“Tapping the market” sounds harmless enough—like turning on a faucet for a quick splash of liquidity.

CrossingBridge Insights

CrossingBridge Insights is our opportunity to share our thoughts on interesting trends and data points through our Quarterly Commentaries, Market Observations, recent news, and random musings. We hope you enjoy and we welcome your feedback.

David Sherman

Recent Posts

The hazards of chasing yield often appear obvious only in the rearview mirror, yet they frequently build in plain sight.

“Alignment of interests” is a formidable driver that shapes incentives and outcomes to naturally pull parties in the same direction — reducing conflict and building mutual success.

On President’s Day, I was riding the Hohokam Mountain Bike Trail in Tucson—a beautiful single-track winding through desert mountains.

The CrossingBridge Low Duration High Income Fund (CBLDX) was recently highlighted as a featured fund in Barron’s timely article titled “The Chaos-Resistant Fund Portfolio.”

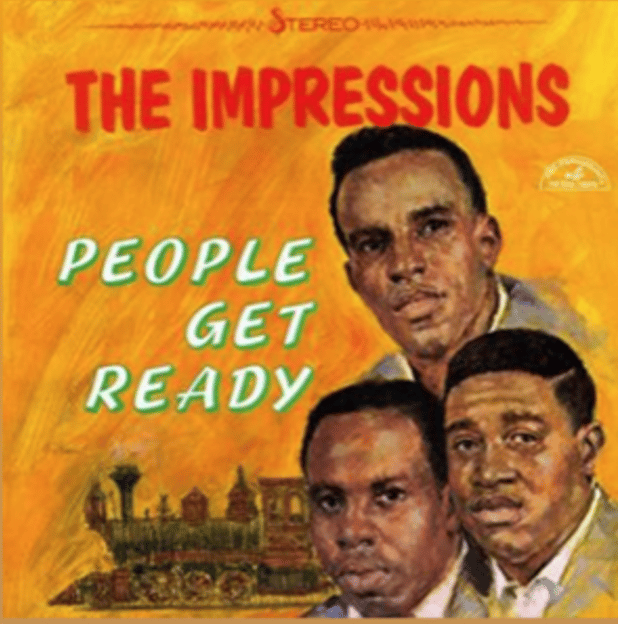

In the 1960s, war, peace, freedom, equal rights, and economic inequality were the issues of the day.

Along with esteemed industry colleagues, Rosenwald and Brochin, I teach “Global Value Investing” to the MBA students at NYU Stern School of Business in the fall semester. Each one of us sees value investing through different lenses: credit...

Skilled mountain climbers sometimes find themselves forced to employ sophisticated techniques. One in particular, known as “chimney climbing”, requires that the mountaineer wedge their body between two opposing rock surfaces, pushing on each side in...

The recent NCAA college basketball tournaments remind us that players regularly come off the bench to give their teams an extra boost.

Written in 1965, a tumultuous time of social change and civil unrest, the song, People Get Ready, expresses optimism that faith and love will win out. Today, there is a convergence of economic, political, social, and technological transformation....