have become increasingly tolerant of ever-higher leverage ratios. Further, they have given undue credence to EBITDA add-backs19 that reflect the promises of issuers to grow revenues, cut costs and capture synergies. A recent UBS study20 shows that among 2015 and 2016 vintage B-rated loans, actual leverage in the two years following issuance is more than double the future estimated leverage ratio at the time of issuance.21 Thus, leveraged loans, largely held by CLOs, are much riskier than generally acknowledged. The excesses of the leveraged loan market will be a ticking time bomb for some and an opportunity for others.

Taking into account the current environment and our expectations, we have been:

- Eliminating second lien loans22 and becoming more cautious with respect to first-lien loans.

- Proactively selling credits when they begin to show deterioration.

- Focusing on instruments at the top of capital structures with strong asset coverage, which we believe are appropriately priced for potential volatility and process risk.

- Identifying event-driven opportunities with processes that can be analyzed and a range of outcomes handicapped.

Nevertheless, we believe pockets of opportunity exist as reflected by our increase in exposure to the energy industry. In 2015/16, we felt that valuations did not reflect the uncertainty remaining in proving out reserves and executing production plans. Now we have the benefit of actual results. Some opportunities have caught our eye.

The CrossingBridge Low Duration High Yield Fund’s allocation to the energy sector was only 0.17% at the beginning of this year, but has grown to 2.95% as of September 30th.

Contrary to some beliefs, oil prices are not highly correlated to economic growth or movement in the value of the U.S. dollar. Over the last 20 years, the quarterly correlation of oil prices to U.S. gross domestic product and the U.S. dollar is 0.195 and -0.236, respectively.23 Regardless, we believe our energy investments provide an excellent source of yield that compensates for the expected future volatility and risk, especially given our focus on investing at the top of the capital structure. Below, we discuss new energy-related positions purchased during the quarter.

CITGO Holding (CITHOL)24 – CITHOL is the holding company for a large US-based oil refiner. The company is ultimately owned by the government of Venezuela, but, per U.S. federal law, the country has no direct control of the assets or cash flows. On July 16th, 2019, the company announced a refinancing transaction by which it proposed to redeem its 10.75% Secured Notes due 2/15/20 with the proceeds from issuance of new notes and a new term loan. A conditional notice of redemption was also issued for the Notes at around this time with an anticipated redemption date of August 16th. The company successfully priced the new notes and loan on July 24th, at which time we began purchasing the called Notes for the CrossingBridge Low Duration High Yield Fund on July 29th.

EP Energy LLC (EPENEG)25– EP Energy is an independent exploration and production company engaged in unconventional onshore oil and gas production in South Texas (Eagle Ford basin), Western Texas (Permian basin) and Northeastern Utah (Uinta basin). As has been the case with all E&P companies, EP has been buffeted by the prolonged and continuing period of commodity price decline and volatility over the last five years. Given the large capital expenditures required to maintain production and high interest expense due to the company’s heavy debt load, the company has not been able to cover fully these costs for the last 2.5 years, necessitating additional debt issuance and debt-for-debt exchanges to put off defaults. Having analyzed the company’s reported reserves and stress-tested reserve coverage of the debt based on changing oil prices, we concluded that, in the inevitable restructuring, it seemed highly likely that the 1st Lien Guaranteed Senior Secured Reserve-Based Revolving Credit Facility due 2021, fully drawn in August 2019, would be fully covered by the “proven developed producing” reserves. Thus, it was our view that a reorganization would result in the loan being rolled into a super-priority debtor-in-possession (“DIP”) financing during Chapter 11 or left in place, at the top of the balance sheet, to be refinanced or converted into a secured exit loan at the end of the bankruptcy. We purchased a portion of the loan, with a coupon of LIBOR + 250 basis points, shortly before the company filed Chapter 11. As expected, the company filed on October 3, 2019 with a proposed Plan of Reorganization that includes repayment in full (with all accrued interest) or conversion of the loan into a new secured loan. Post-reorganization, the company, benefitting from its reduced interest burden, should have the financial ability to optimize development of its large energy reserves.

Fieldwood Energy LLC (FIEENE)26 – Fieldwood is an independent exploration and production company engaged in oil and gas production, primarily in the shallow waters of the Gulf of Mexico. The company filed a pre-packaged Chapter 11 in February 2018 and emerged in April 2018, having reduced debt by about 50%. The company also received a $525 mm equity infusion to permit it to acquire and develop deep-water reserves it agreed to purchase prior to filing bankruptcy. With its dramatically reduced leverage, our analysis showed that, in most scenarios, the company would be able to fund its necessary capital expenditures, pay scheduled interest and generate free cash flow solely based on its shallow water production. Moreover, a discounted cash flow analysis of the shallow water proven developed producing reserves showed that these reserves fully covered the debt that we purchased. The acquisition and development of deep-water reserves should permit the company, following upfront investment, to increase total reserves, double production and improve cash flow, likely resulting in a further improvement in credit quality. During 3Q19, we purchased the company’s 1st Lien Exit Term Loan at an average yield-to-maturity of 12.22%.

Fall is here and “winter is coming”27

David Sherman and the Cohanzick team

Endnotes

1 Being There, a book by Jerzy Kosinski (1970), was subsequently adapted into a film in 1979 starring Peter Sellers. In the movie, a simpleminded, sheltered gardener unwittingly becomes a trusted advisor to a powerful businessman and, ultimately, the President of the United States.

2 The Merrill Lynch Option Volatility Estimate (MOVE) Index is a yield curve-weighted index of the volatility implied by 1-month Treasury options for the 2-year, 5-year, 10-year and 30-year Treasury bonds.

3 Merrill Lynch Option Volatility Estimate Index, Bloomberg

4 Federal Excess Reserves, St. Louis Federal Reserve

5 A Federal Funds Rate that neither stimulates nor restrains economic growth is referred to as the “natural” or “equilibrium” rate. Additional discussion may be found in our 1Q 2019 Commentary entitled “Responsive or Reactive?” https://blog.crossingbridgefunds.com/blog/cbldx-quarterly-commentary-q1-2019

6 A repo takes place when a borrower that needs cash for a short period, typically overnight, deposits securities, often Treasury Notes, with a lender to borrow an equivalent amount of cash. The repo rate is the difference in price of the securities at the time of deposit and the price at which the borrower agrees to repurchase them. The repo rate is usually aligned closely with the Federal Funds Rate, 1.90% on September 30, 2019. In mid-September, however, the repo rate rose sharply, as high as 10%. Several explanations have been offered. Federal corporate tax payments were due on September 16 causing greater demand for cash. This coincided with a Treasury Department auction through which $78 billion in cash was used to purchase government securities, reducing the availability of cash for repo. In response, the Fed stepped in to offer its own repo trades in order to keep repo rates closer to the Federal Funds Rate.

7 A point we touched on in our 2Q 2019 Commentary entitled “Rise of the Living Dead” https://blog.crossingbridgefunds.com/blog/cbldx-quarterly-commentary-q2-2019

8 Portugal, Ireland, Italy, Greece and Spain. Greece required bailout loans in 2010, 2012 and 2015 provided by the IMF, the Eurogroup and the ECB.

9 Bloomberg, Corporate Ratings screen

10 Bloomberg, Corporate Ratings screen

11 Specific examples are worth noting:

- Chemical producer/distributor (private) – A global, value-added distributor of specialty minerals and additives has seen a decline in revenue growth for the past three quarters due to reductions in pricing and volume. With broadly diversified end markets, weakness appears directly related to the global economic slowdown as well as a disruption in one major end market segment due to recent consolidation. Operating margins have also compressed due to lower volume and higher raw material costs. Moody’s downgraded the company’s 1st lien loan to B3 in in September 2018 and S&P downgraded in to CCC+ in August 2019. Since its most recent peak at 98.75 in May 2019, the 1st lien loan has fallen to a low of 80.25 at the end of 3Q19. The company has good liquidity and can withstand a more significant decline in performance and still cover capital expenditures and debt service, but leverage has increased, driving the credit downgrades and, likely, causing CLOs to sell their positions.

- Boiler manufacturer (private) – A leading producer of commercial, residential and industrial boilers, the company has experienced three successive quarters of declining revenues and EBITDA because of slow growth/declines in three business segments and a sharp drop off in sales of boilers primarily used in commercial and industrial settings. Management attributes the decline in sales and backlog to customer delays, particularly of large capital projects. Management also attributes a decline in margins to a 36% year-over-year increase in steel prices due the increase in tariffs. The company has responded through price increases and cost cutting initiatives including reductions in headcount. The company has been focused on expansion of sales in China, but ongoing trade tensions call this into question. Both Moody’s and S&P cut the company’s credit rating during 3Q19. The company’s bonds began the year in the upper 90s, but they fell as low as 91 in 3Q19 before rebounding to the mid-90s recently. The company has reasonable liquidity to withstand the weak environment extending for several quarters, but leverage is increasing and the outlook is uncertain, suggesting that the bond’s price is more likely to fall than rise.

- Northwest Hardwoods – In a recent Wall Street Journal article (‘It’s a Crisis’; Lumber Mills Slash Jobs as

- Trade War Cuts Deep, September 26, 2019), the CEO of Northwest Hardwoods said, “We feel stuck in a much larger chess match” in discussing the impact of the trade war between the U.S. and China. A leading producer of hardwood used in furniture, flooring, cabinetry, etc. the company is feeling the impact of a 40% decline in exports of hardwood lumber to China and is closing two U.S. plants that employ 100 people. The slowing Chinese economy has reduced demand for hardwood furniture and the U.S.-imposed tariffs and rising anti-American sentiment has caused Chinese furniture manufactures to source hardwoods from other countries, potentially permanently displacing U.S. hardwood in the Chinese market. Downgraded by Moody’s twice this year, the company’s bonds were already at distressed levels, in the low 70s at the beginning of 2019, but have recently fallen into the upper 50s as investors have grown increasingly concerned that an inability to cover interest expense will precipitate a restructuring.

- Printing equipment manufacturer (private) – The company added leverage to make an acquisition in early 2018, but a sharp decline in customer orders beginning in 4Q18 caused leverage to skyrocket as last-twelve months’ EBITDA fell nearly to break-even by 2Q19. Bonds began the year in the upper 90s, but, at the end of 3Q19, were quoted in the low 40s as liquidity appeared to tighten and the company seemed increasingly likely to default on an upcoming interest payment. With the company’s competitors experiencing similar declines, customers, facing an uncertain economic environment, have appear to have decided to delay new equipment orders.

12 J.P. Morgan Research

13 J.P. Morgan Research

14 According to Goldman Sachs, at 68%, CLOs’ share of the U.S. institutional primary leveraged loan market is at its highest level since 2002. This compares to 41% in 2011. The Credit Trader – Trade Tensions Regain the Upper Hand, Goldman Sachs, August 1, 2019.

15 CLO’s are actively managed pools of loans, the cash flows of which are securitized into debt and equity-like tranches that permit fixed income investors to invest based on their risk/return parameters. CLOs are subject to periodic testing to ensure that the CLO manager is maintaining an appropriate level of risk and is properly diversified.

16 Morgan Stanley Research and Bloomberg

17 A loan with interest rates that reset every three months will have a duration of approximately 0.25. This is a measure of price sensitivity to changes in interest rates.

18 UBS Research and S&P LCD Data

19 EBITDA is use as a heuristic measurement of unlevered pretax cash flow before capital investment. EBITDA is an acronym for earnings before interest, taxes, depreciation and amortization.

20 Global Strategy – Leveraged loans: how much do credit ratings understate the risks?, UBS, October 1, 2019

21 At the time of issuance estimated leverage for these 2015/16 B rated loans was expected to be 3.5-3.7x Debt/EBITDA, but the actual ratio was 7.5-7.7x in the second year after issuance. The addbacks and adjustments at the time of issuance were not yet realized.

22 As of September 30, 2019, the CrossingBridge Low Duration High Yield Fund held no second lien loans.

23 Bloomberg Data

24 In the CrossingBridge Low Duration High Yield Fund, our position in CITGO represented 0.00% on 6/30/19 and 0.00% on 9/30/19.

25 In the CrossingBridge Low Duration High Yield Fund, our position in EP Energy represented 0.00% on 6/30/19 and 1.82% on 9/30/19.

26 In the CrossingBridge Low Duration High Yield Fund, our position in Fieldwood Energy represented 0.00% on 6/30/19 and 1.09% on 9/30/19.

27 “Winter Is Coming” is the motto of House Stark, one of the Great Houses of Westeros in the HBO television series and book series by George R.R. Martin, Game of Thrones. The meaning behind these words is one of warning and constant vigilance. The Starks, being the lords of the North, strive to always be prepared for the coming of winter, which hits their lands the hardest.